Wise Debit Card Review 2024

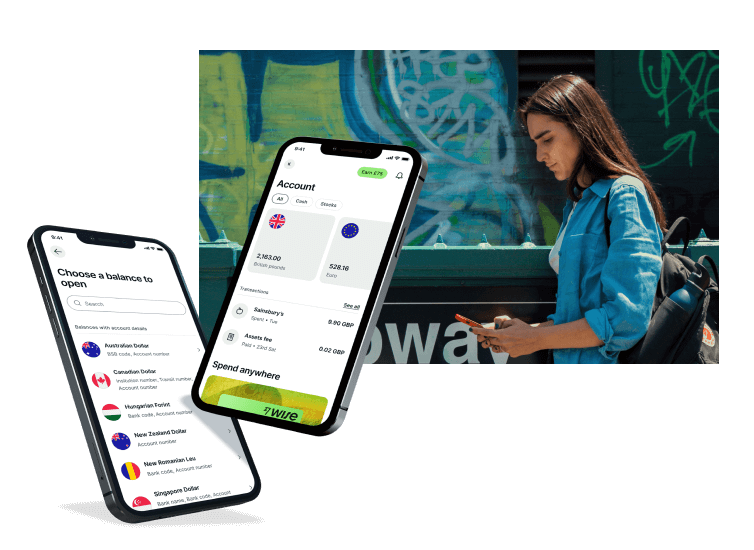

The Wise card (formerly known as TransferWise) works with the multi-currency account to give customers an easy way to spend their balances in multiple countries. With interbank rates and low fees, this product almost sounds good to be true.

So, is it?

What is the Wise card?

The Wise debit Mastercard® is attached to your Wise multi currency account and can be used to:

- Make purchases internationally

- Spend money overseas like having a local card, even if you don't have the currency you need in your account

- Receive money from overseas using local bank account details in AUD, NZD, RON, GBP, USD, CAD, HUF, SGD, TRY and EUR

- Transfer money to bank accounts around the world

Pros and cons of the Wise card

- No annual fee, hidden transaction fees, exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in 10 currencies - incl. Australia (AUD), New Zealand (NZD), the UK (GBP), the USA (USD), Europe (EUR)

- It takes 7-14 business days to receive the card

- Free cash withdrawals under $350 every 30 days

Learn more about the Wise card

Wise card features

- Hold and exchange 40+ currencies in your Wise account

- Spend in 150+ countries, withdraw at 2.3 million ATMs

- Convert currencies in your account with the mid-market exchange rate and low fees

- Virtual cards available instantly

- View and manage your account in the Wise app

- Freeze and unfreeze your physical card and virtual cards instantly

- Wise holds an Australian Financial Services License (AFSL), and is regulated and overseen by authorities all over the world

Who is the Wise card for?

The Wise debit card is available in Australia for both personal and business customers, which means it can be a great way for lots of people to manage their money conveniently - and cut transaction costs at the same time. The Wise debit card is great for:

- Travellers looking to make contactless or mobile payments can use the Wise card as a travel debit card

- Anyone on holiday who wants to withdraw cash cheaply from local ATMs

- People who love to shop online with international retailers

- Anyone who wants a low cost, secure account with both virtual and physical cards

- Entrepreneurs who need to spend in foreign currencies

- Business owners who want to offer international debit cards to team members to manage spending and expenses

Is the Wise card a good option?

If you want to easily and frequently access the funds you're holding with Wise with a card, it's a great option. It's a cheap and easy way to spend and withdraw cash internationally. When you need to convert between currencies, Wise uses the mid-market exchange rate at the time you convert, with low fees from 0.43%.

How is Wise's debit card different?

Wise's debit card (formerly known as TransferWise) is unique compared to both foreign currency accounts and travel cards, because it allows you to directly access money you receive from overseas and spend that money using a card, without any limitations.

Can I get the Wise debit card in Australia?

Yes. You can get your Wise debit card in Australia in just a few simple steps.

You’ll first need to register a Wise multi-currency account using your email address, Facebook, Apple or Google ID. Top up your Wise account in the currency of your choice and then you can order your Wise card in the app, for a one time 10 AUD fee.

How to get your free Wise Card (formerly known as TransferWise)

![]()

Activate your card

Activate your card online and receive your PIN. To activate your card, buy something with chip or PIN and select “credit” on the terminal.

![]()

Step 3: Spend

Start using your debit card while you travel abroad. You can use it anywhere that accepts Mastercard.

Learn more about the Wise Debit Card

How does the Wise card work?

How does the Wise (TransferWise) card work? You use the Wise Debit Card (formerly known as TransferWise) in the same way you would use any debit card. You can withdraw money with it and make purchases in shops, restaurants and any place that accepts card.

If you have the balance of the currency for the country you're in, it will simply deduct the amount from your Borderless account. If you don't have any of the domestic currency, Wise will convert the currency for you at the mid-market rate, so you can make your purchase or withdrawal. Simple!

Example:

Samantha lives in the UK, but is currently in Berlin for work. She has a Wise account and recently received her debit card. In her account she has US dollars, Euros and Pounds. When she first gets to Berlin, she uses her card to make purchases and they are deducted straight from her balance of Euros.

However, towards the end of the trip she runs out of Euros. When Samantha goes to make a purchase, Wise automatically converts the required balance from one of the remaining currencies in her account. In this example, Wise converted Samantha's US dollars into Euros to complete her purchase, as that was the currency balance which incurred the lowest available fee.

Learn more about the Wise Card

Can I use the Wise travel card abroad?

The Wise travel card is specifically created to make your life easier when travelling abroad. All you’ll need to do is open your Wise account before you travel, with your local ID and proof of address for verification, then order a linked international Wise card for a low, one time fee, for spending and cash withdrawals in 150+ countries.

When you spend with your Wise card, the balance needed is deducted from your Wise account. If you have the right currency for the country you’re in, the funds are simply taken from that balance with no fee to pay. If you don’t have the currency you need where you are, the card can automatically convert your balance from the currency that incurs the lowest available fees, using the mid-market exchange rate.

Here’s what you can do with your Wise card:

- Make contactless payments in person while you’re away

- Add your card to a wallet like Apple Pay for mobile spending

- Make cash withdrawals at ATMs globally

- Spend online in foreign currencies

Is the Wise travel card a good option?

The Wise card is a good debit card for international travel as it’s been optimised for international features, and with a focus on keeping fees low and your options flexible. Here’s how the Wise card can shine as a travel card:

- The Wise card is secure and not linked to your everyday NZD account

- You’ll be able to hold 40+ currencies, to convert in advance of spending if you like

- Your card can convert currencies for your if you don’t have the balance in the required currency

- You can use your Wise card to make cash withdrawals so you don’t need to arrange your travel money in advance

Wise card fees for spending abroad

Spending in foreign currencies with a Wise card could be significantly cheaper compared to using your bank’s debit card.

Your bank is likely to add a foreign transaction fee to every purchase or withdrawal you make in a different currency - this is often in the region of 3% of the cost of the transaction. Wise on the other hand uses the mid-market exchange rate with low fees from 0.43%. That means that you can cut your costs whenever you use a Wise debit card to shop when you travel, spend with international ecommerce stores, or make a cash withdrawal overseas. More on how that works, next.

How to activate your Wise card

Once your physical card arrives in the post you’ll need to activate it. This is done simply by making a purchase using your PIN number - or if you’d prefer you can make a cash withdrawal or check your balance in an ATM. You’ll be able to find your PIN, as well as your card number and CVV code, in the Wise app at any time.

How to top up your Wise card

Your Wise debit card is linked to your Wise multi-currency account. To add funds to your Wise account you’ll need to take the following steps:

- Log into your Wise account online or in the Wise app

- Select the currency balance you want to top up

- Tap Add

- Confirm the currency you want to pay with

- Enter the amount you want to top up and select a payment method

- Check everything over, confirm and follow the prompts to complete the payment

You can also add money to your Wise account directly from your online banking service using your local bank details for eligible currencies.

How do Wise card fees compare for spending abroad?

Spending in foreign currencies with a Wise card could be significantly cheaper compared to using your bank’s debit card.

Your bank is likely to add a foreign transaction fee to every purchase or withdrawal you make in a different currency - this is often in the region of 3% of the cost of the transaction. Wise on the other hand uses the mid-market exchange rate with low fees from 0.43%. That means that you can cut your costs whenever you use a Wise debit card to shop when you travel, spend with international ecommerce stores, or make a cash withdrawal overseas.

More on how that works. next.

Wise card vs bank

Banks usually add a foreign transaction fee whenever you spend with a credit or debit card, on top of any other charges - such as international ATM fees or cash advance charges for example. Wise is different, offering the mid-market exchange rate with low conversion fees from 0.43%, and no foreign transaction fee.

Here’s a quick comparison of how Wise card spending compares to using a bank credit or debit card when you’re overseas:

| Provider | Exchange rate and foreign transaction fee |

|---|---|

| Wise | Mid-market exchange rate + no foreign transaction fee |

| Westpac | Card network exchange rate + 3% foreign transaction fee |

| ANZ | Card network exchange rate + 3% foreign transaction fee |

| St George | Card network exchange rate + 3% foreign transaction fee |

| Commbank | Card network exchange rate + 3% foreign transaction fee(3.5% for some cards from 1 December 2023) |

Click here to read how Wise money transfers compare to international bank transfers

What is a Wise card?

The Wise card is a Visa debit card - not a credit card - that’s linked to a Wise multi-currency account. It’s great for spending and making cash withdrawals, online, at home and abroad - and best of all, you’ll get currency conversion using the mid-market exchange rate whenever you choose to spend in a foreign currency.

- Make payments and withdrawals in 150+ countries

- Use 2.3 million ATMs for withdrawals, all around the world

- Top up in the currency you prefer and check your account balances at a glance in the app

- Switch currencies with the mid-market exchange rate and low, transparent fees

- Spend any currency you hold in the account for free

- Auto convert feature makes sure you always pay the lowest possible fee when spending currencies you don’t hold in your account

- Instant transaction notifications for security

- Get instant access to 3 virtual cards

- Freeze and unfreeze your card whenever you need to

- Visa debit card - making it easier to manage your budget without running up debts or incurring credit charges

Wise virtual card

The Wise virtual card - also known as the Wise digital card - allows you to make payments online and in stores with your phone. Simply add your virtual card to a mobile wallet like Apple Pay or Google Pay, to make contactless payments in stores and buy things online. You can have up to 3 virtual cards at any one time which can make it easier to manage your budget by assigning different spending types to different cards.

Wise virtual cards have different card details to your physical card, and can be frozen instantly whenever you’re not using them - offering a handy added layer of security. You’ll be able to start using your Wise digital card as soon as you order your physical card, with no need to wait for the physical card to be delivered.

Learn more about the Wise Virtual Card

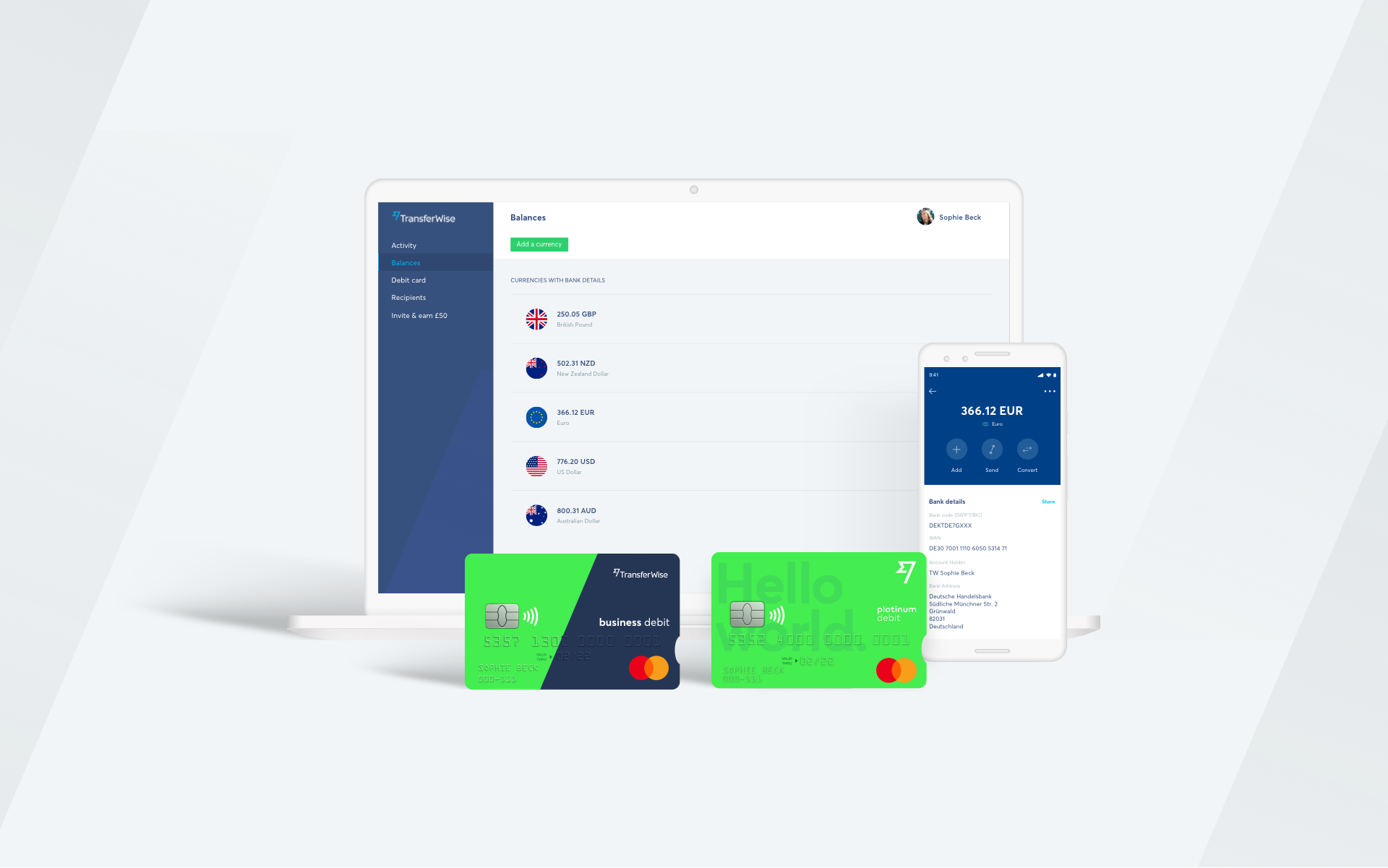

Wise Debit Card for business

Wise can provide business support for your international transfers.

With Wise's multi-currency account, it makes sense to have the additional Wise MasterCard for your business travels so you can spend money like a local, too.

Read about the Wise account here.

Learn more about the Wise Debit Card

Where is the Wise Debit Card available?

The Wise account is available in a broad selection of countries globally, including Australia, New Zealand, the UK, the US, Singapore, Malaysia, Japan and EEA (European Economic Area). With the Wise account you will also receive:

- New Zealand account number

- American account number and routing number

- British account number and sort code

- Australian account number and BSB code

- European IBAN and BIC/SWIFT code

- Singaporean bank name, bank code and account number

- Romanian account number and BIC/SWIFT code

- Canadian institution number, transit number and account number

- Hungarian account number

- Turkish bank name and IBAN

See a full list of the countries it is currently available here.

Wise card fees

While it is free to create a Wise Account, there are some fees you need to be aware of:

- When you're converting currency within the Wise account, there is a percentage based fee you will be charged. This depends on the currency, you can find out more here.

- There’s a 10 AUD one time fee to get your Wise debit card.

- You can make 2 withdrawals up to 350 AUD a month for free - after that, a fee of 1.5 AUD + 1.75% applies

To read more about Wise fees, you can click here.

Wise exchange rates

Wise provides a currency calculator on their website. It shows the mid-market rate which is the same rate they offer for your transfer.

Saying that, it can still be tricky to compare exchange rates and total costs that Wise offer against banks and money transfer providers. Our comparison table accurately does this for you.

Wise card limits

Your Wise card comes with default set limits which you can change if you would like to.

The Wise ATM withdrawal limits are 7,000 AUD a month. Your daily limit is also automatically set to 7,000 AUD, but you can adjust this down in the app if you’d prefer to. The Wise monthly spending limit is set at 52,500 AUD - this limit can also be adjusted in the Wise app. Wise monthly limits reset at the end of each calendar month.

| Transaction type | Single transaction limit | Daily limit | Monthly limit |

|---|---|---|---|

| Chip and PIN or mobile wallet like Apple Pay or Google Pay |

|

|

|

| ATM withdrawal |

|

|

|

| Contactless |

|

|

|

| Magnetic stripe |

|

|

|

| Online purchase |

|

|

|

What do customers say about Wise?

Trustpilot TrustScore: 4.1/5

On TrustPilot, customers think Wise is an "excellent company" to use.

Customers mostly praised Wise for its ease-of-use and speed, but also how good their exchange rates are. Negatively, the most common complaint we could find was about limited customer service and that sometimes ID took a long time to be verified.

How to contact Wise if you have a problem

Email Support: support@transferwise.com

Website: https://wise.com/help/

Is Wise safe to use?

Yes. Wise (formerly TransferWise) is completely regulated in Australia. They also have an Australian Financial Services Licence, and are regulated by the Australian Securities and Investment Commission (ASIC).

There are very stringent guidelines that Wise must follow in order to send your money. This makes them a safe, and trustworthy option for your international money transfers.

They also take measures to protect the sensitive data you provide them like your personal details and identification. The company encrypt any information you give them and have a strict customer agreement. You can email Wise to find out more.

Conclusion: Is the Wise card worth it?

The Wise debit card can make life easier - and help you save money - if you travel often, shop with international ecommerce stores, or have a business and want to issue your team with international debit cards to manage spending.

Wise currency exchange always uses the real mid-market exchange rate with no markup and no hidden fees - and with the Wise debit card’s smart auto convert feature you don’t even need to switch currencies before you travel. Leave the Wise card to switch to the currencies you need, when you need them, with the lowest possible fee every time.

FAQs - Wise Debit Card

Can I use my Wise card abroad?

Yes. In fact, the Wise card can help you cut the costs of currency conversion when you spend and make withdrawals in over 170 countries around the world.

What's the difference between a debit card and a virtual card?

A virtual debit card works similarly to a physical debit card, but it only exists on your computer or smart phone. That means you can add it to a mobile wallet for on the go payments - or use it for online shopping. You can’t use a virtual card to make an ATM withdrawal, or in any situation where the physical card must be presented to the merchant.

Is the Wise card contactless?

Yes. The Wise international debit card is contactless for convenient spending.