How to send large money transfers with Wise

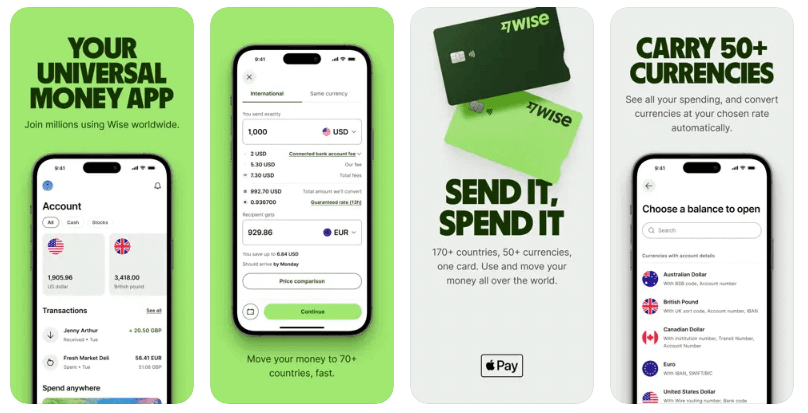

Wise is a global specialist in international transfers, allowing customers to move money around the world securely, with low fees and the mid-market exchange rate. Sending a high value transfer can be worrying – but with Wise you can rest assured that your money is safe, and you may even qualify for an automatic discount on fees for sending large money transfers.So – whether you need to make a large transfer for a one off purchase like a downpayment on a new property, to move an international inheritance or to invest, or you’re looking for high value business transfers, Wise can help. This guide covers all you need to know about sending large value money transfers with Wise including fees, features, speed and safety.

- About Wise money transfers

- Is Wise safe for large amounts?

- How to transfer large amount of money

- Required documents

- Transfer fees & exchange rates

- Transfer limits

- Payment methods

Key points: Wise large transfers

- Wise offers international transfers for personal and business customers with high payment limits that vary by currency

- Customers sending high value payments, or sending money very frequently, may qualify for automatic discounts on Wise fees

- Wise high value transfers can be arranged online or in the Wise app, conveniently and quickly

- Wise is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL)

About Wise money transfer

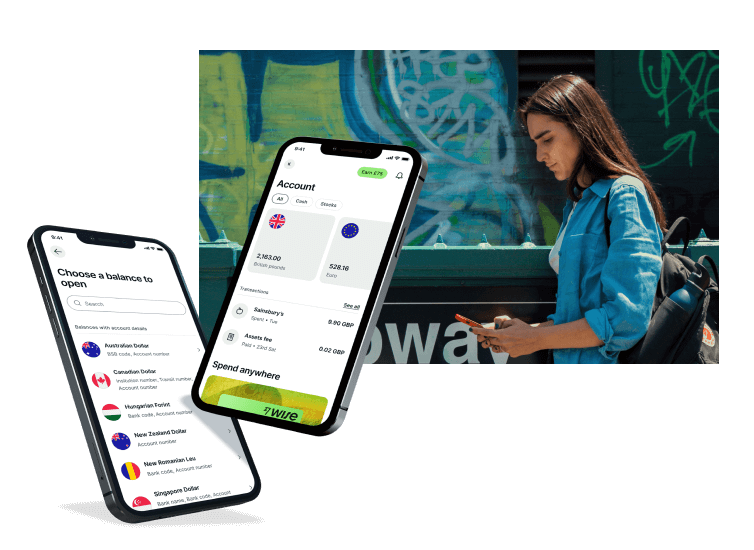

Wise supports high amount transfers for personal and business customers. Wise payments have low, transparent fees, and use the mid-market exchange rate. Transfers are fast and safe, and you can pick from multiple payment methods to process your payment in the way that suits you best.

Wise has high transfer limits, usually around the equivalent of 1 million GBP (just over 2 million AUD at the time of research). Wise limits vary based on the currency you’re sending to and from, and also the payment method you choose. You’ll see the limit that applies to your specific currency when you start to set up the payment, and can easily get in touch with the Wise high value transfers team if you have questions.

For customers in Australia, it’s good to know that sending from AUD using RTGS as your preferred payment limit means that there’s no Wise limit to worry about at all.

| Wise large transfers pros | Wise large transfers cons |

|---|---|

| ✅ High transfer limits

✅ Mid-market exchange rates ✅ Discounts on Wise fees for high value transfers ✅ Transfers are fast and secure ✅ Dedicated support for high value payments |

❌ Wise fees apply which vary based on currency and value of payment

❌ You’ll need extra documents for verification ❌ Limits vary depending on the payment method you select |

📲

Learn more about international money transfers

Is Wise safe for large amounts?

Yes, Wise is safe for high value transfers for individual and business customers.

Wise is a digital first provider with strong security measures in place. All funds are safeguarded, and there are 24/7 manual and automatic anti-fraud processes running to make sure your money is secure at all times.

How to transfer large amount of money with Wise

Sending transfers with Wise is easy, and can be done on the Wise website or via the Wise mobile app. You’ll need to make sure you’ve got any documents that may be required for verification handy in advance, but getting everything started can be done in just a few steps.

Here is how to send large amounts of money with Wise:

- Log into your Wise account, tap Send money and enter how much you want to transfer, or how much you need the recipient to get

- Confirm the way you’ll pay, and review the fees and exchange rates offered – any relevant discount will be automatically included in the quote generated

- Enter the recipient’s personal and banking details – check them carefully

- Fund your payment using one of the listed options – usually RTGS, PayID, card or bank transfer

- Confirm and your payment will get started – you can track the transfer in the Wise app, and you’ll hear from the Wise team directly if documents are needed to move your money

Sending a high value payment can be stressful. There are a few things you can do to make sure everything goes as smoothly as possible:

- Check if your own bank has payment limits which may stop you from funding the Wise transfer

- Check if the recipient’s bank has any limits which may stop the payment being received

- Check the Wise transfer limits for the specific currency you need – you may need to send your money in more than one transfer if it exceeds the limit

- Have your documents handy so you can easily photograph and upload them if the Wise team ask for verification paperwork

If you’re looking to send a business payment, the process will work similarly to sending a personal payment.

📲

Learn more about how to transfer money overseas with Wise

Required documents for sending large transfers

The documents needed for sending a high value payment with Wise can vary based on the reason you need to send the money, or where it came from in the first place. Usually banks, financial service providers and money transfer services like Wise are legally required to check the funds being sent have not been obtained illegally. That means demonstrating the source of the funds before it can be sent.

If you’re not sure what’s needed there’s a handy dynamic feature on the Wise landing page, showing which documents are required for the transfer based on where the money came from. Here are a few examples, of common reasons why you may need to send a high value payment:

| Reason for payment | Examples of documents needed |

|---|---|

| Sending money from a property sale | Final sales contract signed by both parties

Letter from a solicitor, auditor or regulated accountant

Bank statements showing you received the money

Extracts from the property register |

| Sending money from an inheritance | Signed copy of the will

Grant of probate or court document

Letter from a solicitor

Bank statements showing you received the money |

| Sending money from your salary | Recent payslips

Salary section of your contract

A letter from your employer saying how much you earn

Last 3 months of bank statements |

| Sending money from investments | Investment certificates, contract notes, or statements

Confirmation from your investment company, bank, or dividend payer

Bank statements showing you received the money |

| Sending money from a loan | Your loan agreement

3 months of loan statements

Bank statements showing you received the money |

The paperwork needed depends on the scenario, as you can see – so if you’re sending money from a property sale you may be asked for the sales contract or settlement statement, showing the property details. On the other hand, if you’re sending money from an inheritance you may provide something like a grant of probate or will showing the name of the person leaving you money and your relationship with them.

Large value business payments may also need documents to support them. In some cases – such as sending a payment from investments or a loan – the business documents you need will be fairly similar to those needed by a personal customer. If you’re sending funds accrued through business revenue you’ll need paperwork like bank statements or audits instead.

The Wise large value transfer team can help you work out what you need if you’re not completely sure of the paperwork that will apply based on your situation. Plus, you can learn more about the documents Wise needs to verify high value payments here.

Wise large transfer fees

Wise gets cheaper for higher value transfers, as the variable fee is automatically reduced the more you send. In this context, high value transfers are usually over the equivalent of around 20,000 GBP (about 41,000 AUD at the time of writing) as a one off payment, or per month.

Here’s how it works:

| Transfer value (per month) | Wise variable fee discount |

|---|---|

| Up to 20,000 GBP or currency equivalent | No discount |

| 20,000 GBP to 300,000 GBP or currency equivalent | 0.1% |

| 300,000 GBP to 500,000 GBP or currency equivalent | 0.15% |

| 500,000 GBP to 1 million GBP or currency equivalent | 0.16% |

| Over 1 million GBP or currency equivalent | 0.17% |

Because this is a percentage discount, the absolute amount saved can rack up quickly when you’re sending high value payments. Let’s look at a couple of examples for sending high value transfers, including the fees and rates available.

| Sending amount | Exchange rate | Wise variable fee | Received amount |

|---|---|---|---|

| 200,000 AUD to GBP | Mid market rate | 0.33% | 95,756.85 GBP |

| 2 million AUD to GBP | Mid market rate | 0.25% | 958,543.57 GBP |

| 200,000 AUD to EUR | Mid market rate | 0.27% | 110,477.35 EUR |

| 2 million AUD to EUR | Mid market rate | 0.21% | 1,105,318.45 EUR |

Correct at time of writing – 14th April 2025

Exchange rates for large transfers

The Wise exchange rate is the mid-market rate, with no markup added and no hidden fees. All the costs you pay are split out for transparency and to make them easy to check and compare.

This can mean that the rate you get is better than that offered by a provider which uses an exchange rate markup. And since the amounts being sent are high, even the small differences in exchange rates can create big differences in the amount you get in the end.

Learn more about Wise exchange rates for popular pairs like:

- Wise AUD to GBP exchange rates

- Wise AUD to EUR exchange rates

- Wise AUD to JPY exchange rates

- Wise AUD to USD exchange rate

- Wise AUD to CAD exchange rates

Wise transfer limits

Wise transfer limits vary based on the sending currency – but the amount you can send is usually around the equivalent of 1 million GBP.

Here’s a quick look at the standard limits for sending from some major currencies with Wise:

| Currency | Wise sending limit |

|---|---|

| USD | Up to 1 million USD in most cases |

| GBP | Up to 1 million GBP |

| EUR | Up to 1.2 million EUR |

| CAD | Up to 1.5 million CAD |

| JPY | Up to 1 million JPY |

Correct at time of writing – 14th April 2025

Wise transfer limits can also vary based on payment methods. Sending the payment from a Wise account balance may allow you to send a higher amount. You’ll see this in the app when you set up your payment if it’s the case for your particular currency.

How long does Wise take to transfer money?

The time it takes for a Wise high value transfer to be processed can vary depending on the details of the payment, the value, currency and how you pay. Because there are often additional checks including manual checks which need to be completed to process high value transfers safely and legally, the payment may take a short while to process.

You’ll see an estimate of the delivery time in the app when you set up your payment, you can track the transfer while it’s on the way, and you’ll always be able to reach out to the Wise team if you need extra help along the way.

📲

Learn more about sending international transfers over $10,000

Wise payment methods for high amount transfers

Wise has different payment methods for transfers. From Australia you can select to pay by:

- Bank transfer – often one of the cheaper options, but this may take a day or two to arrive with Wise

- Debit/credit card – usually a very fast option but the limits are much lower compared to a bank transfer

- RTGS – no limits apply when sending AUD by RTGS

- PayID – convenient option which relatively high Wise limits

- Wise Account balance – very fast to get moving, often with low fees

Wise customer support for high amount transfers

The easiest way to get in touch with Wise is to log into your account on the Wise app and start an in-app chat. You’ll be able to speak to someone 24/7, and if you need a phone number to escalate your question you’ll be able to find that here too. Wise has a specific high value transfer customer support team who will reach out to you if you need support at any stage of the process.

Conclusion: Transferring large sums of money with Wise

Wise is safe to use for high value payments, for yourself or your business. Wise transfer limits are set high, although they do vary by currency. You’ll get the mid-market exchange rate to convert your currency, and high value transfers may even qualify for a discount on the Wise variable fee which applies.

Before you send your Wise high value transfer you’ll need to make sure you have the documents required for legal verification processes – but after that the transfer is fairly easy to set up, and you’ll be able to track your money every step of the way once it’s moving.

Wise large transfers FAQs

Does Wise have a transfer limit?

Wise has a transfer limit which varies by currency. In some cases, the payment method also matters. When you set up a Wise transfer you’ll only be shown the payment methods which are available for that transfer value. You can then split your payment into several smaller transfers if you need to, based on your preferred payment option.

What is the maximum you can transfer with Wise?

The Wise limit is set according to the currency you fund the payment in usually. To give some examples, you can normally send up to 1.8 million AUD from Australian dollars, 1 million USD from US dollars, or up to 1 million GBP if you’re paying in pounds, and up to 1.2 million EUR for euro transfers.

How to increase Wise transfer limit?

If you’re trying to send a transfer that’s higher than the Wise transfer limit for that payment you might be able to make several smaller transfers, or choose a different way to pay if higher limits apply for different payment types. If you’re ever stuck the Wise high value transfer team can help advise you – just open an in-app chat to get the help you need.