Commonwealth Bank Foreign Currency Account Review [2023]

With a Commonwealth Bank Foreign Currency Account, you can manage a foreign currency balance alongside your Commbank AUD account in the Commbank NetBank online banking system. This can offer convenient ways to receive, hold, exchange and send payments in foreign currencies, as well as cutting down some conversion costs.

Foreign currency and multi-currency accounts can be very helpful for both personal and business customers – but as different accounts have their own features and fees, comparing a few is essential to get the right option for you.

This guide covers what you need to know about opening a Commonwealth Bank multi-currency account, including the advantages, costs, eligibility, and how to open one. We’ll also touch on how specialist providers like Wise and Revolut can be helpful alternatives if the Commbank multi currency account isn’t right for you.

Table of contents

- What is the Commonwealth Bank multi-currency account?

- Pros and cons

- How does the Commonwealth Bank multi-currency account compare

- When is a multi-currency account needed?

- Features of the Commonwealth Bank multi-currency account

- Eligibility

- CBA fees

- CBA alternatives

What is the Commonwealth Bank (CBA) multi-currency account?

You can open a CBA Foreign Currency Account if you’re already a Commbank customer with an eligible AUD account. With your Commbank Foreign Currency Account up and running you’ll be able to review your foreign currency balance alongside your normal AUD funds, online and on the go. You’ll also be able to send international payments, and deposit and withdraw at certain Commonwealth Bank branches, including cash deposits in AUD and foreign currency.

Pros and cons of Commonwealth Bank multi-currency account

Pros

- Available to hold most convertible currencies

- Review your foreign currency account online in NetBank

- No maintenance fee for your foreign currency account

- Transfer money easily – and for free – between your CBA accounts

- Exchange currencies 24/7

Cons

- No cheque book or keycard available with this account

- Fees apply to send and receive international payments

- 1% fee to deposit or withdraw foreign currency notes

- Limited interest earning opportunities

How does the Commonwealth Bank multi-currency account compare?

Commonwealth Bank isn’t your only option if you want a multi-currency account to hold and exchange one or more foreign currencies easily. To help you decide if CBA is right for you, let’s compare it to another large Australian bank – Bank of Queensland – and a couple of online alternative providers which offer multi-currency account products, Wise and Revolut.

| Commonwealth Bank | Wise | Revolut | Bank of Queensland | |

|---|---|---|---|---|

| Availability | Customers must be Australian residents, over 18, and hold an eligible CBA AUD account | Available to customers in all but a handful of countries around the world | Available in supported regions including Australia, the UK, the US and the EU | Available to eligible business customers |

| Account Fees | No maintenance fee

6 AUD to send an international payment online

11 AUD to receive a payment |

No maintenance fee

Currency conversion and international transfer fees from 0.41% |

Maintenance fee from 0 AUD – 24.99 AUD/month, depending on plan

International transfer fees from 0.3% – 2% depending on currency |

No maintenance fee

International transfer fees apply to send and receive payments, costs vary based on currencies involved |

| Linked Debit Card | Not available | Available | Available | Not available |

| Best Features | Offered in most convertible currencies

Manage foreign currencies online in NetBank |

Hold and exchange 50+ currencies

Get local bank details to receive payments in 10 currencies for free |

Hold and exchange 25+ currencies

Get some fee free ATM withdrawals and free currency exchange, to plan limits |

Foreign exchange and currency risk management tools available online for convenience |

Ultimately which foreign currency account is best for you will depend a lot on the services you need, and whether you’re opening a day to day account for yourself, an investment account product or a business account for example. Specialist providers like Wise and Revolut can offer feature packed accounts you can manage online and through an app – which may also have lower fees and better exchange rates compared to products available from major banks. Compare a few options to pick the right one for your specific needs.

Commonwealth Bank Foreign Currency Account alternatives

If you’re not sure the Commonwealth Bank Foreign Currency Account is the right option for you, the good news is that there are plenty of alternatives. Here are a few to consider:

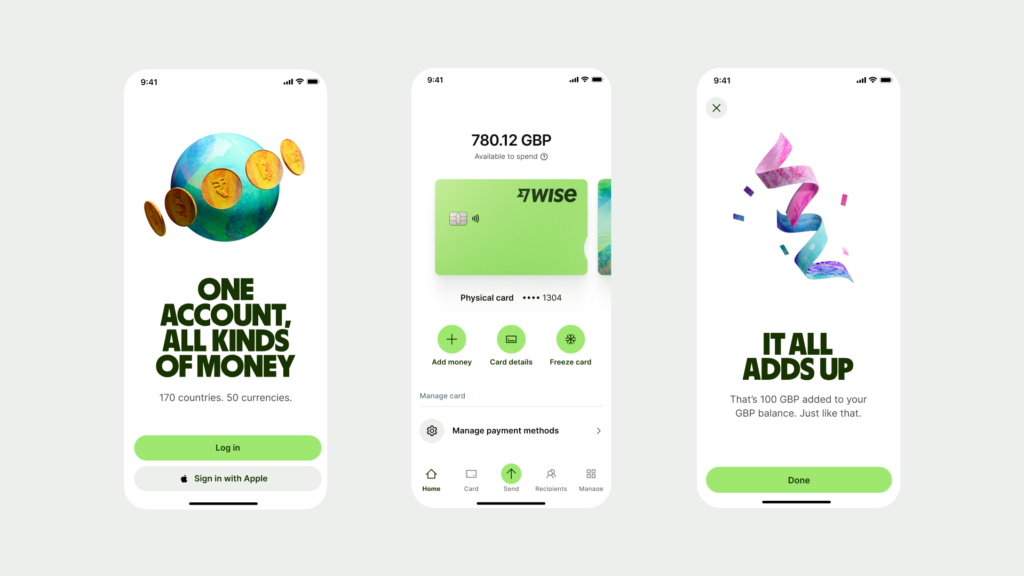

Wise Multi-currency Account

Open a personal Wise account online for free, or get a full feature Wise business account for a small one time fee. All accounts come with linked international debit cards for easy payments and withdrawals, some fee free ATM withdrawals every month, and currency exchange which uses the Google exchange rate.

Foreign Currencies: 50+ supported for holding and exchange

Fees & Exchange Rates: No maintenance fees, mid-market exchange rates, currency exchange from 0.41%

International Transfers: From 0.41%

Debit Card: Available

Revolut

Revolut has multi-currency accounts for personal and business customers which include fee free standard accounts, and alternative plans which have monthly fees but come with more features and free transactions. All accounts have linked cards, some fee free ATM withdrawals and some currency exchange which uses the Google rate.

Foreign Currencies: 25+ supported for holding and exchange

Fees & Exchange Rates: 0 AUD – 24.99 AUD/month maintenance fee, all plans include some free currency exchange, but limits may apply based on account tier

International Transfers: From 0.3% – 2% based on currencies

Debit Card: Available

Bank of Queensland

Bank of Queensland has accounts available for business customers who need to manage different currencies, send and receive payments and access currency risk management products.

Foreign Currencies: Based on business need

Fees & Exchange Rates: No maintenance fee, transaction fees apply

International Transfers: International transfer fees apply to send and receive payments, costs vary based on currencies involved

Debit Card: Not available

Here’s a side by side comparison so your can see the features and fees of each provider more easily.

| Wise | Revolut | Bank of Queensland | |

|---|---|---|---|

| Currencies supported | 50+ | 25+ | Based on business need |

| Maintenance Fees | No maintenance fee | Maintenance fee from 0 AUD – 24.99 AUD/month, depending on plan | No maintenance fee |

| International transfers | Currency conversion and international transfer fees from 0.41% | International transfer fees from 0.3% – 2% depending on currency | International transfer fees apply to send and receive payments, costs vary based on currencies involved |

| Linked Debit Card | Available | Available | Not available |

| ATM fees | Some free ATM withdrawals every month, low fees once plan limits are reached | Some free ATM withdrawals every month, low fees once plan limits are reached | Not available |

There’s no single best multi-currency or foreign currency account out there, so comparing a few is the smart way to get the best balance of features and fees for your specific needs. Use this guide to Commbank alternatives to see if any may suit you – and to kickstart your search for the perfect account for your requirements

When is a multi-currency account needed?

Multi-currency accounts are useful for both individual and business customers. While the features you get can vary, this type of account offers the option to hold a balance in a foreign currency, which can be handy if you make international transfers regularly, or if you want to invest overseas for example.

Some multi-currency accounts are optimised for day to day use, with linked international debit cards, while others are more intended for online payments or business use. Here’s a reminder of our picks, and what they’re best for:

Commbank – best for customers looking to view their foreign currency balance alongside their normal AUD balance, with facilities to deposit and withdraw foreign currency notes in branch

Wise – best for receiving free payments from 30 countries, holding 50+ currencies, and exchanging between them with the Google rate

Revolut – best for fee free ATM withdrawals and Google rate currency exchange to plan limits – just pick the account plan to best suit your transaction needs

Bank of Queensland – best for business customers looking to access foreign currency management tools online

Features of Commonwealth Bank Foreign Currency Account

Commonwealth Bank is a leading financial institution with branches throughout Europe, Asia and North America as well as here in Australia. It’s a trustworthy and established bank with a good branch network if you need to transact in person. Here are a few of the notable features of opening an account with CBA, to help you decide if a Commbank Foreign Currency Account might suit you.

NetBank

By opening an account with Commonwealth, you’ll have access to online and mobile banking with NetBank. NetBank lets you review your AUD bank account alongside your foreign currency account, so you can manage your transactions easily and all in one place.

Free transfers between Commonwealth accounts

If you or your business use Commonwealth for your other banking needs, you’ll be able to enjoy fee-free transfers between your Commonwealth Bank accounts.

Comprehensive coverage for foreign currencies

Commonwealth Bank Foreign Currency Accounts are available in almost all convertible currencies. You can then convert and exchange between currencies, or send payments, using the Commonwealth Bank exchange rate.

What is the eligibility for a Commonwealth Bank multi-currency account?

To apply for a Commonwealth Bank multi-currency account you’ll need to be:

- An Australian resident

- Over 18 years old

- A CBA customer with an eligible AUD everyday or savings account

Who is it good for?

Foreign currency accounts are handy for anyone who needs to receive, hold, send or spend foreign currencies. The Commonwealth Bank Foreign Currency Account allows customers to hold and review a foreign currency balance online, alongside their AUD balance. That can be convenient, and lets you send payments in either AUD or your preferred foreign currency easily.

International transfers with CBA are reasonably cheap if you manage your transfers online – although a currency exchange rate markup may apply if conversion is needed. The CBA Foreign Currency Account is also handy for anyone who needs to deposit or withdraw foreign currency cash at a branch. This service comes with a fee, but can be helpful if you prefer to transact in cash.

How to apply for a Commonwealth Bank Foreign Currency Account

You can apply for a CBA Foreign Currency Account easily in NetBank, if you’re already a CBA customer. In this case, just log into your NetBank app and follow the prompts to add a foreign currency account.

If you’re not a Commbank customer just yet, you’ll have to apply for an eligible AUD everyday or savings account before you can get a foreign currency account. Once you have this AUD account set up, you can then get your foreign currency account through NetBank easily. Bear in mind that although there are no fees for the Commbank Foreign Currency Account, there might be a maintenance charge for the AUD account you select.

The process to apply for a Commonwealth Bank AUD account online is as follows:

- Find the account you’re interested in online and click Open Now

- You’ll need to confirm you’re not a CBA customer already

- Follow the prompts to enter your personal and contact details

- Upload your documents for verification

- The first time you go to a CBA branch you’ll be asked to show your ID in person and give a signature

What documents you’ll need

You can apply online for an AUD account with CBA if you have a local Australian proof of address, and one of the following:

- Passport – if you’re using a foreign passport you must also have a valid visa

- Australian Birth Certificate

- Australian drivers licence

- Medicare card

If you’re applying for a business account you’ll need proof of ID and address for all business owners and people with significant shareholdings, as well as business ID documents which can vary widely depending on the business type you have.

Commonwealth Bank multi currency account fees

There’s no monthly fee for a Commonwealth Bank Foreign Currency Account, but you’ll pay charges for some services you access through the account. One important cost to consider is the fee you pay for international money transfers. Here’s what you need to know:

| International transfer type | CBA fee |

| Outgoing, arranged in branch | 30 AUD + any relevant correspondent bank fees or exchange rate markup |

| Outgoing, arranged in NetBank | 6 AUD + any relevant correspondent bank fees or exchange rate markup |

| Incoming | Up to 11 AUD |

Commonwealth Bank exchange rate

When you send a payment to be deposited in a different currency, or when you exchange from one currency to another within your CBA Foreign Currency Accounts, you’ll get the Commonwealth Bank exchange rate. This is likely to include a markup added to the mid-market exchange rate.

You’ll be able to find the live CBA exchange rate in NetBank, and can then compare it to the Google exchange rate to spot if a markup has been used.

Commonwealth Bank Correspondent Bank fees

If you’re sending a payment overseas through CBA you may find a correspondent bank deducts charges as the transfer is processed. This usually means the recipient gets less than you expect in the end. In some currencies, when sending a payment from a CBA Foreign Currency Account, you can select to pay the correspondent bank fee yourself. Here’s what that will cost:

| Currency | Correspondent bank fee |

| EUR | 33 EUR |

| GBP | 17 GBP |

| NZD | 17 NZD |

| USD | 37 USD |

How to use Commonwealth Bank Foreign Currency Account

You can make international money transfers online, in the NetBank app or in a branch.

Here’s an easy step by step to send a payment overseas from your CBA Foreign Currency Account:

- Log into NetBank

- Select Transfers and BPAY, then International Money Transfer.

- Choose the destination country

- Add the recipient’s details

- Double-check and confirm

Funding methods

You can add funds to your Commbank Foreign Currency Account in the following ways:

- Have money deposited to your account electronically by bank transfer

- Deposit cash in AUD at CBA branches

- Deposit cash in foreign currency at select CBA branches

Payout methods

Make payments from your foreign currency account in the currency of the account, or in a different foreign currency. You can also withdraw in AUD or foreign currencies in cash at select branches.

How to use Commonwealth Bank Foreign Currency Account abroad

As long as you can access the internet, you can log into NetBank to manage your Commonwealth Bank Foreign Currency Account abroad just the same as you can at home. However, it’s useful to note this account does not have a linked card so you won’t be able to get your money in foreign currencies for immediate spending when you’re overseas.

Supported currencies

Commonwealth Bank offers foreign currency accounts in almost all convertible currencies. You can also send money in 30 currencies, to over 200 countries and territories.

Commonwealth Bank Foreign Currency Account limits

There’s no limit to the amount of money you can transfer between Commbank accounts you hold in your own name. However, there are limits to international money transfers made online and by phone. If you need to send a higher amount you may need to set up your transfer in a branch which comes with higher fees.

- International money transfer limit – NetBank: 5,000 AUD/day

- International money transfer limit – phone banking: 50,000 AUD/day

Are Commonwealth Bank multi-currency accounts safe?

Yes. Commbank is an established and trusted bank which is fully licensed to trade in Australia, and to offer a full range of products and services to personal and business customers.

Conclusion

Opening a multi-currency account can be helpful for both personal and business customers who need to hold, send, spend and exchange one or more foreign currencies.

You’ll have a good choice of options when it comes to foreign currency accounts. Commonwealth Bank Foreign Currency Accounts might be a good option if you already bank with CBA and want to add in a facility to hold and manage a foreign currency alongside your existing AUD account.

Alternatively, if you want an account with a linked card for flexible spending and withdrawals as you travel, you might want to look at alternatives like Wise and Revolut, which can be cheap and convenient ways to manage your money across currencies online and on the move.

FAQs

- Does Commonwealth Bank offer foreign currency accounts?

Yes. Commonwealth Bank offers foreign currency accounts in almost every convertible currency, as long as you also hold an eligible AUD account with them.

- Can I deposit foreign currency into my Commonwealth Bank account?

You can deposit foreign currency cash into your CBA account at select Commonwealth branches.

- Does Commonwealth Bank charge international fees?

Yes. There’s no maintenance fee for a CBA Foreign Currency Account – but you will need to pay transaction fees for the services you use, including a 6 AUD charge for international transfers made online, plus relevant foreign exchange or correspondent bank fees.

- Can I access my Commonwealth Bank Foreign Currency Account overseas?

You can manage your CBA Foreign Currency Account overseas through NetBank. However, it’s useful to note this account does not have a linked card so you won’t be able to get your money in foreign currencies for immediate spending when you’re overseas.