How to Open an Australian Bank Account Online from Overseas

If you’re heading to live life under the Aussie sun or if you’re already here enjoying the laidback lifestyle, then opening an Australian bank account for your money is something you’ll want to do soon. It’s possible and in most cases very easy and inexpensive to open an Australian bank account online if you are travelling here from overseas.

First the basics. There are four big banks in Australia. They are National Australia Bank (NAB), Commonwealth Bank (CBA) the Australia and New Zealand Banking Group (ANZ Bank), and Westpac. They all allow non-residents from overseas to open an Australian bank account online and you can even do this before you get to Australia.

In five short steps, here’s the easiest way to open an Australian bank account online:

-

1

Go to the website of the bank you've chosen. From there you will be able to fill in the details they need. If you prefer to do it over the phone, most banks will have contact numbers. Just make sure you're calling within Australian business hours.

-

2

Make sure you know your exact arrival date in Australia if you’re not here yet. In some cases you'll need to provide this date to the bank when you apply for an account.

-

3

Have a permanent Aussie address. Banks require proof of residency and not all will accept an overseas one when you complete your application.

-

4

Scan and upload all of the requested documents including your passport and visa.

-

5

Once approved online and when you are in Australia, head to your nearest branch to verify your documents and complete your application.

If you’d like to know more about your options of the best banks in Australia and ways to open an account online then read on. This guide tells you everything you need to know!

Can I open an Australian bank account online from overseas?

Yes. You can open a bank account online in Australia without any problems.

Australia's four main banks NAB, Commonwealth Bank, ANZ and Westpac offer online applications for their standard current and savings accounts which are open to anyone, including those travelling on visas.

With simple eligibility requirements, it's easy to apply:

- Arrival date in Australia. If you're not here already, you will need to know when you plan to arrive.

Banks require you to arrive anywhere between 3 and 12 months after your application.

- Know where you’ll be living. Like your arrival date, most banks want to know where you’ll be living if you’re not here already. If you can’t provide an Australian address then you can provide your overseas one until you have a residential address here.

- Upload your documents.

- Be 18 or over. This is a usual requirement of all banks in Australia. However, Westpac and Commonwealth do have accounts for younger customers.

- Employer and salary details. You may find that banks request this information from you when you complete your digital application. This is usually dependent on the type of visa you are travelling on.

We recommend you verify your documents as soon as you can after you arrive. This will mean you can start withdrawing and spending in Australia.

What documents do I need to supply to the bank?

When applying online for an Australian bank account, you’ll need to supply documents that prove your identity and right to work and earn in Australia.

In most cases, these documents are:

- Your passport

- Your visa

- Proof of address

- Tax information e.g. TFN (Tax File Number)

- Employer details and salary

After you open your account, you will need to visit your chosen branch to verify your identity.

This appointment should be booked as soon as possible after you’ve completed your application – the sooner you can verify yourself, the sooner your bank account in Australia is open and ready to use. In this appointment, the bank may ask for documents such as:

- An Australian residential address if you provided an overseas one on your online application

- An Australian Medicare card or National Identity card (or other form of ID e.g. birth certificate)

What are my options?

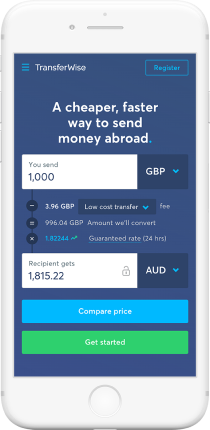

We know people have many different reasons to travel to Australia and although we recommend to open a bank account to ensure the security and safety of your money, we also know this might not suit everyone’s situation. If this applies to you, then you might want to take a look at the Wise multi-currency account (formerly TransferWise).

The Wise Account

The multi-currency Wise account has no set up fees, no monthly fees and no receiving fees.

Available to people in Europe, the UK, USA, Singapore, Canada, Australia and New Zealand, this account allows you to open up a local bank accounts in all of these countries. Plus it holds over 50 currencies and also comes with a debit card so you can withdraw money from your account.

Although we’d recommend opening a bank account if you’re in Australia for an extended time, this is a great option if you’re looking for something to temporarily hold your currencies while you settle in.

Be aware that the card does takes 7-14 days to be delivered, so manage your time and prepare if you think you might need it soon.

For more information on the Wise Debit Card, read our review.

How to choose the right account for you

If you’re living life down under already then you’re likely to have an idea of how accessible banks and ATMs are here. This is important to consider, but with each bank offering different packages and accounts, it’s definitely worth taking the time to understand which one suits you and your situation best.

Cheque, Savings or Credit?

Australia’s banking system uses EFTPOS (Electronic Funds Transfer as Point of Sale) rather than a debit card system. Essentially the same, EFTPOS is native to Australia and New Zealand and is a very easy way to pay for goods during your stay.

There are three main types of accounts available to you in Australia, and it’s important to know the difference as you’re generally asked which account you’d like to use to pay for most items.

Here's our take on them:

Cheque – A standard current account for everyday purchases. Linked to your EFTPOS or debit card, money will be deducted from your current account.

Savings – A savings account is a great option to put some money aside and is usually opened together with a current account. This account allows you to earn some interest on the money you're holding in your account.

Credit – A credit card will be harder to get in Australia and dependent on more factors than a cheque or savings account. If you do wish to get one, it will need to be a few months after you’ve settled in Australia so the bank can monitor your financial trends.

Best option when you're on a Working Holiday Visa

If you’re travelling on a Working Holiday Visa then you here’s a quick breakdown of what you can apply for when you’re here:

- Westpac has a separate Migrant Banking section online. You’ll need to fill in the application form specifically in this section to open a current account. No fees for the first year when you apply online and if you’re not here yet then you have 12 months after your application to arrive in Australia.

- Commbank is a great choice for travellers. An easy application form with a zero-monthly fee for a year if you open an account online. If you’re not here yet, then you have 3 months after your application to arrive in Australia.

- ANZ has a good option of current accounts open to travellers. For a low monthly fee, you can submit your application easily online and have 12 months after your application to arrive in Australia.

- NAB is also a great option for travellers as they offer a great current account with no monthly fees. Unfortunately, you can’t apply online with NAB. If you’re travelling on a Working Holiday visa, book yourself an in-branch appointment to open your account.

Best option for Expats

If you are relocating with work, with your family or alone, then you might want to explore some of the features of other accounts Australian banks can offer.

A lot of accounts beyond a current account require in-branch discussion, so we would recommend opening a current account with any of the big four, and then looking to open Savings or Credit accounts when you’re settled in Australia.

Opening a Bank Account in Australia from New Zealand

Many New Zealanders make the move to Australia each year, and vice versa. The great news is, opening a bank account online in Australia from New Zealand is relatively easy. Because there isn't a huge time difference it becomes easier if you'd prefer to do it over the phone too. In addition to this, some banks work out of both New Zealand and Australia. For example, ANZ bank.

Before you leave New Zealand it's a good idea to check that the name on your passport matches your other forms of identification. This way you won't have any issues when you get to Australia and need to confirm your identity at the bank.

What are the fees of opening an Australian bank account online from overseas?

Australian banks have very minimal fees linked to them, whether you apply from overseas or in Australia. If you're looking to open your account, then it won't cost you much.

That being said, it’s important to know what you’re signing up for as banks are never completely free of charges. Here is a list of the common fees attached to the standard current accounts of all of Australia’s big four banks:

ANZ (Australia and New Zealand Bank)

ANZ provides everyday banking with their Access Advantage current account.

- Monthly fee:

$5/month

- Overdraft fee:

$100 upfront for an overdraft of <$20,000

For other account fees, click here for more information.

Commbank (Commonwealth Bank)

Commbank offer an Everyday Account Smart Access current account for shopping, paying bills, withdrawing cash and more.

- Monthly fee:

$4/month, 12 months free with new account

- Overdraft fee:

$15 per account per day overdrawn

For other account fees, click here for more information.

NAB (National Australia Bank)

NAB offers a Classic Banking current account. Once you have an Australian working visa you can apply through the migrant banking channel before you arrive in Australia. However, you won't be able to withdraw any money from your accounts until you get to Australia and visit a branch.

- Monthly fee:

$0

- Overdraft fee:

$0

For other account fees, click here for more information.

Westpac

Westpac has a Choice current account for everyday banking.

They are a great choice as they have a separate migrant banking section designated to help foreigners get set up ahead of their move to Australia.

- Monthly fee:

$4/month; 12 months free with new account

- Overdraft fee:

$15 per account per day overdrawn

For other account fees, click here for more information.

ANZ, Commonwealth Bank and Westpac waive their monthly fees if you:

-

deposit $2,000 a month

-

are under 25 or over 60 years old

-

or a full-time student

Depending on what type of account/s you are wanting to open, the above fees should give you a basic idea of how much a standard current account will cost you.

When applying for a bank account, you will also want to consider additional fees so that you understand what you’re signing up for including ATM fees and international money transfer fees.

ATM fees

ATM fees are uncommon in Australia and were largely removed back in 2017 when the four big banks - ANZ, Westpac, NAB and Commbank - agreed to eradicate charges for ATMs between their customers collectively.

Nowadays, this means that not only will you find it relatively easy to locate an ATM nearby, you'll have many more options beyond your own bank's ATM and you'll be able to withdraw your money for free.

That being said, this alliance doesn't extend to all banks in Australia. Most of the smaller providers will often still charge you an average of $2.

Some ATM fees for commonly used banks in Australia:

- 'Big four' (ANZ, NAB, Westpac and Commbank) - Free

- Citi Group ATMs - $2 excluding Westpac Customers (Free)

- Bendigo Bank ATMs - $2.50 excluding Suncorp Customers (Free)

- Bankwest ATMs - Free. $2.50 excluding Commbank Customers (Free) for use of ATMs in 7/11 stores

- St. George Bank ATMs - Free

Westpac and Commbank are our recommended choices to avoid ATM fees in Australia. They have alliances with other smaller banks as well as the big four banks too. Westpac also have what they call the Westpac Global ATM Alliance which includes deals with international banks as well as Australia - a great choice if you're going to be a frequent traveller.

International transfer fees

If you’re looking to open a bank account in Australia, you’re likely going to need to transfer some money from your current account back home to your new Australian account. Otherwise known as an international transfer, it can cost you a lot if you're not careful.

There are many options to transfer your cash in today’s technological world, and whether you’re looking for ease, value or just the fastest route, you’ve got a lot of choices.

A transfer through your bank will always have multiple fees linked so we wouldn’t recommend this route. These fees can cost you up to 8% of your total transfer:

- An upfront fee

- A service fee

- A mark up on the exchange rate

If you’re looking for alternative ways to send your cash to your new Australian account, then we recommend using our money transfer comparison table to choose the best option to transfer your cash abroad.

How can I transfer money to Australia without a bank account?

There are ways to transfer money to Australia without actually opening a traditional bank account. Although there are many benefits of opening a bank account, your circumstances may not suit doing so. We've already mentioned the TransferWise Borderless Account, but if you’re travelling from the UK, USA or Europe, then the alternative options below are also good alternatives to the big four banks:

Revolut

Revolut is a British digital banking app and can be a great alternative while you get settled in your new life down under. Easy to set up, you will be automatically given a UK bank account and a Euro IBAN account when you apply. From there, it holds 29 currencies with AUD included and interbank rates when exchanging.

Not a long-term option but certainly a smart one while you get set up.

Starling Bank/ Monzo/ N26

All of these banks are app-based ‘neobanks’ and have forged a new way of banking that leaves traditional and often unfair methods behind. Easy to use, each aim to let you spend and transfer in multiple currencies without paying multiple exchange rates.

While N26 is German-based and specifically for Europeans only (since Brexit), Starling and Monzo are British-based and very easy and quick to set up. At the moment, none are available in the US.

If you'd like to read up on more options, then check out our money transfer page.

If you’re not keen to set up an Australian bank account before you arrive, both Starling Bank and Monzo are great options to spend and protect your money while you get set up in Australia. All you need is 10 minutes, identification and a UK address to apply on your phone.