5 Alternative Money Transfer Companies to CurrencyFair

This guide lists 5 of the best alternative money transfer companies to CurrencyFair, rating them in terms of value, speed and ease of use to make sure you have everything you need to choose the best option for you.

Gone are the days of expensive international bank transfers and nowadays, we know people can feel overwhelmed with all the choices and services available. While CurrencyFair is a great option, there are plenty of similar alternatives that compete closely who may provide a better (or worse) service.

So whether you're looking for a quick single exchange or perhaps planning to set up multiple transfers to different currencies, we're here to tell you everything you need to know.

CurrencyFair Alternatives

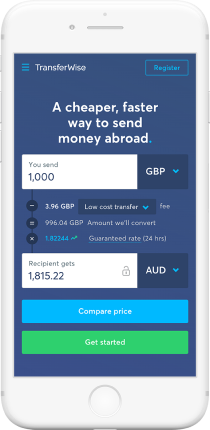

Wise (formerly known as TransferWise)

Wise is an international transfer provider founded in 2011. Started by two Estonians who were frustrated with how much they lost in foreign exchange, you can fast forward 9 years and see Wise as a trusted and popular option in the FX market.

With over 7 million customers, this global company moves over $5 billion USD every month and is one of the most popular choices amongst customers looking to send money internationally.

Wise is better than CurrencyFair in terms of being more cost-effective for smaller transactions, faster for sending money and also offering a larger range of currencies to exchange with.

Pros

- Has a great app (4.8 out of 5 stars) and easy-to-navigate website

- Converts money at the real mid-market rate (no mark-up or conversion fee applied)

- Transfer fee is calculated on a percentage of the amount being exchanged. This percentage is calculated multiple factors: how you choose to pay, the amount you’re sending and the exchange rate at the time of transfer.

- Supports 50+ currencies for currency exchange

- Money delivered between 1-2 business days

Cons

- Not open to everyone worldwide yet

- Transfer fees can get costly when transferring larger amounts of money based on the percentage calculation

- Does not yet support sending money to and from all currencies offered

| Wise | CurrencyFair | |

|---|---|---|

| Transfer fee | % amount check here | % amount |

| Exchange rate margin | 0-0.015% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 4.8 out of 5 stars |

| Speed | 2 working days | 2-5 working days |

Coverage | 50+ countries | 17 currencies. Click here for full list. |

Wise is undoubtedly the more popular option globally and has really set themselves apart from their competitors through their popular app. They offer simple and transparent transfer fees and currency conversion rates for your international money transfer.

CurrencyFair can be the better option for bigger transactions. If you're looking to transfer a larger sum of money (£4000+) then Wise's percentage calculation can sting you. With CurrencyFair's fixed transfer fee percentage (0.25-0.3) it gives you a far better deal for your larger transfer amount.

Value | Speed | Ease |

|---|---|---|

Wise | Wise | Wise |

WorldFirst

Founded in 2004, WorldFirst is a UK-based company that has now grown across Australia, Asia, and Europe. However, they no longer operate in the USA. They work with individuals and businesses alike, with over 250,000 customers and 150,000 businesses.

Since their launch, they’ve transferred over £70 billion for their customers globally.

Pros

- Offers 130 currencies to exchange - far more than other money transfer services

- Simple and transparent fee structure on their website

- Low transfer fees for bigger transactions

Cons

- High minimum transfer amounts applied e.g. £1000

- Transfer fees differ with amount being transferred (0.5-0.15%) with a high amount needed (£500k) if you want to get a lower transfer fee applied

- Currency exchange rates are hidden until after you sign up. WorldFirst website only shows the interbank rates

- A poorly rated app - 3.2 out of 5 stars

| WorldFirst | CurrencyFair | |

|---|---|---|

| Transfer fee | % amount | % amount |

| Exchange rate margin | 0.15-0.5% | 0.25-0.3% |

| Mobile app | Yes 3.2 out of 5 stars | Yes 4.8 out of 5 stars |

| Speed | 1-4 working days | 2-5 working days |

Coverage | 130 currencies | 17 currencies Click here for full list |

With 130 currencies to exchange with, WorldFirst is a great option if you’re looking to transfer to or from less popular currencies.

In all other areas though, CurrencyFair wins. Better exchange rates and lower fees, with no minimum transfer amount and a quicker transfer time.

Value | Speed | Ease |

|---|---|---|

CurrencyFair | CurrencyFair | CurrencyFair |

OFX

OFX is an Australian company founded in 1998. One of the oldest players in the money transfer block, OFX is very popular and has offices all over the world.

OFX has transferred over $150 billion AUD worldwide. It has over 1 million customers and boasts an easy-to-use website and app, making it simple and fast to complete a money transfer.

Pros

- Offers 55 currencies to exchange

- Highly rated app - 4.8 out of 5 stars

- Easy-to-navigate website with simply, transparent information

- Converts money at the real mid-market rate - no mark-up or conversion fee applied

- Money delivered between 2-4 business days

Cons

- Minimum transfer amount applied e.g. £100 for GBP

- Transfer fees applied to currencies other than GBP and USD. This is $15 or equivalent.

- Adds mark-up on exchange rate – on average 0.4% above mid-market rate

- Hidden rates online - online currency converter only shows market exchange rates. To find out OFX customer rates, you must login or set up an account

- Some bad reviews on TrustPilot

- Exchange rate and margin changes per ‘pair’ e.g. one currency to another

| OFX | CurrencyFair | |

|---|---|---|

| Transfer fee | Fee-free above $10,000 | % amount |

| Exchange rate margin | 0.4% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 4.8 out of 5 stars |

| Speed | 2-4 working days | 2-5 working days |

Coverage | 55+ currencies | 17 currencies Click here for full list |

OFX offer more currencies and better flexibility with their international exchanges, but is by far the more expensive option. OFX applies a margin to their currency exchange rate, acting as their percentage cut, which is not transparent before you sign up. On average, research shows their rate is worse than CurrencyFair.

We recommend CurrencyFair if you are transferring with a popular currency, but we think there are better companies to get the most value for your cash out there.

Value | Speed | Ease |

|---|---|---|

CurrencyFair | OFX | OFX |

Xoom

You will have heard of PayPal before; it’s one of the biggest online payments systems in the world. While PayPal supports many online money transactions when you shop, it also supports international money transfers through its Xoom service.

Xoom is easy to use and has excellent reviews from customers worldwide. It is one of the leading transfer choices for the US, Canada and Europe, and you are able to transfer to over 30 countries worldwide easily through an app or online.

Warning though, there is a price to pay for the flexibility, range of services and sending money under the name of PayPal. Xoom is more expensive than other money transfer options, with the exchange rate mark up often being higher than others, and total costs added being far more than others.

Pros

- Highly rated and reviewed app: Xoom gets 4.7 out of 5 stars out of 37,000 reviews

- Send to 30 countries worldwide in US dollars or local currency. For the full list, click here.

- A number of payment options available for pay in and pay out: use your PayPal account, debit or credit card to transfer and your recipient can receive via a bank deposit, cash out or door delivery of funds. You can also pay bills directly to countries and different currencies.

- Secure and convenient

- Fast money transfer: money can be delivered in a number of hours in most occasions, or a few days depending on the details of your international money transfer.

Cons

- Adds a mark-up to the exchange rate that differs with each currency, amount and transfer method. This is often not clear and close to the retail exchange rate, making it far more costly than other providers.

- Expensive for international money transfers.

| Xoom | CurrencyFair | |

|---|---|---|

| Transfer fee | 0.30 fixed fee | % amount |

| Exchange rate margin | 3.9-7.4% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 4.8 out of 5 stars |

| Speed | 2 hours | 2-5 working days |

Coverage | 24 currencies | 17 currencies Click here for full list |

PayPal's Xoom service is highly ranked among customers worldwide. It offers a larger menu of options, such as the ability to pay bills directly or allow the recipient to draw out cash in local currency (which only the likes of Western Union and MoneyGram do, for a hefty cost), plus your normal bank account transfers.

Yet if you are looking for a standard money transfer which can be done from bank account to bank account, then Xoom isn't your cheapest or best option. With their mark-up on exchange rates and fees, they don't offer value in international transfers and for that, CurrencyFair would be the better option.

Value | Speed | Ease |

|---|---|---|

CurrencyFair | Xoom | Xoom |

Remitly

Remitly is a US-based foreign exchange company founded in 2011. Their aim is to make it easier and fairer for those working away from their families and friends to send money back home.

As a result, a lot of the currencies supported are not the major currency exchange routes e.g. GBP-USD. Instead, less popular currencies are supported such as Vietnamese dong, Thai baht, Argentine peso or Philippino peso.

If this is something you need, then it’s well worth having a look at Remitly's supported currencies.

Pros

- Offer currencies to be sent from 16 countries, including Europe, UK, US and Canada. From these countries, you can send to over 50 countries ranging Africa, Asia, South America and Europe.

- Highly rated app - 4.8 out of 5 stars

- Express or Economy option to transfer funds (time versus value)

- Low minimum transfer fee applied e.g. £1 for GBP

- Multiple options on how to transfer e.g. bank transfer, cash pick up, home delivery, mobile wallet

- Upfront and transparent fixed fees for Express or Economy

Cons

- Adds mark-up on some exchange rates for certain currency pairs

- Cash pick-up or home delivery options may incur additional costs

- Not all payment options are available to all countries

| Remitly | CurrencyFair | |

|---|---|---|

| Transfer fee | £1.99 for Economy £2.99 for Express | % amount |

| Exchange rate margin | % amount | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 4.8 out of 5 stars |

| Speed | 3-5 working days | 2-5 working days |

Coverage | 55+ currencies. Click here for the full list. | 17 currencies Click here for full list |

Remitly offers a different service to customers than other competitors, and as a result it stands as quite a different alternative to CurrencyFair. Unlike CurrencyFair, Remitly has built their product specifically to help workers send money to their home country and therefore it deliberately does not support major currency routes.

If you are looking to transfer between two popular currencies, then you should not choose Remitly.

However, if you are looking to transfer outside of a major currency exchange route, then you will find Remitly very useful and easy to use.

Value | Speed | Ease |

|---|---|---|

CurrencyFair | Remitly

| Remitly |

Summary

Transferring money doesn't need to be complicated or a hassle. There are many foreign exchange alternatives to CurrencyFair, and when transferring money, you need to be confident in who you're choosing to use. Some provide better or worse exchange rates while others provide different transfer services which may suit your needs better.

For help getting the cheapest alternatives to CurrencyFair check out our international money transfer comparison table.

Here's the overall list of alternatives we recommend in order of preference:

- Wise is the best rated and our overall recommended service for foreign exchange. Easy to use through their app, they offer transparent information and security throughout. See our review here.

- Other alternatives such as WorldFirst and OFX are also very helpful and provide competitive exchange rates that will save you much more money than a bank transfer. Both have great apps and an easy-to-navigate website, so they're worth a look if you're not sold on the alternatives above.

- PayPal's Xoom service is a highly rated option by thousands of customers globally. Although they cost you more than other transfer providers (hence why we've placed them third), they offer a lot of flexibility, security and range of services which are supported by Paypal.

- Remitly is a great option if you are looking to transfer money to less popular destinations and currencies. If you are looking to work abroad and send money home, this might be the best option for you.