3 Alternatives to Payoneer Business Account

Payoneer offers business accounts for freelancers and business owners in Australia and around the world, which can be used to take customer card payments, to receive payments in a selection of currencies, and to send money abroad conveniently. Before you register, compare your options – including features and fees – against some alternatives to Payoneer like Wise and Revolut Business to see which is the best for your specific needs.

This guide explores Payoneer alternatives, like Wise for holding 40+ currencies, with mid-market rates, and Revolut, for selecting from different account tiers to suit your growing business. We’ll explore what these companies like Payoneer have to offer, to help you decide which is the best fit for you.

Quick summary:

- Wise Business – great for managing 40+ currencies in one account, and extensive card and payment services, with no ongoing fees and the mid-market exchange rate

- Revolut Business – great for choosing different fee paying account plans, which all offer 25+ currencies for holding and exchange, card services, and ways to transfer locally and overseas

- Airwallex – great for accounts to hold, receive and exchange 20+ currencies, with some options to waive monthly charges, and card payment processing services

About Payoneer business account

Payoneer is a specialist in business account and card services, which offers ways to get paid in a selection of currencies with local account details, as well as by taking customer card payments. There are no ongoing fees as long as you use your account regularly, and you can get extras like corporate cards for yourself and your team if you’d like to. Accounts can be opened by freelancers and owners of registered businesses, and there are also extras like Employer of Record services if you need bolt on business perks to help you manage administration and compliance more smoothly. Fees apply.

Does Payoneer work in Australia?

Yes. Payoneer works in Australia, offering account and card services for freelancers and businesses of all sizes. Here are a few of the features you get with a Payoneer account in Australia:

- Receive, hold, send and exchange a selection of major currencies for your everyday transaction needs

- Take customer card payments from Australia and internationally

- Issue corporate cards for yourself and team members to make it easier to manage business spending for supplies and other allowable expenses

- Request payments from customers using Payoneer tools to get paid quicker

Alternatives to Payoneer Business account in Australia: Side by side

The good news is that there are plenty of different providers or specialist business accounts here in Australia. This means that you can easily find the right one for your needs – but it also means you need to invest time in researching your options. This guide is here to help.

Here we’ve picked out some alternatives to the Payoneer Business account in Australia which might suit your needs, depending on which features and transaction types are most important to you. Here’s a summary – and there’s more details coming up right after:

| Provider | Account features | International payments | Integrations |

|---|---|---|---|

| Payoneer | Hold 30+ currencies

Convert payments in 6 major currencies in your account. You can also use 4 currencies – CZK, PLN, RUB and VND for tax payment purposes

0.5% currency conversion fee |

Send payments in 70+ currencies

Transfer fees up to 3% depending on payment details

Receive payments from 9 countries and the EEA using your account details |

View available integrations in the Developer tab once you’ve registered an account |

| Wise Business | Hold 40+ currencies

65 AUD fee for full feature access, no monthly fee

Low transaction fees and mid-market exchange rates |

Send in 40+ currencies

Send fees from 0.65%

Receive 20+ currencies |

Integrations include Xero, FreeAgent, Quickbooks

API access available |

| Revolut Business | Hold 25+ currencies

Monthly fees from 21 AUD – 79 AUD with custom options for enterprise customers

Plans include some no fee transactions monthly before fair usage fees begin |

Send in 35+ currencies (some restrictions apply)

Send fees from 10 AUD outside of plan limits

Receive 25+ currencies |

Accounting: Xero, FreeAgent, Quickbooks

HR: Google Workplace, BabbooHR, Breathe

Productivity: Make, Zapier, Slack

Payments: Adobe Commerce, BigCommerce, Shopify |

| Airwallex | Hold 20+ currencies

Receive domestic and international card payments

Optimised for online and digital businesses |

Send in 60+ currencies

Send fees from 0 AUD – 30 AUD

Receive 20+ currencies |

Bank feeds sync with Xero, QuickBooks, and NetSuite, with advanced features for some account plans |

*Details correct at time of research – 3rd May 2025

Wise is a good alternative to Payoneer because it offers the mid-market rate for currency conversion, has simple and transparent fees, supports 40+ currencies for holding and exchange and has easy ways to receive incoming payments with account details in 20+ currencies.

Revolut is a good alternative to Payoneer if you’d rather pick from several different account plans to choose the one which meets your transaction needs most closely – you can get fixed amounts of no fee transactions monthly depending on what matters most to your company.

Airwallex is a good alternative to Payoneer if you want to compare the costs of processing card transactions, and also need to hold, receive, exchange, send and spend in 20+ currencies with no hassle and low fees.

📲You may also like: Wise vs Western Union

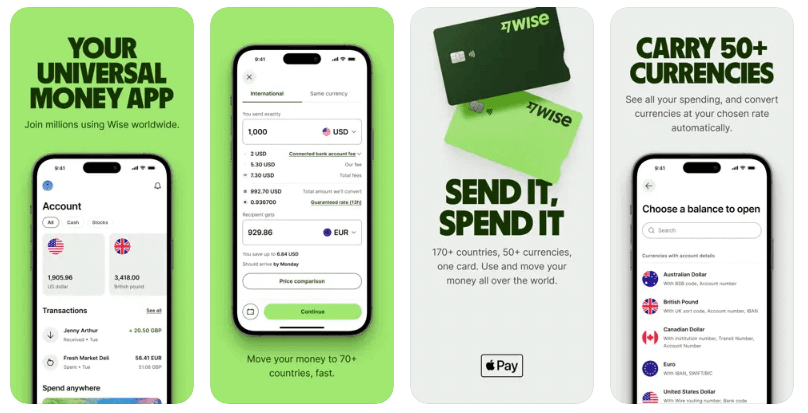

Wise Business Account

You can open a Wise Business Account online or in the Wise app, to hold 40+ currencies, receive payments with account details in 20+ currencies, and to spend around the world with your linked Wise debit or expense cards. There are no monthly fees for your Wise account, and it offers currency conversion based on the mid-market rate plus a transparent conversion fee which varies by currency. For business customers, WIse also supports international payments in a very broad range of currencies, with batch payment options to allow you to pay up to 1,000 people all at once.

Wise is a large and established specialist provider which has industry level safety and security measures designed to protect customer funds and data. As with all financial services, customers should follow recommended security practices. Your funds are safeguarded in top tier banks around the world to ensure your money is protected, whichever currency you hold.

- Wise Business opening and monthly fees: No monthly fees, one time 65 AUD opening fee

- Wise Business international transfer fees: Transfer with a variable fee, from 0.65%, with mid-market rates on currency exchange

- Wise Business exchange rate: Wise uses mid-market rates with low, transparent fees you’ll see before you convert

Best Wise Business features

- Hold and exchange 40+ currencies, receive in 20+ with account details

- Currency exchange uses mid-market rates and low fees

- Send payments around the world, often instantly and usually within 24 hours

- Debit and expense cards available, plus multi-user access and batch payment solutions

📲

Learn more about Wise Business

Wise Business pros and cons

| Wise Business pros | Wise Business cons |

|---|---|

| ✅ Hold and exchange 40+ currencies

✅ Mid-market rates with low, transparent fees ✅ Debit and expense cards available ✅ Time saving perks like a powerful API, multi-user access and batch payment solutions |

❌ No branch access for depositing cash

❌ Variable transaction fees can apply |

Is Wise Business safe?

Wise Business is a digital first provider which has high levels of security built into all of its operations. Your funds are held in a top tier bank for safeguarding purposes, and your account is secured by 2 factor authentication. Card transactions are monitored for suspicious activity, and you can also freeze your card instantly if you need to and get instant transaction notifications with your phone.

Wise Business or Payoneer?

Wise Business has a broader range of currencies for holding and exchange, and also uses a simple and transparent fee structure. Wise has the mid-market exchange rate with variable conversion fees which you can clearly check and compare before you transact, as well as low cost transfers which can be quick or even instant.

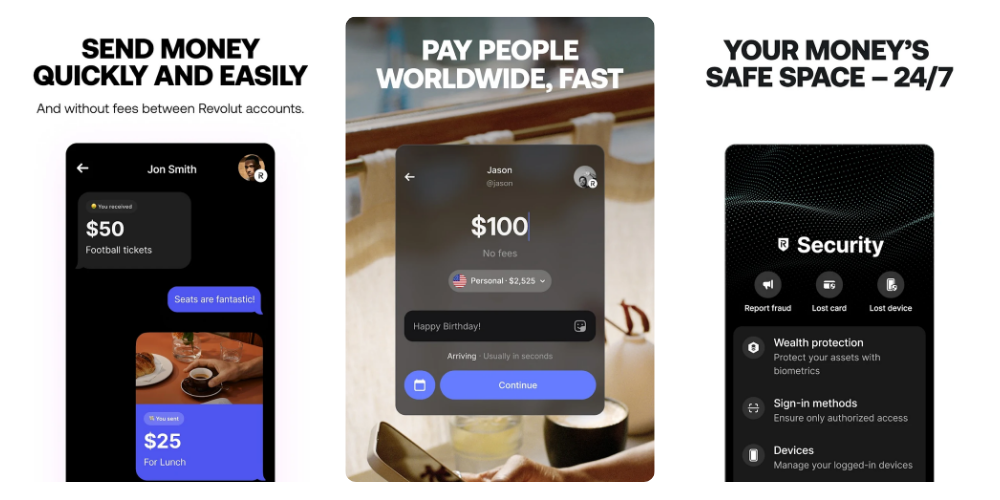

Revolut Business

Revolut offers 3 different business account plans in Australia, with fees of 21 AUD or 79 AUD a month for off the peg plans, and tailor made solutions for enterprise level customers. You can use your account to hold and exchange 25+ currencies, receive payments in select currencies to your account, and get linked payment and team expense cards. Revolut’s model means that different account types all get some no fee transactions monthly, with fees kicking in once you exhaust your limits.

Revolut Business is a safe and reliable option to use in Australia. Your money is held securely, and all customers must complete a thorough verification process to open an account.

- Revolut Business opening and monthly fees: No opening fee – monthly fees are 21 AUD or 79 AUD for off the peg solutions, or you can build a custom plan as an enterprise customer

- Revolut Business international transfer fees: All plans have some no fee transfers monthly. Send fees from 10 AUD outside of plan limits

- Revolut Business exchange rate: Weekday exchange at the Revolut rate to plan limit, then 0.6% fair usage fee applies. 1% out of hours fee for weekend exchange

Best Revolut Business features

- 3 different account plans to suit businesses from startup to enterprise level

- All account tiers have a fixed level of no fee transactions per month, including currency exchange, local and international transfers

- Get a debit card for yourself and issue additional expense cards for your team

- Send and receive international payments with fees from 10 AUD each time

📲

You may also like: Revolut Australia Review

Revolut Business pros and cons

| Revolut Business pros | Revolut Business cons |

|---|---|

| ✅ 3 different account tiers to suit different business types and sizes

✅ All accounts have debit or expense cards and offer multi-currency features ✅ Some no fee transactions included, like limited weekday currency conversion ✅ Higher tier accounts get rewards, account management support and custom card options |

❌All account have monthly fees

❌Fair usage fees apply if you exceed monthly no-fee transaction limits, with extra charges if you need currency conversion on a weekend

|

Is Revolut Business safe?

Revolut is a large provider that offers personal and business accounts to customers all over the world. It has been built with safety in mind, as it incorporates security features designed to protect customer accounts.

Revolut Business or Payoneer?

Payoneer offers the same basic account features to all customers, whereas Revolut has different account tiers which all have their own fees and come with differing numbers of no fee transactions. This can appeal if there’s a Revolut account which closely matches your anticipated transaction requirements, as it may keep the costs low for you.

Airwallex Account

Airwallex offers accounts to businesses around the world, with fees, features and options that vary a little depending on where your business is based. In Australia you can open an account with ongoing fees of 29 AUD to 499 AUD, with options to waive the fee on the lowest tier account if you hold a balance of 10,000 AUD and deposit at least 5,000 AUD a month to your account. Airwallex has the benefit that it also lets you process customer card payments – a service that’s not always available from digital providers. Fees apply, but this can be attractive if you’re an ecommerce business.

Airwallex is a large and trusted business which has strong security measures in place. Customer funds are segregated for safekeeping, which means your money is safe even in the unlikely event that Airwallex were to run into financial difficulties itself.

- Airwallex opening and monthly fees: No opening fee – monthly charges from 29 AUD to 499 AUD, with options to waive the fee on the lowest tier account

- Airwallex international transfer fees: Send for free with local payments to 120 countries, or pay 10 AUD to 30 AUD for SWIFT transfers – exchange fees may apply

- Airwallex exchange rate: the rate offered depends on the currency you need to exchange, with fees of 0.5% on major currencies, and 1% on other options

Best Airwallex features

- Receive, hold and exchange 20+ currencies in your account

- Send payments with no transfer fees to 120+ countries

- Take customer card payments in different currencies conveniently

- Card services available

Airwallex pros and cons

| Airwallex pros | Airwallex cons |

|---|---|

| ✅ Hold, receive and exchange 20+ currencies

✅ Good range of options for sending money abroad, including free transfer methods ✅ Card payments are supported ✅Expense management tools available for some account plans |

❌ Airwallex cards can not be used in an ATM

❌Monthly fees can be high, and a fee of 0.5% – 1% applies on all currency conversion |

Is Airwallex safe?

Airwallex implements security measures intended to protect the customer, using a selection of industry level measures to ensure their data and their money are secure. You’ll need to complete a verification process to open your account in the first place, and can then secure your account with 2 factor authentication. Your funds are segregated from Airwallex working capital to ensure you will always have access to your money.

Airwallex or Payoneer?

Payoneer allows customer card payments with fees of up to 3.99% – but to see the exact costs of processing the payments you take regularly you’ll need to register an account. This may make Airwallex a better choice if you need card processing services, as fees are set out clearly, and start from 1.65% + 0.30 AUD for domestic payments.

Alternatives to Payoneer for international business payments

Most businesses need to send international payments – whether that’s just every now and again or on a very regular basis. International transactions can come with high and unexpected fees – so checking the costs in advance can be another good way to weigh up the different providers you can select. To help we’ve compared the providers we’ve been looking at head to head on payment features – here’s what you need to know:

| Provider | Coverage | Transfer fees | Transfer speed | Exchange rate |

|---|---|---|---|---|

| Payoneer | Send payments in 70+ currencies

|

Transfer fees up to 3% depending on payment details | Variable delivery times – you can view estimates in the app | 0.5% currency conversion fee |

| Wise | Send in 40+ currencies | From 0.65% | Can be instant – the vast majority of payments arrive in 24 hours* | Mid-market exchange rate |

| Revolut Business | Send in 35+ currencies (some restrictions apply) | 10 AUD for transfers outside of plan allowance

35 AUD additional fee for SWIFT OUR payments |

Usually up to 2 business days | Weekday exchange at the Revolut rate to plan limit, then 0.6% fair usage fee applies

1% out of hours fee for weekend exchange |

| Airwallex | Send in 60+ currencies | Free to transfer using local networks

10 AUD – 30 AUD for SWIFT payments |

The majority of payments arrive in 24 hours | Wholesale rate + fees of 0.5% or 1% depending on the currency |

*Details correct at time of research – 3rd May 2025

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions

Here’s a summary of the services we’ve been exploring today, based on their options for sending money overseas.

Wise Business: Send in 40+ currencies, with payments which can arrive instantly, and in most cases are deposited in 24 hours. Currency exchange uses the mid-market rate. Track payments with the Wise app easily so you can see where your money has got to.

Revolut Business: Send in 35+ currencies with all accounts offering some transfers which waive fees. Once you exhaust your limit of no fee transfers, you pay 10 AUD for standard transfers overseas, with currency costs depending on the account tier and how you transact.

Airwallex: Send in 60+ currencies with no transfer fee for payments using local networks, and a charge of 10 AUD – 30 AUD for SWIFT payments. Exchange is calculated using the wholesale rate with fees of 0.5% for major currencies, or 1% for other currencies. Transfers usually arrive in 24 hours.

Is there a safer alternative to Payoneer?

Payoneer is a safe provider to choose when selecting an account for your business. You will need to use normal safety precautions like keeping your passcodes secret, as you would with any provider – but with common sense precautions, Payoneer is perfectly safe to use.

All of the providers we have reviewed in this guide are considered safe with normal precautions – here’s a summary of the others:

Wise: Customer funds are held in a top tier bank for safeguarding, and accounts are secured by 2 factor authentication. Freeze and unfreeze your card instantly if you need to, and get instant transaction notifications with your phone. Reach out for help in the app, 24/7 if you ever need it.

Revolut: Revolut was built as an app, and has been designed to integrate industry level security. You’ll be able to see your account and transactions in the app easily, get help when you need it through the chat function and manage card transactions to ensure your account is always safe.

Airwallex: Customer funds are segregated from Airwallex working capital to ensure you will always have access to your money, and you can also view, check and manage your account and card with your phone

📲

Learn more about international money transfers

What to consider when choosing a business account?

Having several different providers for your business account can seem a bit overwhelming. Here are a few things to think about when you’re deciding which is the best choice for your specific needs:

- Choosing an account with low or no monthly fees, and low transaction costs on things like currency conversion, transfers and card costs helps keep your overall bills lower

- If you need multi-currency services, check which currencies are available to hold, and where you can send payments to as this can vary a lot between accounts

- Get feedback from others and from online resources to select an account provider which has a good reputation for customer service

- Check available integrations to make sure it will work with your existing systems like HR, productivity and accounting software

Conclusion: Is there a better alternative to Payoneer business in Australia?

Payoneer is a popular business account and card service in many countries including Australia. You may find it’s the right option for you, particularly if you want to take customer card payments, but it’s not the only choice, and it’s not right for all business types and transaction needs.

When exploring alternatives to Payoneer for your business needs, consider these top options: Wise for multi-currency management with mid-market rates, Revolut for tiered account plans, and Airwallex for card processing services. Each Payoneer alternative offers unique benefits to suit different business requirements.

Alternatives to Payoneer for business: FAQs

Which provider is the best to open a business account with?

Australian business owners and freelancers have a good choice of specialist account services to choose from. Payoneer may be a good fit for some, but there’s also Wise for low cost currency conversion with the mid market rate, or Revolut for different accounts to suit businesses of all different sizes. You may also want to compare Payoneer vs Airwallex on card processing costs if that’s something you need.

Is Wise better than Payoneer?

Payoneer and Wise offer different features, so which is best depends on your needs. Payoneer offers card processing services which Wise does not, but Wise does offer more currencies for holding and exchange, mid-market rates and transparent low pricing. Compare both to decide which is best for you.

Is Revolut Business better than Payoneer?

Both Revolut and Payoneer offer attractive business accounts, but they’re different in their features and pricing approach. Payoneer has a pay as you go model with no ongoing fees as long as you use your account regularly enough. Revolut has monthly fees but also throws in no fee transactions in return for your monthly maintenance charge.

Is Airwallex better than Payoneer?

Neither is better – but both may appeal if you take customer card payments for your business. In this case look carefully at the fees for card payment processing offered by each service. Fees vary based on card type and whether it’s a local or international card – but this can make a big difference in the overall costs you pay for your account.