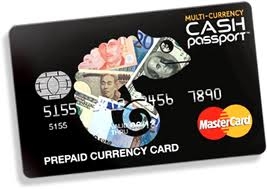

Australia Post Multi-currency Cash Passport Travel Card Review

Learn about the Australia Post Multi-currency Cash Passport in this review to help you decide whether this is the card for you.

- Multi-currency Mastercard

- Withdraw local currency at over 2 million Mastercard ATMs worldwide

- Load up to 10 currencies

- Lock in exchange rate

- No transaction fee for purchases or withdrawals

- 24/7 Global Emergency Assistance

Pros and cons of using Auspost Multi-currency Cash Passport

- Back-up card with your primary card

- Free replacement card

- No age limit

- Manage your account online

- Can’t change your PIN

- Reload funds can take 2 days

- Not all currencies are available all the time

- $10 cancellation fee

Benefits of the Auspost Multi-currency Cash Passport

Security

- Chip and PIN

- 24/7 Global Emergency Assistance

- Free back-up card provided

Convenience

- Easy way to manage, spend and save on multiple currencies

- No bank account required

Savings

- No international ATM fee

- No retail transaction fee

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations

Manage Your Money

- Reload and manage your funds easily online

- Ability to reallocate your funds easily online

- Redeem your unused funds easily on your return

Currencies and Countries

Currencies Supported

- Australian dollars (AUD)

- US dollars (USD)

- Euro (EUR)

- Great British pounds (GBP)

- New Zealand dollars (NZD)

- Hong Kong dollars (HKD)

- Canadian dollars (CAD)

- Singapore dollars (SGD)

- Thai baht (THB)

- Japanese yen (JPY)

Load Amounts

- Minimum Load $100

- Maximum Load $100,000 p.a.

Transaction Limits

- ATM Withdrawal Limit (24 hours) : AUD 3,000 (or currency equivalent)

- POS Transaction Limit (24 hours): AUD 15,000

Fees

All prices are in AUD

| Card Purchase | Initial Load | Reload Funds |

|---|---|---|

| Free | Free | $5 flat fee per reload |

| Foreign Currency Conversion | Inactivity Fee | Card Termination |

|---|---|---|

| Mastercard rate plus 5.95% of transaction value | $4 per month | $10 |

| Negative Balance | Replacement or Back-up card | Emergency Cash Transfer |

|---|---|---|

| $20 | Free | $5.00 |

| ATM Withdrawal Fees |

|---|

| No International ATM withdrawal fee (fee may be imposed by ATM operator

2.95% domestic ATM withdrawal fee |

Case Study

Jason does wildlife photography as a hobby. For the next 4 weeks, Jason will be traveling various countries in Asia to photograph zoos and animals in the wild to create his portfolio.

When Jason found out that the Australia Post Multi-currency card held all the currencies he would need, and more for future trips, Jason enquired about getting one in his nearest Post Office. He found that there was no international ATM, or transaction fee so he could save more of his AUD w when spending in a supported foreign currency. He could also reallocate his funds to a different currency quickly and easily online if needed.

Jason loaded his AUD before his trip into the currencies he needed, and locked in the exchange rate. Jason is now photographing and documenting the rehabilitation of elephants in Thailand.

Online Tools

Save time and let our online tools crunch the numbers for you.

Currency converter

Burning to know what the exchange rate is? Check today’s exchange rate on any amount.

Travel money comparison tool

Heading overseas? Find the best rates for exchanging currency online or find a store near you.

Knowledge centre

Learn the ins and outs of currency

Money transfer comparison tool

Finding the best deal can be nightmare. We bring together all your options by highlighting the fees and rates.