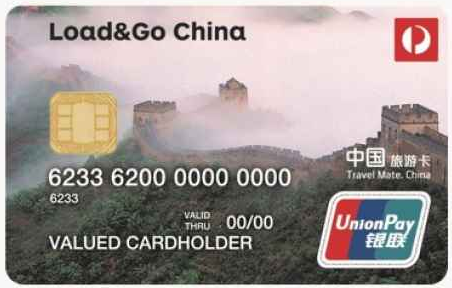

Australia Post Load&Go China Travel Card Review

If you are planning a trip to China, learn about the Australia Post Load&Go China Card in this review to help you decide whether this is the card for you.

- Hold your China Yuan and Australian Dollars on one reloadable card

- Free to load and reload

- No monthly fees

- 0% commission when you transfer from AUD to CNY

- Use UnionPay in more than 140 countries worldwide

Pros and cons of using Load&Go China Travel Card

- Change your PIN via Card Manager

- Free card purchase and reloads

- Unlimited POS transaction limit

- Exclusive cardholder benefits

- Only redeem your remaining card balance within a year of expiry

- $9.95 replacement or closure card fee

- No back-up card sent – $9.95 upon request

Benefits of the Load&Go China Travel Card

Security

- 6 digit PIN

- Order a back-up card if your primary card is ever lost or stolen

Convenience

- Withdraw from any ATM showing the UnionPay logo

- Unlimited number of purchases per day

Savings

- Exchange rates based on Post Office live rates the date of loading or reloading funds

- Access exclusive cardholder benefits with a range of China travel resources – benefits range from ticket discounts to privileges at hotels, dining, shopping and entertainment.

Currencies and Countries

Currencies Supported

- Australian dollars (AUD)

- Chinese Yuan (CNY)

Load Amounts

- Minimum Load $100

- Maximum Load $10,000

Transaction Limits

- ATM Withdrawal Limit (24 hours) : AUD 2,500 (or currency equivalent)

- POS Transaction Limit (24 hours): Unlimited

Fees

All prices are in AUD

| Card Purchase | Replacement or Back-up card | Reload Funds |

|---|---|---|

| Free | $9.95 | Free |

| Foreign Currency Conversion* | Negative Balance | Card Termination |

|---|---|---|

| 3% of transaction value | Incur costs and interest | $9.95 |

| Inactivity Fee | Transaction Fee | Emergency Cash Transfer |

|---|---|---|

| Free | $0.09 applies with purchases made in AUD | $5.00 |

* Foreign currency conversion is charged when you spend in a currency that is not loaded in the card

| ATM Withdrawal Fees |

|---|

| AUD 2.00 |

Case Study

Emma is flying out to China to teach English for 4 months. She doesn’t want to use her Australian Debit bank card out there, or carry cash around with her. She also feels nervous about the security of her money being so far from home.

Emma researched before her travels and found out about the Australia Post Load&Go China card. She read that it was completely free to load and reload, as well as having a 6-digit PIN and ability to order a back-up card if hers went missing. This meant that Emma could load her AUD onto the card, and lock in the exchange rate, so she knew exactly how much CNY she had on her arrival.

What Emma also found out when she got to China was that her card offered her benefits like discounted tickets, and privileges for hotels and dining.

Online Tools

Save time and let our online tools crunch the numbers for you.

Currency converter

Burning to know what the exchange rate is? Check today’s exchange rate on any amount.

Travel money comparison tool

Heading overseas? Find the best rates for exchanging currency online or find a store near you.

Knowledge centre

Learn the ins and outs of currency

Money transfer comparison tool

Finding the best deal can be nightmare. We bring together all your options by highlighting the fees and rates.