How to open a bank account in New Zealand from Australia: The Easy Way 2026

If you’re planning a move to New Zealand, getting a bank account set up can be a good way to hit the ground running once you arrive. You may also be interested in opening a NZD account even if you don’t plan to relocate – as a frequent visitor, or if you need to send NZD payments often for example.

This guide walks through your options to open a NZD account from Australia with some popular New Zealand banks – and some alternatives like Wise and Revolut. More on that, later.

Key points: Online bank account opening

- To open an account in New Zealand with a bank you must either live there already, or plan to relocate there in the near future

- With New Zealand banks you may be able to start the process of opening an account prior to relocating, but you won’t get full account access until you move

- Accounts to hold, send, spend and receive NZD are also available for non-residents through alternative providers like Wise and Revolut

- New Zealand bank accounts may have monthly fees and transaction fees, including relatively high costs if you transact across foreign currencies

- There’s no single best New Zealand bank account for foreigners, new arrivals and non-residents – compare a few to help you choose

What documents do I need?

Some New Zealand banks have their own processes for supporting people who plan to move to the country, to get an account set up in advance of moving. To give an example, let’s walk through the documents you need to access this service from Westpac New Zealand:

- A certified copy of your passport

- A certified copy of your Visa for New Zealand

- A certified copy of your proof of address (this can be outside of New Zealand)

- A completed application form

All document copies have to be certified by a qualified person, like a lawyer. You’ll need to visit a Westpac branch once you arrive in New Zealand to show your original paperwork, and to register your local address in New Zealand, before you can get full account access.

However, this process does give you a head start and allows you to get your application submitted ahead of time. It’s important to note though, that with services like this it’s common that you can pay money in immediately, but you may not be able to make withdrawals until you actually arrive and verify your account in person.

If you’re not planning on moving to New Zealand you may struggle to open an account with a New Zealand bank. In this case, alternative services like Wise and Revolut – which you can open from Australia before you travel – might be a good choice instead.

Save the paperwork with alternative solutions like Wise or Revolut

If you’re not planning on moving to New Zealand you might struggle to get a bank account with a New Zealand bank. Generally to be eligible to open an account, a bank will need you to provide your New Zealand visa or your New Zealand residential address.

If that doesn’t work for you take a look instead at an online alternative like Wise or Revolut. Both offer accounts with multi-currency holding facilities which can handle both AUD and NZD, among other currencies. Depending on the account you choose you may also get NZD account details to get paid by others in New Zealand dollars conveniently and for free.You can set up your account online or in-app and upload your proof of ID and your Australian address. There’s no need to schedule a bank appointment, as the whole process is done digitally. We’ll look at this in more detail a little later, so you can weigh up if either Wise or Revolut might suit you.

Click here for a full Revolut review

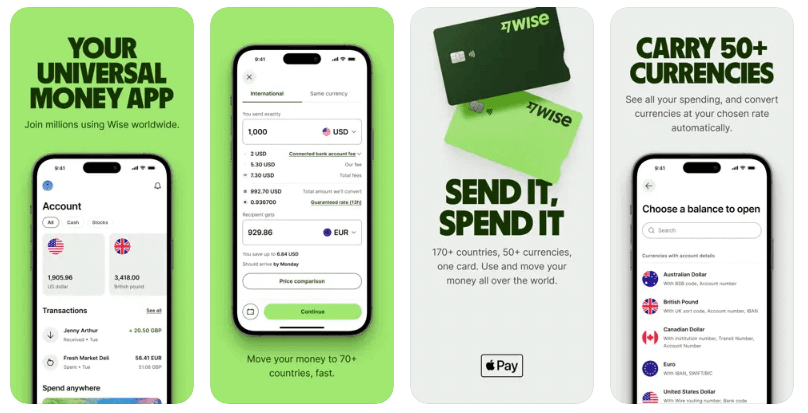

Wise

Wise is a financial technology company which has multi-currency accounts and cards, which can be used to hold, exchange, send, spend and manage 40+ currencies including NZD and AUD.

You’ll be able to open your Wise account from your phone or laptop, to make payments, convert currencies and check your balance instantly. The whole process, from application and verification to onboarding and account management, is done online or in-app, with no need to visit a physical location. Simply upload your Australian proof of ID and address to get verified, with no need for a New Zealand residence visa.

Wise accounts come with New Zealand bank details so you can receive local NZD payments, and a linked Wise debit card for easy spending around the world.

Account types:

- Personal accounts

- Business accounts

Both personal and business customers can open a Wise multi-currency account with no minimum balance or monthly fees to pay. You just pay a low, transparent fee for the services you use.

Eligibility: You’ll need a government issued ID and in some cases a proof of address or tax number to apply. Australian proof of address is accepted.

Is it safe? Yes. Wise is also overseen by a range of global regulatory bodies around the world.

To open a Wise account:

- Download the Wise app or open the Wise desktop site

- Click Sign up and create an account with your email, Facebook, Google or Apple ID

- Follow the prompts to enter the details needed

- Upload a snap of your ID and address documents

- Once your account has been verified you’re good to go

Read a step by step guide on how Wise works or go to Wise

Revolut

Revolut is a financial app which has multi-currency accounts and cards you can manage with just your phone. All accounts have some fee free currency exchange, and linked debit cards, with the exact account features based on the plan you select. Choose a standard plan with no monthly fees, or you might decide to upgrade to pay a monthly fee and get more perks and higher fee free transaction levels.

Revolut supports around 25 currencies, and has a good range of features including accounts for children and saving or investment options.

Account types: Standard account plans are free or you can upgrade to a paid plan on a variety of different tiers – fees for customers in Australia run from 0 AUD to 24.99 AUD a month.

Eligibility: Available to customers with addresses in the UK, the EEA, Australia, Singapore, Switzerland, Japan, and New Zealand.

Is it safe? Yes. Revolut operates safely in the countries it serves, with oversight from a range of global bodies.

How to open an account with Revolut

To open an account with Revolut:

- Download the Revolut app

- Enter your phone number and set a PIN – you’ll get a verification message from Revolut

- Use the verification code to access the app and enter the details needed to create your account

- Upload the required documents for verification

- You can deposit funds and use your account once verified

BNZ

If you’re planning on moving to New Zealand you can open a BNZ account from Australia, and receive an account number within 15 days of applying. Once you have an account number you can deposit funds into your account and view the balance online. However, you won’t be able to withdraw any money until you arrive in New Zealand and show all your paperwork to activate the account in full.

Different BNZ account types are available, including everyday accounts and savings products, as well as a full range of banking services like loans and mortgages.

Account types: BNZ has a broad range of accounts on offer, including day to day accounts, student accounts and savings products

Eligibility: You’ll need to be a resident of New Zealand already, or be planning on moving soon, with a New Zealand visa already in place

Is it safe? Yes – BNZ is a large and trusted bank which operates securely.

How to open an account with BNZ:

- Check eligibility for the account you want to open

- Assemble the required paperwork

- Start the application online, uploading documents and details

- Visit a branch on arrival in New Zealand, to complete the opening process

Westpac

Westpac is a familiar name which offers account services in New Zealand as well as Australia. You’ll need to be planning on moving to New Zealand in the next 6 months, and you’ll have to provide a full suite of documents to apply, including a New Zealand visa. Once your account is approved you can start to build a credit history and savings in New Zealand, before opening the account in full on arrival in the country.

Account types: Broad selection of banking products and accounts

Eligibility: Customers must be planning on moving to New Zealand in the next 180 days after application, with a certified visa

Is it safe? Yes – Westpac is a large and reliable bank, which is regulated and licensed

How to open an account with Westpac:

- Check you meet the eligibility criteria

- Assemble the required paperwork, including having documents certified

- Download, print and complete the required application

- Email all the documents needed to Westpac for checking

- Complete the application in a branch when you arrive in New Zealand

How to open a New Zealand bank account as a foreigner

Generally to open a New Zealand bank account you’ll either need to be a resident in New Zealand already, or be planning on moving there soon. If you’re expecting to move to New Zealand to live, work or study in the near future, and have a visa already, some banks will let you start to open an account online, with full feature access granted when you arrive and show your paperwork at a branch in person.

If you don’t plan on moving to New Zealand and you don’t have a local address there, you’ll probably struggle to get an account from a bank – but you could try a multi-currency account from a specialist digital provider like Wise or Revolut instead.

What do I need to know before opening a bank account in New Zealand?

New Zealand banks usually require you to have a local proof of address document. The exception is if you’re planning on moving to New Zealand in the near future. Banks like Westpac, for example, allow New Zealand visa holders who plan to move in the next 180 days to apply for an account in advance of moving. This means you can transfer over funds in advance of your relocation, and start building both savings and a credit history in New Zealand. However, it’s worth noting that with these arrangements, you’ll generally have to present all your documents in the original form, and provide a local proof of address, once you actually arrive in New Zealand, to make withdrawals and get full feature account access.

Can I open a bank account in New Zealand only with my passport?

It’s not possible to open a bank account in New Zealand with just a passport. Banks will need to see additional paperwork – usually including a valid visa for New Zealand if you’re using a foreign passport to prove your ID. In most cases to open an account with a New Zealand bank you’ll also need a local New Zealand address, with supporting documents such as a rental agreement or utility bill in your name.

If you don’t have an address in New Zealand, look at online banking alternatives like Wise or Revolut which allow customers to hold and spend NZD without needing to be a New Zealand resident.

Which account is best in New Zealand for foreigners?

New Zealand has plenty of different banks with their own account products to choose from, although the range you can access may depend on whether you’re planning on moving to New Zealand or not. If you’re not a New Zealand resident and you don’t plan to relocate there, an alternative is to choose a specialist service from a provider like Wise or Revolut.

Let’s take a look at a few examples of both specialist NZD account services, and popular banks you may want to choose:

| Service | Wise | Revolut | BNZ | Westpac |

|---|---|---|---|---|

| Currencies covered | 40+ currencies, incl. AUD, NZD | 30+ currencies | NZD | NZD |

| Open before you arrive in New Zealand | Yes | Yes | Start the process before you travel | Start the process before you travel |

| Open online | Yes | Yes | No | No |

| Opening fee | No fee | No fee | No fee | No fee |

| Maintenance fee | No fee | Up to 24.99 AUD/month | Varied fees based on account choice | Varied fees based on account choice |

| International transfers | Low fee, varies by currency | Varies based on destination | No fee when sending online in a foreign currency

Exchange rate markups are likely to apply |

5 NZD for online payments

Exchange rate markups are likely to apply |

*Details correct at time of research – 19th March 2025

New Zealand banks have a broad selection of account types on offer, but usually require you to have a local address, or to plan to relocate in the near future. If you don’t, you may find you can’t access a standard account type from a New Zealand bank – specialist services from providers like Wise and Revolut can be a good alternative in this case.

What is a bank account in New Zealand needed for?

If you’re an Australian planning to relocate to New Zealand, or simply spend a lot of time there, having a NZD bank account can be very helpful. Here are some of the ways you might choose to use your new NZD account:

- Cut the costs of spending in NZD, in person when you travel and when you shop online

- Prepare for your move if you’re planning to relocate to New Zealand

- Start to build a credit history in New Zealand, which is handy if you’re relocating there

- Convert funds from AUD for investing in NZD or to diversify your savings

- Send payments to individuals and businesses in New Zealand – such as paying for travel or an overseas mortgage

Benefits of opening a bank account in New Zealand

Here are a few of the benefits you can expect if you choose to open a bank account in New Zealand:

- Reduce the costs of spending in NZD

- Cut out foreign transaction fees when spending in New Zealand

- Get paid by others in NZD

- Hold your funds in NZD without needing to convert back to Australian dollars

- Send money to others in New Zealand, for personal or business purposes, with lower overall costs

Can I open a bank account in New Zealand before arrival?

You can open a bank account in New Zealand with banks like BNZ and Westpac, if you plan to move to New Zealand in the near future. However, it’s important to note that you’ll typically have to show a valid New Zealand visa, and you’ll need to provide a local New Zealand proof of address once you arrive, to get full feature account access. You may find you can pay money into the New Zealand account – but you can’t withdraw any funds until you’ve arrived in the country and visited a branch.

As an alternative which you can use without needing a visa and New Zealand proof of address, take a look at specialist digital services which offer multi-currency accounts you can open from Australia and use to hold and exchange NZD alongside other currencies like AUD. Check out Wise and Revolut as good examples of online account providers which may suit your needs.

Can I open a bank account online

You can start the account opening process online, if you plan to move to New Zealand in the near future, with major banks like BNZ and Westpac. However, banks tend to ask customers to attend in person when they arrive in New Zealand, to show their documents and confirm their new address. Instead, you could get an account set up fully online or through an app – without needing a New Zealand address – by picking a specialist alternative service from a provider like Wise or Revolut.

How long does it take to open a bank account in New Zealand?

If you’re opening an account in advance of moving to New Zealand, it could take a while to have your documents verified and get account access. BNZ, for example, commits to responding to applications within 15 days of submission. In addition, you’ll need to go to a branch once you arrive in New Zealand to show your original documents and update your address information.

What are the types of bank accounts in New Zealand

Like most countries, when it comes to banking in New Zealand, there are some common account types available to suit varying financial needs. Whether you need a New Zealand account for simple daily transactions, a savings account to safely store and grow your money or a business account for your new venture, you’re sure to find what you need.

Typical bank accounts in New Zealand include:

- Current account: Ideal for daily transactions, like making payments, using a linked debit card, receiving a salary and transferring funds

- Student account: A specialized account for those in higher education, which typically comes with special offers and features like low or no fees and an interest-free overdraft

- Savings account: Specially designed accounts for short and long-term savings, usually with no account-maintenance fees

- Business account: Designed for freelancers and business owners to receive payments from customers and generally manage their business finances

How to choose a bank account in New Zealand

There are several important factors that you should look at before choosing your provider and bank account in New Zealand. Consider how easy the account is to open, especially if you’re a non-resident. Banks may have varying requirements for foreigners, and usually request proof of a local address, which you might not have immediately on your arrival. Some may also require more extensive paperwork, which could be a challenge if you’re just settling in.

It’s also crucial to do your research and compare fee structures of different banks, as this can significantly impact your finances in the long-run.

How much does it cost to open a bank account in New Zealand?

You won’t usually need to pay any fee when you open a bank account in New Zealand. However, monthly maintenance fees may apply, which can sometimes be waived if you hold a fixed minimum deposit or if you qualify for a fee discount. In many cases you’ll need to make an opening deposit when you set up your New Zealand bank account – and you won’t necessarily be able to withdraw this until you relocate, if you’re opening an account prior to your move.

As an alternative, non-bank providers like Wise and Revolut can be a flexible way to hold and exchange NZD as well as other currencies like AUD, with low overall fees and good exchange rates.

Is it possible to open a fee-free account in New Zealand?

The range of account products in New Zealand is quite broad, including some accounts which either have no monthly fees, or which waive fees for people in certain categories, such as younger people or students. However, even if you find an account which has no fixed fees, it’s worth remembering that there are likely to be other charges, such as service and transaction fees, and costs if you use other options like an overdraft or payment card.

What are the additional costs?

Keep an eye out for the following costs when selecting the NZD account for you:

- Monthly maintenance fees – or fall below fees

- International payment fees

- Foreign transaction fees when spending or withdrawing with your card

- Overdraft fees

- Credit card costs including cash advances and interest

- Cheque book and cheque cashing fees

- Account dormancy or early closure fees

Tips for sending money between Australia and New Zealand

If you’re moving to New Zealand, the chances are that you’ll need to send payments between Australia and New Zealand – to pay for accommodation and to get your bank account set up, for example. International transfer fees can be pretty high, and include several different charges.

Here are some tips to cut the costs on international wire transfer fees:

- Compare the exchange rate you’re offered against the mid-market exchange rate to see if a markup is being used

- Review the terms and conditions of your specific account to see the transfer fee which will apply

- Check if there are third party fees associated with the SWIFT network – these can push up the overall costs

- Consider using a specialist service like Wise instead of your regular bank – this can keep the costs down and mean you get a faster service, too

Conclusion: Open a bank account online New Zealand

New Zealand banks do allow you to open an account from Australia, but usually only if you are planning on moving to New Zealand in the near future, and already have a valid visa. Banks like BNZ and Westpac have processes that allow you to start the application in advance, and pay in funds before you move – however you won’t be able to make withdrawals until you arrive in New Zealand and visit a branch with your paperwork for verification.

If you’re looking for a simpler solution, an alternative provider like Wise or Revolut could help. Open an account fully online or in-app, and hold NZD alongside AUD and other major currencies for convenience.

Open a New Zealand bank account online FAQs

Can a foreigner open an account in New Zealand?

Yes, foreigners can open New Zealand bank accounts. However, you’ll need to either already be a resident of New Zealand with a valid proof of address, or be planning on moving there in the next few months. If you don’t qualify, a flexible account from a specialist provider may be a better option.

How much do I need to open a bank account in New Zealand?

You won’t need to pay a fee to open a New Zealand bank account in most cases. However, you may need to make a minimum opening deposit, which you can’t then withdraw until you’ve moved to the country and completed the account opening process in a branch.

Can I open a New Zealand bank account online?

You can’t normally open a New Zealand bank account online unless you’ve already got a local

New Zealand address. If you plan to move to New Zealand you’ll be able to start an account application but you’ll need to go to a branch to complete the process after you relocate. A better alternative is probably to look at online specialists, which have fully digital onboarding and verification processes, with NZD details to send and receive payments.

How to apply for a bank account online in New Zealand?

You can start your application for a New Zealand bank account online if you plan to relocate there and have a valid visa. You’ll then need to visit a branch in person to complete the process once you move. Instead, for an onboarding process you can manage entirely from home, check out alternatives like Wise and Revolut.

Can I open a bank account in New Zealand before landing?

You can’t normally open a New Zealand bank account in full without a local address. Online and digital specialist services like Wise and Revolut may be more flexible, with accounts you can open with proof of address from Australia instead.