5 Best International Money Transfer Apps Reviewed – 2026

If you need to send a payment overseas, using an international money transfer app allows you to get everything set up right from your phone or smart device, without even leaving the house. Money transfer apps are available for Apple and Android phones, and often come from digital first providers which focus on speed, efficiency and an intuitive user interface.

Read on to learn more about the 5 best international money transfer apps for Australian customers based on the features, fees, exchange rates and delivery times available.

5 Best Online Money Transfer Apps in 2026

Here’s a look at the 5 online money transfer apps we’ll look at in this guide, and a quick word about why:

- Wise: Transfer in app to 160+ countries with the mid-market rate and fast or instant delivery times

- WorldRemit: In app payments to bank accounts, for cash collection, to mobile money wallets and as airtime

- OFX: Send money conveniently in app with no upper limit, and 24/7 phone support if you need it

- XE: Transfer to 130+ countries from Australia and get live rate data in the same app

- CurrencyFair: In app payments to 150+ countries in 20 currencies, with multilingual support on hand

Here’s a summary of the consumer ratings we’ve found for the money transfer apps we’ll look at in this guide:

| International Money Transfer Apps | App Store | Play Store | ||

|---|---|---|---|---|

| Ratings | Number of Reviews | Ratings | Number of Reviews | |

| Wise | 4.6 out of 5 | 40,000 | 4.7 out of 5 | 730,000+ |

| WorldRemit | 4.8 out of 5 | 179,000+ | 4.6 out of 5 | 195,000+ |

| OFX | 4.8 out of 5 | 2,500+ | 4.6 out of 5 | 3,800+ |

| XE | 4.8 out of 5 | 27,000+ | 4.6 out of 5 | 165,000+ |

| CurrencyFair | 4.3 out of 5 | <100 | 2.6 out of 5 | 1,000 |

- Data correct at time of writing – 19th January 2024

As there are often far more reviews listed on Google Play, we’ve taken our ranking from this. However, as you can see in the table, there’s not much in it – so it’s well worth comparing all the money transfer apps we review to see which suits your specific preferences.

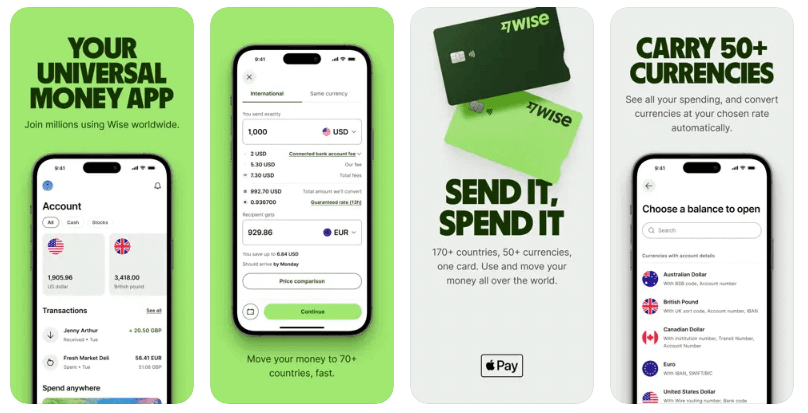

Wise

Fees and exchange rates: mid-market exchange rate, and low transparent fees from 0.43%

Fees and exchange rates: mid-market exchange rate, and low transparent fees from 0.43%- Safety: Regulated locally, and globally wherever services are offered

- Speed: 50%+ of transfers are instant, 90% arrive in 24 hours

- Customer reviews: 4.6 out of 5 stars on App store, from 40,000 reviews; 4.7 out of 5 stars on Google Play, from 730,000+ reviews

Wise offers international money transfers and multi-currency accounts for personal and business customers. Use the Wise app to create an account and get verified to send payments to 160+ countries, in 40+ currencies, with the mid-market exchange rate and low, transparent transfer fees.

As well as transfers, you can also open a Wise account to hold 40+ currencies, and receive payments from overseas with local bank details for up to 9 currencies – all with no monthly fee or minimum balance. If you travel or shop online you may also want to order an optional linked debit card for easy spending and withdrawals.

More than half of Wise international payments arrive instantly, and you can usually send up to around 1 million GBP or the currency equivalent, depending on the destination country.

Wise pros and cons

Pros:

- Mid-market exchange rates and transparent fees from 0.43%

- Send payments to 160+ countries, or open a multi-currency account to hold and exchange 40+ currencies, with a linked debit card

- Over 50% of transfers arrive instantly, 90%+ are there in 24 hours

Cons:

- Services, fees and delivery times vary based on destination

- No cash pay out options available, transfers to bank accounts only

- There’s a one time fee to open a business account or get a debit card

| App Store | Play Store | |

|---|---|---|

| Rating |

|

|

| Number of reviews |

|

|

WorldRemit

- Fees and exchange rates: variable fees, and exchange rates which include a markup

- Safety: Regulated locally, and globally wherever services are offered

- Speed: Cash collection can be quick or instant, bank deposits may take a day or two

- Customer reviews: 4.8 out of 5 stars on App store, from 179,000+ reviews; 4.6 out of 5 stars on Google Play, from 195,000+ reviews

WorldRemit lets you send payments to 130+ countries from Australia, with a selection of pay out options including bank or mobile money deposit, cash collection or as airtime top up. Not all services are available in all destination countries, so it is important to double check your options based on where you’re sending to.

Many WorldRemit payments are fast or instant. If you’re sending money for cash collection it could be available in just a few minutes, and payments to mobile money accounts and for airtime are also usually very fast. Bank deposits may take a little longer depending on the specific transfer – but many payments still arrive on the same day you send them. Limits apply which vary based on destination and pay out method.

WorldRemit pros and cons

Pros:

- Send for bank or mobile money deposit, cash collection or as airtime top up

- Many payments are received in minutes when sent for cash collection

- Instant rate and fee quotes available

- Send to 130+ countries from Australia

Cons:

- Exchange rates include a markup

- Variable transfer fees depending on the country and payment method you pick

- Not all services are available in all countries

| App Store | Play Store | |

|---|---|---|

| Rating |

|

|

| Number of reviews |

|

|

OFX

- Fees and exchange rates: exchange rates include a markup, 15 AUD fee for payments under 10,000 AUD, waived above that

- Safety: Regulated locally, and globally wherever services are offered

- Speed: 1 -2 days for major currencies, 3 – 5 days for exotic currencies

- Customer reviews: 4.8 out of 5 stars on App store, from 2,500 reviews; 4.6 out of 5 stars on Google Play, from 3,800+ reviews

- Speed: 1 -2 days for major currencies, 3 – 5 days for exotic currencies

- Customer reviews: 4.8 out of 5 stars on App store, from 2,500 reviews; 4.6 out of 5 stars on Google Play, from 3,800+ reviews

OFX is a global currency specialist which offers payments to 170+ countries from Australia, as well as currency risk management solutions and business accounts for online sellers. You can set up your payment entirely online or in app once you have registered an account and been verified – or there’s a 24/7 phone line if you ever get stuck or want to talk your transaction through with someone.

OFX payments can arrive on the same day you send them, but may also take a few days if you’re sending an unusual currency. There’s no upper or lower payment limit with OFX.

OFX pros and cons

Pros:

- 24/7 phone support if you ever need it

- Send in 50+ currencies, to 170+ countries

- No transfer fee for high value payments

- Business customers can open multi-currency accounts to hold and receive 7 currencies

- Currency risk management products also available

Cons:

- Variable markups apply to the rates used

- 15 AUD transfer fee for payments under 10,000 AUD

- Delivery times may take up to 5 days for exotic currencies

| App Store | Play Store | |

|---|---|---|

| Rating |

|

|

| Number of reviews | 2,500 reviews |

|

XE

- Fees and exchange rates: Exchange rates include a markup, fees are variable based on destination

- Safety: Regulated locally, and globally wherever services are offered

- Speed: 1 – 4 days depending on pay in and pay out options selected

- Customer reviews: 4.8 out of 5 stars on App store, from 27,000 reviews; 4.6 out of 5 stars on Google Play, from 165,000+ reviews

XE Money Transfer has been in business for over 25 years, and covers transfers to 130 countries in around 100 currencies. You can set up your payment in the XE app, where you’ll also be able to find handy information like live and historic mid-market exchange rates.

XE Money Transfer fees vary based on where you’re sending to and the value of your payment. Exchange rate markups will also apply, but you’ll be able to get a quote in the app before you confirm your transfer, to check it’s good value for your specific transfer. You can send up to the currency equivalent of over 2 million AUD from Australia.

XE pros and cons

Pros:

- Send to 130+ countries

- Get live exchange rate data, and historic information to review trends

- Very high transfer limits

- Easy to use app from an established business

Cons:

- Variable fees apply

- Exchange rates include a markup

| App Store | Play Store | |

|---|---|---|

| Rating |

|

|

| Number of reviews |

|

|

CurrencyFair

- Fees and exchange rates: Exchange rates include a markup, fees are variable based on destination

- Safety: Regulated locally, and globally wherever services are offered

- Speed: 1 – 4 days depending on pay in and pay out options selected

- Customer reviews: 4.8 out of 5 stars on App store, from 27,000 reviews; 4.6 out of 5 stars on Google Play, from 165,000+ reviews

CurrencyFair supports transfers to 150+ countries, in 20+ currencies, with a transparent 3 EUR equivalent fee, and an average exchange rate markup of 0.53%. While transfer times vary, many deposits arrive in 24 hours.

CurrencyFair doesn’t have huge numbers of app reviews recorded at the time of writing, but it’s a reputable business which is safe to use – so worth checking out if you want to compare your international money transfer app options.

CurrencyFair pros and cons

Pros:

- Send to 150+ countries, in 20+ currencies

- Transparent fees apply

- Many payments arrive in 24 hours

- Regulated and licensed business

Cons:

- Fees include both a transfer charge and a rate markup

- Variable transfer times apply

- Not many reviews of the app available

| App Store | Play Store | |

|---|---|---|

| Rating |

|

|

| Number of reviews |

|

|

What is the best app for transferring money?

All the international money transfer apps we’ve profiled in this guide have their own unique features – that means that which is the best for you will depend on the specific transfer you want to make. Here’s a summary:

| App Name | Best for | Fees | Speed | Transfer Limits | Operating System |

|---|---|---|---|---|---|

| Wise | Transfer to 160+ countries; mid-market rate and fast or instant delivery times | No exchange rate markup, fees from 0.43% | 50%+ of transfers are instant, 90% arrive in 24 hours | Usually the equivalent of 1 million GBP | Apple & Android |

| WorldRemit | In app payments to bank accounts, for cash collection, to mobile money wallets | Variable fees, rates include a markup | Cash collection can be quick, bank deposits may take a 1-2 days | Limits apply based on destination & payout | Apple & Android |

| OFX | Send money conveniently in app with no upper limit, and 24/7 phone support if you need it | 15 AUD fee for payments under the value of 10,000 AUD, waived above that | 1 – 2 days for most payments | No limit | Apple & Android |

| XE | Transfer to 130+ countries from Australia and get live rate data in the same app | Variable fees, and exchange rates which include a markup | Variable delivery times based on pay in and pay out options | In excess of 2 million AUD | Apple & Android |

| CurrencyFair | In app payments to 150+ countries, 20 currencies | 3 EUR equivalent fee, average markup 0.53% | Many transfers arrive in 24 hours | Limits apply based on destination & payout | Apple & Android |

Conclusion – 5 Best international money transfer apps

There’s no single best international money transfer app. Each option will suit a different customer, with different payment needs. Use this guide as a starting point to pick the right one for you – based on the costs, convenience and the range of services available.

At Currency Shop you can compare providers transparently, to find the best money transfer service for your needs based on both the fees and exchange rates available.

FAQs – Best international money transfer apps

Which money transfer apps work internationally?

Many international money transfer services have apps – check out Wise, XE, OFX, WorldRemit and other similar services to compare your options.

Which apps transfer money instantly?

Delivery times for international transfers do vary widely depending on where you’re sending payments to, and how you want them to be received. Wise offers many instant bank deposit transfers, while WorldRemit can offer near instant cash collections for example.

Are money transfer apps safe to use?

Yes, as long as you pick a reputable provider. All the providers we’ve highlighted in this review are fully licensed and regulated, making them a safe way to send your payment.

How do international money transfer apps work?

To make a payment with an international money transfer app you’ll need to create an account, and get a quote for the fees and exchange rate available. Pay with your card, or through a bank transfer, and your money will be on its way.

What is the easiest app to send money?

There’s no single easiest international money transfer app – use this guide to pick the right one for you based on our analysis and the customer rating information shared from Apple App store and Google Play.