Wise Debit Card Review 2026: Fees, Rates and Limits

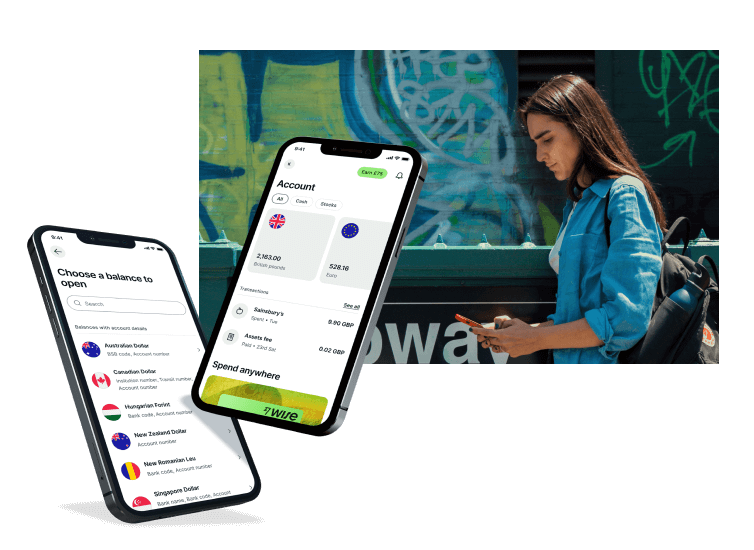

The Wise card works with the Wise multi-currency account to give customers a cheap and easy way to convert and spend AUD in over 150 countries they travel to.

With Wise you’ll get the mid-market exchange rate with low, transparent fees when currency conversion is needed for spending abroad, making Wise a great debit card option for spending overseas. Read on for our full Wise card review, covering everything you need to know.

What is the Wise card?

The Wise card is attached to your Wise multi currency account and can be used to:

- Make purchases internationally

- Spend money overseas like having a local card, even if you don't have the currency you need in your account

- Receive money from overseas in your Wise account using local account details in major currencies like AUD, NZD, GBP, USD, and EUR

- Transfer money to bank accounts around the world

Wise card pros and cons

- No annual fee, hidden transaction fees, or exchange rate markups. Fees are shown upfront

- No minimum balance requirements

- Allows you to make payments and withdrawals in over 150 countries

- The Wise travel card uses the mid-market exchange rate to convert between currencies, making it a good option when travelling abroad

- Local account details in 8+ currencies - incl. AUD, NZD, GBP ,USD and EUR

- It takes 7-14 business days to receive the card

- Withdrawing fees apply if you make 3 or more withdrawals, or withdraw over 350 AUD in a month

Wise card features

- Hold and exchange 40+ currencies in your Wise account

- Spend and withdraw in 150+ countries

- Convert currencies in your account with the mid-market exchange rate and low fees

- Virtual cards available instantly

- With the Wise travel card spend seamlessly when you travel abroad

- View and manage your account in the Wise app

- Freeze and unfreeze your physical card and virtual cards instantly

- Wise holds an Australian Financial Services License (AFSL), and is regulated and overseen by authorities all over the world

Is Wise a good travel card?

The Wise card can be used in 150+ countries globally, with no fee to spend a currency you hold in your account. That means that the Wise card can be a great travel card for more or less any trip you might make.

Your Wise card is linked to a Wise multi-currency account which can hold 40+ currencies, allowing you to add money in AUD and convert to the currency you need with a few taps, using the mid-market rate and low conversion fees. If you’d prefer to leave your balance in dollars that’s also OK. The card will convert the amount you need for your spending and withdrawals at the point you transact, with the same great fees and the mid-market rate.

Who is the Wise card for?

The Wise debit card is available in Australia for both personal and business customers, which means it can be a great way for lots of people to manage their money conveniently - and cut transaction costs at the same time. The Wise debit card is great for:

- Travellers looking to make contactless or mobile payments can use the Wise card as a travel debit card

- Anyone on holiday who wants to withdraw cash cheaply from local ATMs

- People who love to shop online with international retailers

- Anyone who wants a low cost, secure account with both virtual and physical cards

- Entrepreneurs who need to spend in foreign currencies

- Business owners who want to offer international debit cards to team members to manage spending and expenses

Wise travel card review from an Australian customer

Here’s what some happy customers from Australia say about using the Wise card:

“I have recommended Wise to many friends as we have travelled throughout the world over the past 10 years and used Wise each time. It has never failed to work without exception with simple processes for transfers, payments, and adding funds as required. (...)” * Kevin, Australia

*Customer names have been changed for privacy. Customers are not paid to leave reviews. Reviews taken from Trustpilot on September 2025.

Can I get the Wise debit card in Australia?

Yes. You can get your Wise debit card in Australia in just a few simple steps.

-

Account creation process: Download the Wise app, or open the Wise desktop site. Register a Wise multi-currency account using your email address, Facebook, Apple or Google ID.

-

Identity verification: Follow the prompts to upload images of your ID document - like your passport - and a proof of address, such as a utility bill or bank statement.

-

Ordering your Wise travel card: Top up your Wise account in the currency of your choice and then you can order your Wise card in the app, for a one time 10 AUD fee. Standard card delivery takes 7 - 14 days, or you can get expedited delivery in 1 - 2 days for a fee.

-

Funding your Wise account: Add money to Wise easily online or in the app, paying from your bank, with a card, or using a wallet like Apple Pay. You can leave your balance in AUD or convert right away to the currency you need in your destination.

-

Using your card abroad: Tap to pay, make cash withdrawals and use Chip and PIN just like you would at home. If you have enough balance in the currency needed there’s no extra fee to spend, with low cost conversion at the point of payment if not.

Is the Wise card a good option?

If you want to easily and frequently access the funds you're holding with Wise with a card, it's a great option. It's a cheap and easy way to spend and withdraw cash internationally. When you need to convert between currencies, Wise uses the mid-market exchange rate at the time you convert, with low fees from 0.63%.

Is the Wise travel card Mastercard or Visa?

The Wise travel card may be issued on either the Mastercard or Visa network. Both are very widely accepted all around the world. You’ll simply need to look out for the network logo which is shown on your card, at payment terminals, on ATMs and at the checkout when you shop online.

Is Wise a credit card or debit card?

The Wise card is a powerful international debit card. You’ll need to add money to your linked digital Wise account before you can spend with your card, and then you can make contactless, Chip and PIN, and online payments seamlessly in 150+ countries around the world.

How is Wise's debit card different?

Wise's debit card (formerly known as TransferWise) is unique compared to both foreign currency accounts and travel cards, because it allows you to directly access money you receive from overseas and spend that money using a card, without any limitations.

How does the Wise card work?

How does the Wise (TransferWise) card work? You use the Wise Debit Card (formerly known as TransferWise) in the same way you would use any debit card. You can withdraw money with it and make purchases in shops, restaurants and any place that accepts card.

If you have the balance of the currency for the country you're in, it will simply deduct the amount from your Wise multi-currency account. If you don't have any of the domestic currency, Wise will convert the currency for you at the mid-market rate, so you can make your purchase or withdrawal. Simple!

Example:

Samantha lives in the UK, but is currently in Berlin for work. She has a Wise account and recently received her debit card. In her account she has US dollars, Euros and Pounds. When she first gets to Berlin, she uses her card to make purchases and they are deducted straight from her balance of Euros.

However, towards the end of the trip she runs out of Euros. When Samantha goes to make a purchase, Wise automatically converts the required balance from one of the remaining currencies in her account. In this example, Wise converted Samantha's US dollars into Euros to complete her purchase, as that was the currency balance which incurred the lowest available fee.

How to use a Wise debit card

Once you have your Wise debit card you’ll need to add a balance to your account with a bank transfer, card or using PayID for example. You can top up in dollars, or any of the other 20+ supported top up currencies, and then either hold your balance as it is, or convert to a new currency for spending later.

Once you have funds in your Wise account you can use your Wise debit card just like you would any other debit card. Tap to make contactless payments, add your card to a wallet like Apple Pay for on the move transactions, and use your physical card for Chip and PIN payments and ATM withdrawals.

You’ll be able to keep on top of your account in the Wise app, with transaction notifications and easy ways to see your balance across all currencies at a glance. If you’re ever concerned about your card being lost or stolen you can simply freeze it in the app. Plus, for added security you can generate virtual Wise cards for use online and with mobile wallets, which can be reassuring when you spend with new retailers. Just use your virtual card once and then freeze it, without needing to stop transacting with your physical card.

Can I use the Wise travel card abroad?

The Wise travel card is specifically created to make your life easier when travelling abroad. All you’ll need to do is open your Wise account before you travel, with your local ID and proof of address for verification, then order a linked international Wise card for a low, one time fee, for spending and cash withdrawals in 150+ countries.

When you spend with your Wise card, the balance needed is deducted from your Wise account. If you have the right currency for the country you’re in, the funds are simply taken from that balance with no fee to pay. If you don’t have the currency you need where you are, the card can automatically convert your balance from the currency that incurs the lowest available fees, using the mid-market exchange rate.

Here’s what you can do with your Wise card:

- Make contactless payments in person while you’re away

- Add your card to a wallet like Apple Pay for mobile spending

- Make cash withdrawals at ATMs globally

- Spend online in foreign currencies

Is the Wise travel card a good option for spending abroad?

The Wise card is a good debit card for international travel as it’s been optimised for international features, and with a focus on keeping fees low and your options flexible. Here’s how the Wise card can shine as a travel card:

- The Wise card is secure and not linked to your everyday AUD account

- You’ll be able to hold 40+ currencies, to convert in advance of spending if you like

- Your card can convert currencies for your if you don’t have the balance in the required currency

- You can use your Wise card to make cash withdrawals so you don’t need to arrange your travel money in advance

How to activate your Wise card

Once your physical card arrives in the post you’ll need to activate it. This is done simply by making a purchase using your PIN number - or if you’d prefer you can make a cash withdrawal or check your balance in an ATM. You’ll be able to find your PIN, as well as your card number and CVV code, in the Wise app at any time.

How to top up your Wise card

Your Wise debit card is linked to your Wise multi-currency account. To add funds to your Wise account you’ll need to take the following steps:

- Log into your Wise account online or in the Wise app

- Select the currency balance you want to top up

- Tap Add

- Confirm the currency you want to pay with

- Enter the amount you want to top up and select a payment method

- Check everything over, confirm and follow the prompts to complete the payment

You can also add money to your Wise account directly from your online banking service using your local bank details for eligible currencies.

How do Wise card fees compare for spending abroad?

Spending in foreign currencies with a Wise card could be significantly cheaper compared to using your bank’s debit card.

Your bank is likely to add a foreign transaction fee to every purchase or withdrawal you make in a different currency - this is often in the region of 3% of the cost of the transaction. Wise on the other hand uses the mid-market exchange rate and charges low fees from 0.63%. That means that you can cut your costs whenever you use a Wise debit card to shop when you travel, spend with international e-commerce stores, or make a cash withdrawal overseas.

More on how that works, next.

Wise card vs bank

Banks usually add a foreign transaction fee whenever you spend with a credit or debit card, on top of any other charges - such as international ATM fees or cash advance charges for example. Wise is different, offering the mid-market exchange rate with low conversion fees from 0.63%, and no foreign transaction fee.

Here’s a quick comparison of how Wise card spending compares to using a bank credit or debit card when you’re overseas:

| Provider | Exchange rate and foreign transaction fee |

|---|---|

| Wise | Mid-market exchange rate + no foreign transaction fee |

| Westpac | Card network exchange rate + 3% foreign transaction fee |

| ANZ | Card network exchange rate + 3% foreign transaction fee |

| St George | Card network exchange rate + 3% foreign transaction fee |

| Commbank | Card network exchange rate + 3.5% foreign transaction fee |

*Details correct at time of research - 10th September 2025

Click here to read how Wise money transfers compare to international bank transfers

What is a Wise card?

The Wise card is a debit card - not a credit card - that’s linked to aWise multi-currency account. It’s great for spending and making cash withdrawals, online, at home and abroad - and best of all, you’ll get currency conversion using the mid-market exchange rate whenever you choose to spend in a foreign currency.

- Make payments and withdrawals in 150+ countries

- Top up in the currency you prefer and check your account balances at a glance in the app

- Switch currencies with the mid-market exchange rate and low, transparent fees

- No fee to spend a currency you hold enough money in

- Auto convert feature makes sure you always pay the lowest possible fee when spending currencies you don’t hold in your account

- Instant transaction notifications for security

- Get instant access to 3 virtual cards

- Freeze and unfreeze your card whenever you need to

- Debit card - making it easier to manage your budget without running up debts or incurring credit charges

Wise virtual card

The Wise virtual card - also known as the Wise digital card - allows you to make payments online and in stores with your phone. Simply add your virtual card to a mobile wallet like Apple Pay or Google Pay, to make contactless payments in stores and buy things online. You can have up to 3 virtual cards at any one time which can make it easier to manage your budget by assigning different spending types to different cards.

Wise virtual cards have different card details to your physical card, and can be frozen instantly whenever you’re not using them - offering a handy added layer of security. You’ll be able to start using your Wise digital card as soon as you order your physical card, with no need to wait for the physical card to be delivered.

Wise debit card for business

Wise can provide business support for your international transfers.

With Wise's multi-currency account, it makes sense to have the additional Wise card for your business travels so you can spend money like a local, too.

Read about the Wise account here.

Where is the Wise debit card available?

The Wise account is available in a broad selection of countries, including Australia, New Zealand, the UK, the US, Singapore, Malaysia, Japan and EEA (European Economic Area).

With the Wise account you will also receive all the details needed to get paid using local transfers from Australia, Canada, the Eurozone, the UK, Hungary, New Zealand, Singapore, Turkey and the US. You can also get SWIFT information to be paid in over 20 currencies, giving even more options whenever someone needs to send you money.

See a full list of the countries it is currently available here.

Wise card fees

While it is free to create a Wise Account, there are some fees you need to be aware of:

| Feature/ Service | Wise travel card fees |

|---|---|

| Order card | 10 AUD |

| Order card with express delivery | From 16 AUD |

| Use card in foreign country | No fee to spend a currency you hold a balance in

Currency conversion from 0.63% where needed |

| Digital card | No fee |

| Replace card | 6 AUD |

| Replace expired card | No fee |

| Monthly fee | No fee |

| ATM fee | 2 withdrawals up to 350 AUD a month with no Wise fee - after that, a fee of 1.5 AUD + 1.75% applies |

*Details correct at time of research - 10th September 2025

To read more about Wise fees, you can click here.

Wise exchange rates

Wise provides a currency calculator on their website. It shows the mid-market rate which is the same rate they offer for your transfer.

Saying that, it can still be tricky to compare exchange rates and total costs that Wise offer against banks and money transfer providers. Our comparison table accurately does this for you.

Wise card limits

Your Wise card comes with default set limits which you can change if you would like to. You can see the limits for your card which are in the Wise app. In both cases there’s a monthly and a daily limit. The daily limit is set to the same amount as the monthly limit as default - but you can set yourself a lower daily limit in the app if you choose to.

What do customers say about Wise?

Trustpilot TrustScore: 4.3/5

On TrustPilot, customers think Wise is an "excellent company" to use.

Customers mostly praised Wise for its ease-of-use and speed, but also how good their exchange rates are. Negatively, the most common complaint we could find was about limited customer service and that sometimes ID took a long time to be verified.

How to contact Wise if you have a problem

Get in contact with Wise via the app or on the website.

Website: https://wise.com/help/

Is Wise regulated in Australia?

Yes. Wise (formerly TransferWise) is completely regulated in Australia. They also have an Australian Financial Services Licence, and are regulated by the Australian Securities and Investment Commission (ASIC).

Is Wise safe to use?

There are very stringent guidelines that Wise must follow in order to send your money. This makes them a safe, and trustworthy option for your international money transfers.

They also take measures to protect the sensitive data you provide them like your personal details and identification. The company encrypts any information you give them and has a strict customer agreement. You can email Wise to find out more.

Security guide for travelers paying with card abroad

While Wise takes steps centrally to protect customer accounts and cards, travellers do still need to be aware of scams. Here are some security best practices for using the Wise travel card abroad:

- Use the Wise digital card for online purchases, which adds an extra layer of security as you don’t need to share your physical card details with the retailer

- Whenever needed you can freeze/unfreeze your Wise cards (physical and virtual) via the Wise app so they can not be used - handy if you ever misplace a card, or if you know you won’t need it for a while

- Use 2 factor authentication on your phone to keep your Wise account as secure as possible

- Set up transaction notifications so you will be alerted any time a transaction on your card is processed - and remember to check your account frequently so you can spot any issues in your account quickly

How to freeze and unfreeze the Wise travel card?

You can freeze and unfreeze the Wise travel card online or in the Wise app. There’s no need to notify Wise when you freeze a card, and you can unfreeze it whenever you’re ready:

- Log into the Wise app and go to your card tab

- Choose your preferred card

- Select Freeze card / Unfreeze card

How to cancel or replace the Wise debit card?

You can cancel or replace the Wise card online or in the Wise app. The exact options available depend a little on the reason you need a new card. Here’s what to do:

- Log into the Wise app and go to the Cards tab

- Tap on Replace Card

- Choose the reason why you're replacing your card from the options, including lost, stolen or damaged

- Tap on Replacement Card

- Enter your delivery address and pay the card fee, to receive your new card

What to do if the Wise debit card is lost or stolen?

If your card is lost you’ll be able to freeze it initially before you order a new one if you would like to. You can freeze the card in the app, and then if you don’t find it, you can order a new one following the process set out above.

If you’re unlucky enough to have your card stolen you can report this in the Wise app, at the same time as ordering a new card. If you report your card as stolen it will be automatically blocked for security and can not be used. You’ll then need to follow the process to order a new card in this case.

In either case, you’re guided through the process and your options by online prompts, so the system is pretty easy to use.

Conclusion: Is the Wise card worth it?

The Wise debit card can make life easier - and help you save money - if you travel often, shop with international ecommerce stores, or have a business and want to issue your team with international debit cards to manage spending.

Wise currency exchange uses the real mid-market exchange rate with no markup and no hidden fees - and with the Wise debit card’s smart auto convert feature you don’t even need to switch currencies before you travel. Leave the Wise card to switch to the currencies you need, when you need them, with the lowest possible Wise fee.

FAQs - Wise Debit Card

Can I use my Wise card abroad?

Yes. In fact, the Wise card can help you cut the costs of currency conversion when you spend and make withdrawals in over 150 countries around the world.

What's the difference between a debit card and a virtual card?

A virtual debit card works similarly to a physical debit card, but it only exists on your computer or smart phone. That means you can add it to a mobile wallet for on the go payments - or use it for online shopping. You can’t use a virtual card to make an ATM withdrawal, or in any situation where the physical card must be presented to the merchant.

Is the Wise card contactless?

Yes. The Wise international debit card is contactless for convenient spending.

Is Wise good for travel?

Yes. The Wise card is optimized for travel use, and can be used in 150+ countries globally. Your card is linked to a Wise multi-currency account which can hold 40+ currencies, with no fee to spend a currency you hold in your account. Whenever you need currency conversion, Wise will use the mid-market rate and low conversion fees to switch your balance to the currency you need.

What is a Wise debit card?

The Wise card is a powerful international debit card. It allows you to transact easily online and in 150+ countries when you travel. Add funds to your account in dollars and spend all around the world with the mid-market rate and low conversion fees.