Find the Best Exchange Rates Fast

I need to exchange currency I need to transfer money

The fastest way to find the smartest deal

Join over 100,000 monthly users saving thousands by finding and comparing exchange rates and fees for their next global adventure or international money transfer. All it takes is a few taps or clicks to compare and select the lowest fees and rates available.

$140.4M saved &

counting

More than 2.3 million satisfied visitors have saved over $140M on currency so far.

Never get ripped

off again

We've partnered with the largest, safest and most trusted money currency brands in the world.

No added costs,

no mark up

Our referral fees don’t affect what you pay. Our exchange expertise is 100% free.

Make smarter

decisions

Explore our growing currency resources and make confident buying decisions.

We compare Australia’s most trusted brands

Not all rates are born equal

At The Currency Shop, we keep things nice and simple. Because every company has different exchange rates and fees, finding the best deal can be a minefield. That’s where we step in. We bring together all your options, highlight the fees and rates per provider, and show you the best possible deals. With all the information in one place, you’ll know you’re making the right choice for your back pocket and peace of mind.

How to Transfer Money from the United Kingdom to Australia

In this guide, we will show you how to transfer money to Australia. We also help you discover the best options for the cheapest and fastest money transfers from the UK.

- Read more ⟶

- 4 min read

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

- 2 min read

The Latest 2020 Australian Dollar Forecasts from the Big 4 Banks

Forecasts for the Australian Dollar from bank experts are revised throughout the year. This article looks at the different outlooks and is updated regularly.

Find the Best Ways to Transfer Money from Australia to New Zealand

The majority of Australian's believe the best way to send money overseas is through their banks, despite massive fees. Find and compare the best options for you.

- Read more ⟶

- 6 min read

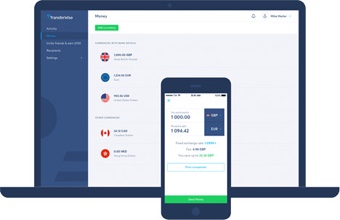

The Wise Borderless Account Review

At its core, the Borderless Account is a foreign currency account, but there are 3 things about this account that makes it different to other multi-currency accounts.

- Read more ⟶

- 8 min read

Send money to 23 countries

What our customers say about us

A very competitive

A very competitive, easy to understand and fast service. The exchange rate I received from The Currency Shops associates was much more competitive than either my UK or Australian bank was able to offer and ended up saving me hundreds of dollars.Was able to source exactly

Great to deal with and excellent market knowledge. Was able to source exactly what I needed in a short time. Will use this service again soon.Great to have an unbiased opinion

Thanks Bec at the Currency Shop for all of your help. Great to have an unbiased opinion to help make important financial decisions.Rebecca was lovely and very helpful

Accidentally phoned these guys while getting quotes for foreign exchange. They found the best rate in town, then also the best agent to use for international transfers. $0 charged, great customer service, highly recommended for all your foreign exchange needs.

2

3

4

5

Stefan L

Featured in

FAQ

The Currency Shop does not exchange currency like a money changer store. It is an exchange rate comparison site. We help you find the best exchange rates by listing and comparing the exchange rates of the banks and safe, reputable currency exchange services in Australia.

Sorry, we can't exchange money for you but it's easy to find a great deal using our comparison tables and location guides. Click here to find a great place to exchange money.

There is no single bank or provider that always have the best exchange rates. You can compare exchange rates, fees and work out the cheapest options for currency exchange or international money transfers.

The cheapest way to transfer money overseas depends on your situation. To find the best way for you, compare the exchange rates, fees and total costs of your transfer. Make sure you compare based off your amount. Some banks and money transfer services offer different exchange rates and fees depending on the amount of the transfer.

Find the best time to buy currency or transfer money with rate alerts.

Find the best time to buy currency or transfer money with rate alerts.