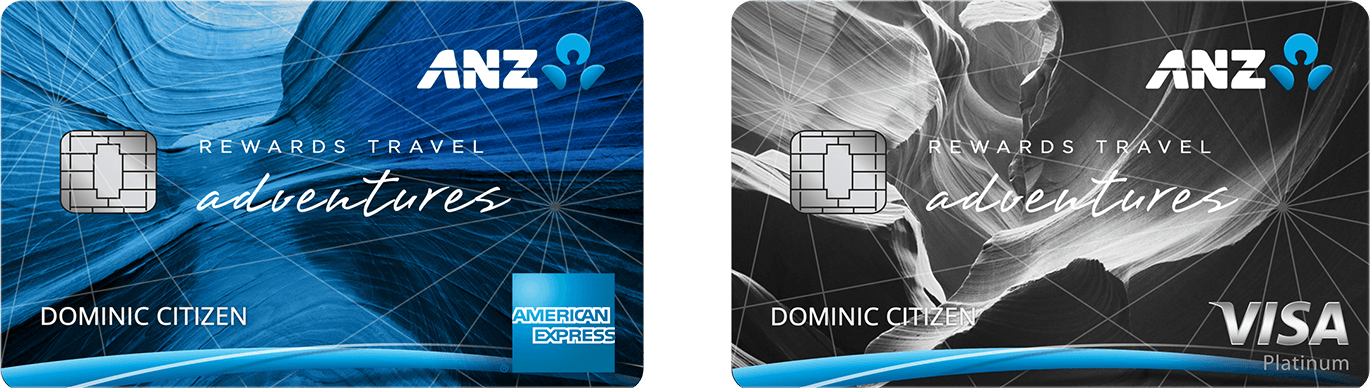

ANZ Rewards Travel Adventures Review

Learn about the ANZ Rewards Travel Adventures credit card in this review to help you decide whether this is the card for you.

- Earn reward points

- Complimentary return domestic flight offered

- Two complimentary Virgin Australia lounge passes offered

- Complimentary travel insurance

- No overseas ATM withdrawal fee

- 24/7 personal concierge

- You don’t have to be an ANZ customer

Pros and cons of using ANZ Rewards Travel Adventure Card

- Complimentary return domestic flight

- Complimentary lounge passes

- Complimentary travel insurance

- No transaction or ATM withdrawal fee overseas

- High annual fee of $225

- Complimentary lounge passes only available to primary card holder

- To be eligible for complimentary offers you must spend over $500 in the first 3 months

- $65 additional cardholder fee

- Minimum credit of $6000

Benefits of the ANZ Rewards Travel Adventure Card

Security

- ANZ Falcon™ provides round-the-clock monitoring for suspicious transactions

- You won't be liable for fraudulent transactions on your ANZ credit card account with ANZ Fraud Money Back Guarantee

- Worldwide emergency credit card replacement

Convenience

- ANZ goMoney® to use your card

- 24/7 Concierge service

- Up to 9 additional card holders

Savings

- No overseas transaction fees

- No cash advance fee when you withdraw cash from an overseas branch or ATM

- No ATM withdrawal fee*

- Complimentary return domestic flight when you spend $500 on eligible purchases within the first 3 months

- Two complimentary Virgin Australia lounge passes when you spend $500 on eligible purchases within the first 3 months**

- Complimentary travel and medical insurance offered by QBE Insurance

*ATMs will likely provide their own charge so beware of this when withdrawing money overseas

**Lounge passes are only available to the primary cardholder

Fees and Charges

Minimum amounts for the ANZ Reward Travel Adventures Card:

| Minimum Income | Minimum Credit | Minimum Repayment |

| $35,000 per annum | $6000 $5 fee per month if you fall below this credit |

2% of the closing balance OR $25 (whichever is cheapest) |

Fees for the ANZ Reward Travel Adventures Card:

| Fee Type | Cost |

| Annual fee | $225 per annum ($170 annual account fee + $55 Rewards progam service fee) |

| Cash advance | $15 |

| Late payment Fee | $20 |

| Interest rate on purchases | 20.24% |

| Interest rate on cash advances | 21.74% |

| Interest rate of standard balance transfers | 21.74% |

| Over limit fee | $20 |

| Additional cardholder fee | $65 per annum |

Reward Points

This is where the difference between Visa and Amex come in, as you can choose which rewards programme you would like to be a part of. You have access to over 1000 different rewards that you can look at here, ranging from entertainment to hotels and including shopping at stores such as Bunnings, Woolworths, Myer, Flight Centre and many more. To give you an idea, we’ve pasted the rewards points below:

- American Express: 2 points per $1 you spend on eligible purchases

- Visa: 1 points per $1 you spend on eligible purchases

There is no cap for earning points so you can earn as much as you like and spend them as you wish. You can also transfer and redeem them for frequent flyer points Velocity, Air New Zealand Airpoints, Cathay Pacific Asia Miles or Singapore Airlines Kris Flyer frequent flyer programs.

TIP: Eligible purchases constitute as your everyday transactions i.e. supermarkets, petrol, food, restaurant’s etc. Note that reward points cannot be collected through: fees, cash, balance transfers, premiums paid for insurance, gambling or for gaming purposes. Anything that is treated as cash advance is also ineligible like lottery, rent, ATO and paying some bills.

Case Study

Olivia lives and works in Melbourne as a full-time interior designer. She wanted a credit card that offered ways she could benefit from the money she spent day-to-day. As she had worked in her industry for over two years now, she was confident in her ability to repay the amount she spent, and also wanted a card that helped her earn reward points that she could transfer to her frequent flyer points.

This would help her pay for her regular flights to see her family in Darwin. As she banks with ANZ already, Olivia first looked with them to see if any of the cards they offered suited her and what she wanted to get from a credit card.

She was instantly attracted to the ANZ Travel Rewards Adventures credit card after hearing of its rewards scheme, teamed with its long list of benefits. As she met the criteria to apply, and was confident of keeping the minimum balance, Olivia applied online and had her credit card ready to use within five business days.

Online Tools

Save time and let our online tools crunch the numbers for you.

Currency converter

Burning to know what the exchange rate is? Check today’s exchange rate on any amount.

Travel money comparison tool

Heading overseas? Find the best rates for exchanging currency online or find a store near you.

Knowledge centre

Learn the ins and outs of currency

Money transfer comparison tool

Finding the best deal can be nightmare. We bring together all your options by highlighting the fees and rates.