How to open a bank account in Portugal from Australia [2026]

However, getting started with a Portuguese account before you arrive is somewhat more complicated. Instead of heading for a Portuguese bank you may find the process is easier and cheaper with a specialist service like Wise, which has an account you can open from Australia, and use to hold, spend, send and exchange Euro. We’ll take a look at how to get started with a bank in sunny Portugal, and with alternative account providers, in just a moment.

Key points: Online bank account opening

- Portuguese bank accounts are available for non-residents through banks and specialist alternatives like Wise and Revolut

- To open an account in Portugal as a non-resident you’ll need to prove your identity and address. You will also often need to obtain a NIF (Portuguese tax number)

- Most Portuguese bank accounts will have ongoing monthly fees and transaction fees are pretty inevitable. These vary depending on how you use your account

- Portuguese banks typically have an opening deposit requirement that ranges from 250-300 Euro

- There’s no single best Portuguese bank account for non-residents – compare a few to help you choose

What documents do I need?

To open a bank account in Portugal you’ll usually need to provide:

- A photo ID document like a passport or a driving license

- Proof of local address (or proof of your foreign address if you’re opening a non-resident bank account)

- Your Portuguese NIF number

- Proof of income

- A Portuguese phone number

As we’ll see in a moment, some Portuguese banks do have options for people planning to move to the country, which may accept an Australian proof of address document to start your account opening process.

Save the paperwork with alternative solutions like Wise

Banks in Portugal usually need a proof of local address to access full account services. You won’t be able to provide a proof of address before you move – and even once you’ve arrived in Portugal, getting a document like a utility bill in your name can take time and be an unnecessary headache.

Instead, hit the ground running with an online and digital account from a provider like Wise, which you can open using your Australian ID and address, to get EUR bank details, and easy ways to pay and get paid in both Euros and Australian dollars.

A digital account from Wise comes with options to hold and exchange EUR alongside a selection of other currencies including AUD, as well as international debit cards. We’ll look at this in more detail a little later.

How to open a Portuguese bank account as a foreigner

Once you’re a resident in Portugal and have a proof of address there, you can open a Portuguese bank account pretty easily. Options exist to open online, in apps, and in person – but only if you can provide all the paperwork needed.

If you’re already in Portugal the steps you’ll usually take to open a bank account are:

- Choose the perfect account for your needs

- Get all your documentation ready

- Apply online, or in a branch in person

- Submit your documents online or in a branch

- Once your account is verified you’ll be able to start transacting

Bear in mind that opening a bank account in Portugal before leaving Australia may be quite a different experience. We’ll look at a couple of banks which allow you to open an account from overseas later – but this may mean having your account’s functionality limited until you physically arrive in Portugal.

📲

Learn more about international money transfers

What do I need to know before opening a bank account in Portugal?

If you’re trying to open a Portuguese bank account before you leave Australia, you may need a Portuguese NIF number.

This is issued by the Portuguese tax authority and is used to pay taxes, run a business, make investments, open a bank account and even to get a phone contract. To get your NIF, you’ll need to bring your passport and proof of address to your local tax office or you can use a financial representative or lawyer that can apply on your behalf.

You’ll also have the option to open a non-resident bank account, where you will need to bring proof of your foreign address in Australia. Lastly, while some banks will let you start the sign-up process online, most Portuguese banks will require you to open your bank account in person.

Can I open a bank account in Portugal only with my passport?

You’re unlikely to be able to open a Portuguese bank account with just a passport. Usually proof of address is required, even if you’re using a service which lets you open your account from overseas and a Portuguese NIF number. Proof of income may also be required as well as a Portuguese phone number, which may be a mandatory part of some banks account opening process.

Which account is best in Portugal for foreigners?

Let’s take a look at a few examples, covering financial technology companies Wise and Revolut, and popular Portuguese banks Millennium BCP and Novo Banco. There’s more detail on each of these options coming up later.

| Service | Wise | Revolut | Millennium BCP | Novo Banco |

|---|---|---|---|---|

| Eligibility | Available to customers in many different regions and countries | Legal residents of countries including the EEA, the UK, Australia and the US | Eligible for those with a Citizen Card or Residency Authorization Card

|

Available to foreign nationalities with Portuguese residence |

| EUR and AUD account options | Yes | Yes | Euro only | Euro only |

| Open before you arrive in Portugal | Yes | Yes | No | No |

| Open online | Yes | Yes | Yes

|

No |

| Fall below fee | No fee | No fee | No fee | No fee |

| Maintenance fee | No fee | Varies by account tier – Standard accounts have no monthly fee | Variable depending on your balance and account usage | 8.22 EUR |

| International money transfers | Low, transparent fees and the mid-market exchange rate | Costs vary by destination, value and account type | No fee for SEPA transfers in Euros on the website, app and ATM

Variable fees for other transfers

|

Free SEPA + credit transfers online or on the app. Otherwise €6.24-36.40 in branch

Non SEPA – up to €20.80 for less than €150, €33.28 for less than €12,500 and €124.80 for more than €12,500 depending on how you arrange them

|

*Details correct at time of research – 17th April 2025

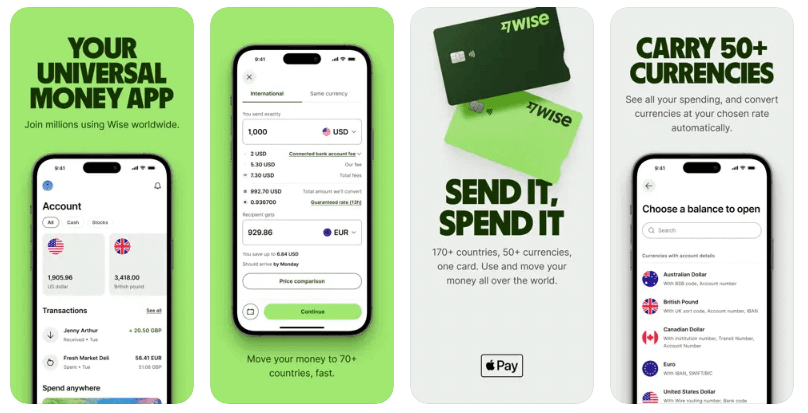

Wise

Wise multi-currency accounts can hold and exchange 40+ currencies including EUR and AUD, and come with a linked debit card for easy spending. Wise currency exchange uses the mid-market exchange rate and low, transparent fees whenever you switch currencies in your account, or spend with your linked Wise international debit card.

Get your account set up online or in-app, and manage your money with nothing but your phone. Use your Wise account to send payments to 140+ countries, and get local and SWIFT account details for up to 8+ currencies including both AUD and EUR, to get paid conveniently by others.

How to open an account with Wise

Open your account with Wise online or in the Wise app, by adding your personal and contact information and uploading your ID and address documents. The process shouldn’t take long, and there’s no minimum balance required to set up your account.

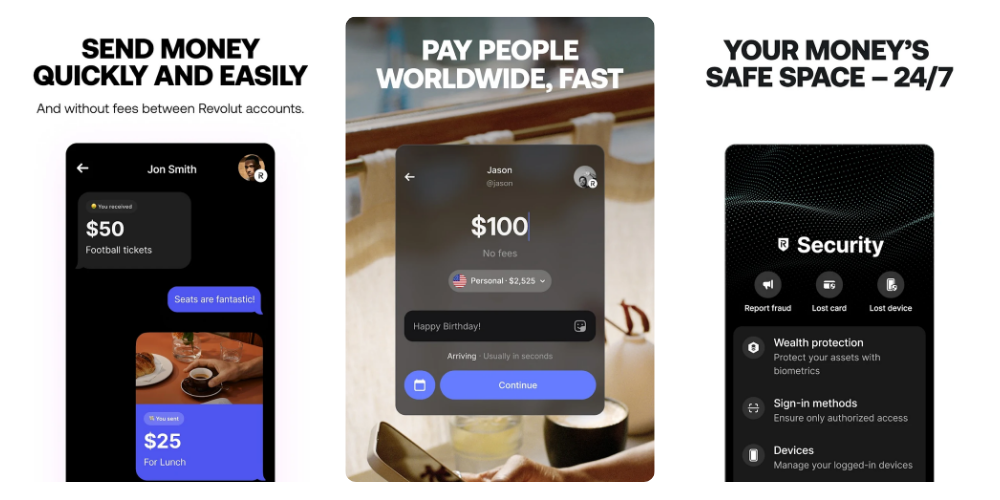

Revolut

Revolut is already a popular specialist option, with over 35 million global customers. Revolut is supported in Australia, and in the European Economic Area, including Portugal, where it offers a choice of digital accounts which can be used to hold and handle a selection of currencies including AUD and EUR, and spend with a linked card.

Choose from Standard plans, which have no ongoing fees but also come with somewhat limited features, or look at the different account tiers which have monthly fees but also offer more no-fee transactions. This allows you to pick the mix of features and fees that suits you – with or without monthly fees to pay.

How to open an account with Revolut

To open an account with Revolut you’ll need to download the Revolut app, register using your personal and contact information, and upload images of the required ID. You’re guided through the process using onscreen prompts.

Millennium BCP

Millennium BCP offers everyday banking and international banking services as well as investment and corporate banking, making it a good choice for a wide range of needs.

The bank offers the Millennium Mais Portugal account for foreign residents who live abroad, but want a bank account in Portugal as well as the Millennium Cliente Frequente account for everyday banking for those with Portuguese residence. All accounts come with monthly maintenance fees and a minimum opening balance of 250 Euro or 150 Euros for university students.

How to open an account with Millennium BCP

Opening an account is easy and can be done online on the website or app. You must be at least 18 years old and have a Portuguese Citizen Card or Residency Authorization Card depending on the account.

Novo Banco

Novo Banco is another reputable Portuguese bank with branches nationwide. It offers a wide range of services from everyday banking to investment services. Their Boas-Vindas Account is a welcome account for foreigners who have just arrived to Portugal and has everything you need for daily banking. It comes with a Verde Credit Card that’s free of charge, access to salary advances and includes personal accident insurance. There’s a 250 Euro minimum to open the account alongside 8.22 Euro monthly maintenance fees and Portuguese residence is required.

How to open an account with Novo Banco

You must open your account with Novo Banco in a branch. Submit an online query to check what’s required or press “Request Contact” to find out more.

What is a bank account in Portugal needed for?

If you’re moving to Portugal, you’ll probably need to get a Portuguese bank account to access basic services, pay rent, and arrange utilities, mobile phones and so on. Portuguese Euro accounts also offer the following features:

- Easy to receive payments from others in EUR

- Hold EUR and other foreign currencies to make transacting internationally cheap and simple

- Spend conveniently with a local bank card in Portugal

- Access other financial services in Portugal like credit cards or loans

📲

Learn more about international bank transfer fees

Benefits of opening a bank account in Portugal

Having a Portuguese bank account if you live there is helpful to limit your costs and make sure you don’t need to unnecessarily convert currencies from EUR to AUD or vice versa. You’re also usually required to have a Portuguese bank account to set up household utilities and arrange direct debits for things like rent.

If you’re not moving to Portugal, a Portuguese bank account can still be handy for those times you travel in Portugal or spend with Euro-based ecommerce stores. Again, it can make life more convenient and cheaper, as you can avoid foreign transaction fees.

Can I open a bank account in Portugal before arrival?

While some Portuguese banks, like Atlantico, may offer the option of opening a bank account before you arrive in the country, it isn’t common. That’s because the majority of Portuguese banks require you to visit a local branch in person.

If you want something more flexible, check out multi-currency accounts from popular providers like Wise, which you can open from Australia and use at home and abroad in a range of currencies.

Can I open a bank account online?

Many Portuguese banks require you to visit a local branch to open a bank account in person. However, there are a few mobile bank options, like N26, a European virtual bank which lets you open an account entirely online in just a few minutes as long as you’re a European resident. Millennium BCP also has an online application system that easily allows you to submit your documents through a digital mobile key or a video call to confirm your identity. Again you must be a resident of Portugal to use this service.

You may also be able to open an account online by using a major bank’s international services, like Barclays or Citibank. However, these options can come with their own drawbacks, which may make specialist alternatives like Wise and Revolut a more straightforward option.

How long does it take to open a bank account in Portugal?

As long as you have all the required documents, the actual process of opening a bank account in Portugal is relatively quick, and opening a bank account online should take just a few minutes. If you are opening a bank account in person, you should be ok to get your account documents and card on the same day as long as verification is complete, with the whole process taking around 20-30 minutes.

What are the types of bank accounts in Portugal?

Portuguese banks have everyday accounts – known as current accounts – and a broad selection of savings account options. There are also foreign currency accounts and joint accounts. Get familiar with the terms and the range of options by browsing the website of one of the major Portuguese banks, to see what there is.

How to choose a bank account in Portugal

Spend a bit of time researching bank account options in Portugal to help you pick one. Most options come with maintenance or account-opening fees, but it’s worth digging a bit deeper to make sure you find an option that works best for you.

Banks in Portugal have generally very good online and mobile banking, which means you’ll seldom need to visit a branch. However, it’s definitely worth checking if the bank you prefer has good in person, online and phone customer service which you can access easily if the self service banking options fail and you need help.

📲

You may also like: Wise vs international bank transfer

How much does it cost to open a bank account in Portugal?

Portuguese bank accounts typically charge a 5-7 Euro monthly fee. They also tend to require an opening deposit that ranges from around 250-300 Euros and there are likely to be additional transaction fees, including ATM and payment fees which can be pretty steep, especially for international transactions outside of Europe.

It’s worth investing the time to read the account fee schedule carefully before you get started, to make sure you don’t run into any unexpected charges when you transact.

Is it possible to open a fee-free account in Portugal?

Most accounts charge a monthly maintenance fee. Even if you do find an account with no maintenance fees, most Portuguese accounts will still have a selection of transaction fees which depend on how you use your account. These costs may not look like the bank fees you’re used to in Australia, so reading the account terms and conditions is essential.

If you’re looking for an international account which has transparent pricing for services, compare the bank options you’re considering against Wise and Revolut, as specialist services with clear and simple pricing and low costs.

What are the additional costs?

Opening your account with a bank Portugal typically requires an opening deposit of 250-300 Euros. Other common costs that you are likely to come across include:

- Foreign transaction fees – when you spend with a card overseas

- Withdrawal fees for ATM use – at home and abroad

- International payment fees – which can vary by destination and payment type

- Charges for receiving funds into the account – particularly for international payments

- Overdraft charges and interest – usually higher if your overdraft has not been arranged in advance

- Fees if a payment is refused or returned due to lack of funds

Tips for transferring money

Living overseas comes with some extra costs, including high fees for sending international payments. However, sending money overseas is usually a fact of life for an expat, so it’s important to be aware of some of the ways your fees may mount up when you use a bank:

- International payment fees can be higher when sending a payment by phone or in a branch

- Expect charges for both sending and receiving payments

- Bank exchange rates usually include a markup which is an extra fee hidden in the rate applied

- Third party costs may be deducted from the payment as it is processed, unless you opt to cover all additional charges when you initiate the transfer

📲

Learn more about how to send money online

Conclusion: Open a bank account online Portugal

Opening a bank account in Portugal is pretty essential if you’re planning on moving there. The good news is that banks in Portugal often have both resident and non-resident accounts. However, you’ll have to provide details of your foreign address in Australia and these accounts may be less comprehensive than the resident accounts on offer which require Portuguese proof of address, residence and a Portuguese NIF number for tax purposes.

If you want something simpler and cheaper, check out providers like Wise for a multi-currency account option you can open online or in-app, using your Australian proof of address. Hold and exchange AUD and EUR side by side, to make living internationally easier, and to cut your costs.

Open a Portuguese bank account online FAQs

Can a foreigner who is non-resident open an account in Portugal?

Yes, non-resident foreigners can open a bank account in Portugal, although it’s much easier for EU residents. The country does offer some non-resident accounts, which requires you to bring proof of your foreign address in Australia, but they might not be as comprehensive as resident accounts. If you want something easier and cheaper, check out Wise or Revolut instead. These are specialist options, which can be used to hold and exchange both AUD and EUR easily.

How much do I need to open a bank account in Portugal?

Portuguese banks typically charge a 5-7 Euro monthly maintenance fee as well as needing a 250-300 Euro opening deposit. Transaction fees will also apply which can be steep, particularly if you need to complete any international transactions. Compare your options and read through the fee schedules carefully to avoid surprises.

Can I open a bank account in Portugal online?

While some banks in Portugal will allow you to open a bank account online, most of them require you to visit your local branch in person. Once you’re in Portugal and have proof of address, opening an account online is easy and means you can pick from pretty much any account offered by the bank.

How to apply for a bank account online in Portugal?

If you’ve got a proof of address and ID documents you may be able to apply for your bank account in Portugal online. However, your options may be limited if you’re not already a resident in Portugal. In this case, an online provider like Wise may be a better bet for a flexible account you can use to transact in EUR as well as AUD.

Can I open a bank account in Portugal before landing?

Most Portuguese banks require you to come to a branch in person to open an account. However, some banks offer a non-resident account option, meaning that you could open the account before moving and then upgrade the account to a full resident account once you are in the country. Another alternative is to check out an online provider like Wise which has EUR among 40+ currencies supported in its low cost multi-currency account.