5 best WorldRemit alternatives for sending money abroad – 2026

WorldRemit is a simple and fast way to send money from Australia to 130+ other countries, online and in app. There’s a decent range of ways for your recipient to get their money at the other end, too, from bank and mobile money deposits to cash collection and airtime top ups.

However, WorldRemit isn’t always the best value for international payments – so it’s worth shopping around with WorldRemit alternatives before you get started. Join us as we walk through 5 alternatives to WorldRemit, how they compare and why they might be better than WorldRemit.

Different WorldRemit alternatives may suit you depending on the specific transaction you want to make. To give some options, we’ll look at 5 great WorldRemit alternatives:

- Wise – Mid-market exchange rates, transparent fees and quick delivery

- OFX – 24/7 phone support and no transfer fee for higher value payments

- TorFX – Personal account management options

- Remitly – Payments on popular remittance routes

- Western Union – Huge agent network for convenient cash transfers

Why you should consider a WorldRemit alternative

WorldRemit is a large, reputable and popular provider of international transfers. Payments can be deposited to a bank or mobile money account, sent as airtime top up, or collected by the recipient in cash which is handy for people who don’t have easy access to a bank account.

However, WorldRemit isn’t always the right provider when you send a payment abroad. It’s worth comparing a few other money transfer services like WorldRemit to see if one is better value for the specific payment you want to make. One thing worth looking at is the exchange rate available from WorldRemit versus other providers. WorldRemit is likely to add a markup to their rate, which pushes up the cost, and isn’t always easy to spot. Some other providers split out the costs of your transfer more transparently, and may also present better value.

One other reason to look for a WorldRemit alternative – if you want to pay in cash. With WorldRemit you can only pay online or in app with a card or from your bank. If you need to pay in cash you’ll need a different site like WorldRemit – we have some suggestions coming right up.

Pros of WorldRemit

- Send money to 130+ countries

- Great range of pay out options including deposit to bank or mobile money account, cash collection and airtime top up

- Easy to arrange online or in app

- Pay by card or bank transfer – variable fees apply depending on how you pay

Cons of WorldRemit

- Not all services are available in all destination countries

- Exchange rates include a markup

- Variable fees apply depending on the transaction details

Alternatives to WorldRemit comparison

In this guide we’ll walk through 5 international money transfer providers that compare to WorldRemit. We selected these companies similar to WorldRemit based on their transfer speed, transparency, ease of use and price – as well as any extras they have on offer, like multi-currency accounts or cards.

Here’s an overview of the WorldRemit alternatives we’ve picked:

| Provider | Exchange rate | Speed | Convenience |

|---|---|---|---|

| Wise | Mid-market exchange rate | 50%+ of payments are instant, 90% arrive in 24 hours |

|

| OFX | Exchange rate includes a markup | Most transfers are received within 24 hours |

|

| TorFX | Exchange rate includes a markup | 1 – 2 working days |

|

| Remitly | Exchange rate includes a markup | Varies by destination and payment type |

|

| Western Union | Exchange rate includes a markup | Cash collection payments can be instant, bank deposits may take a day or two |

|

We’ll work through the providers we’ve selected one by one next – here’s a quick summary of why we think they’re a good WorldRemit alternative to consider, depending on your specific needs:

- Wise provides multi-currency accounts and fast payments with the mid-market exchange rate, deposited to bank accounts in 160+ countries – learn more

- OFX has no transfer fee for high value payments, and a 24/7 phone service which you can use to discuss your transfer with a broker

- TorFX has a personal service with online payments to 50,000 AUD for personal customers

- Remitly offers payments to banks and for cash collection, on popular remittance routes

- Western Union can help if you want to pay for your transfer in person using cash

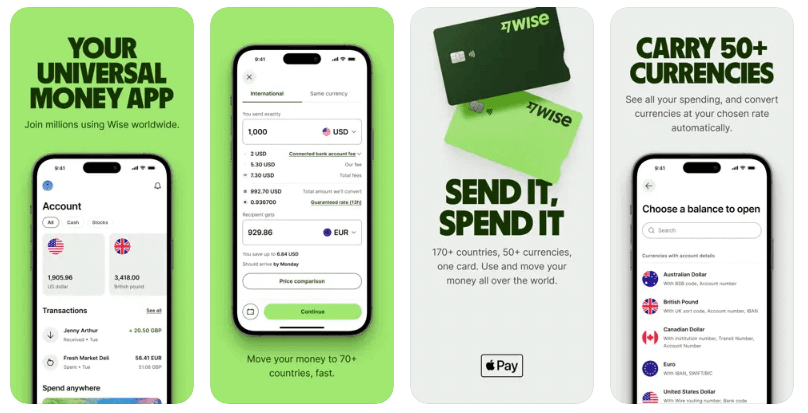

Wise

If you want your payment to be deposited to a bank account, Wise is a WorldRemit alternative you should consider.

Wise offers cheap, fast international payments and multi-currency accounts for business and personal customers, to hold and exchange 40+ currencies in one place. Wise transfers are fast, and can even be deposited into bank accounts in 160+ countries instantly, and all currency exchange uses the mid-market rate with no hidden fees.

Best Wise features

Wise payments use the mid-market exchange rate with transparent fees which can be as low as 0.43% for currency conversion and when sending payments. Plus, if you’re looking for ways to receive, exchange or easily spend in foreign currencies, you can also get a Wise account.

Wise accounts can hold 40+ currencies, receive payments like a local in a selection of global currencies, and you can also order a linked Wise international debit card to spend seamlessly in 150+ countries.

Pros

- Mid-market exchange rate used for currency conversion

- Transparent fees you can see and compare before you make a payment

- Send to 160+ countries, direct to bank accounts

- Open a multi-currency account to get paid in foreign currencies conveniently

Cons

- Fees vary based on payment method and destination

- No cash collection options

Why you should use Wise over WorldRemit

Wise is a good WorldRemit alternative if you want currency exchange which uses the mid-market exchange rate and low, transparent fees. Plus Wise also offers the option to hold and exchange 40+ currencies in their Wise Account – worth considering if you travel often or love to shop with a range of international ecommerce stores.

OFX

If you need to send a high value transfer to a bank account abroad, it’s worth looking at OFX as a WorldRemit alternative.

OFX offers international transfers as well as currency risk management services like forward exchange contracts and limit orders, to personal and business customers. Online sellers and business customers can also get a multi-currency account. It’s particularly handy for higher value transfers as there’s no transfer fee over 10,000 AUD, and you’ll have the reassurance of being able to talk through your transaction with a broker on the phone if you want to.

Best OFX features

OFX is known for its 24/7 phone service which you can use to get information, talk through your payment options, or set up more complex currency risk management tools. OFX uses an exchange rate markup which can be smaller than the one your bank would use, and has no transfer fee when sending 10,000 AUD or more.

Pros

- Send in 50+ currencies, to over 170 countries

- No transfer fee when sending higher value payments

- Most payments arrive in 24 hours

- 24/7 broker service by phone

Cons

- Exchange rates include a markup

- 15 AUD fee if you send a payment worth under 10,000 AUD

Why you should use OFX over WorldRemit

OFX could be a good WorldRemit alternative if you need very high value payments or more complex currency risk management tools. Because OFX has a 24/7 phone service you’ll also be able to talk through your needs with a support agent, which can be reassuring.

TorFX

If you’re looking for a site like WorldRemit which has phone service options and offers high value transfers, TorFX might be a good bet for you.

TorFX holds the highest possible credit rating and is a big hit with customers. It’s a frequent recipient of customer service awards and offers a personal broker service which lets you talk through your transaction needs by phone when you need to. As well as international transfers, TorFX has other currency risk management products for personal and business clients.

Best TorFX features

Use TorFX by phone, online or in app, to send one off or recurring payments, and to access currency services including forward contracts and market orders.

There are no transfer fees when you send a payment with TorFX. Instead, a charge will be added to the exchange rate used to convert your funds.

Pros

- Send in 40 currencies, to 120 countries

- No transfer fee

- Personal broker service to discuss your needs

- Currency risk management options for individuals and businesses

- Make online payments up to the value of 50,000 AUD

Cons

- Exchange rates include a markup

- You’ll need to register an account to see the rates offered and compare the cost of your transfer

Why you should use TorFX over WorldRemit

TorFX may be the best WorldRemit alternative for you if you’re making high value transfers and don’t want to pay a separate transfer fee for the payment. TorFX is also celebrated for its personal service – ideal if you’re looking for in person advice.

Remitly

Remitly offers international payments globally and on popular remittance routes. You can make a Remitly payment from Australia to around 100 different countries. Where Remitly stands out against WorldRemit is in its range of different fee options – for many destinations you can choose cheaper, but slower, economy transfers – or faster and more expensive express payments.

Best Remitly features

Send Remitly payments to bank accounts, mobile money accounts and for cash collection, with services and currencies offered varying by destination country. In some cases you’ll be able to opt to pay with a bank transfer, for an economy payment – or with a Mastercard or Visa card for an Express transfer. Express payments may arrive in minutes, while the cheaper Economy option can take 3 to 5 business days to arrive.

Pros

- Good range of payout options

- Send to around 100 countries

- Choose cheaper fees or a faster transfer depending on your needs

- Online and in-app service for convenience

Cons

- Personal payments only – no business transfers

- Relatively low transfer limits for Tier 1 accounts

- Exchange rates may include a markup, and there’s usually a transfer fee to pay

Why you should use Remitly over WorldRemit

Remitly may be a good WorldRemit alternative if you’re sending a personal payment and would rather pick from a range of fee options and delivery times to suit your personal preferences. Like WorldRemit, Remitly transfers can often be collected in cash locally, or even sent out for home delivery in some destinations.

Western Union

Western Union is one of the oldest and best known money transfer companies globally, with a huge agent network which covers almost every country in the world. Send money online, in-app or in person, with a range of different ways to pay – and different payout options including cash collection and deposit to bank and mobile money accounts, depending on what suits your recipient.

Best Western Union features

Western Union is a great WorldRemit alternative if you want to pay in cash or if you prefer to set up your payment in person with an agent. It’s pretty unrivalled in its agent network, which means that your recipient is likely to be able to find a convenient location locally to get their money – often in minutes.

Pros

- Cash collection payments can be instant

- Range of ways to pay, and for the money to be received

- Send to almost every country on the planet

- Easy to use app – or an in person service at an agent if you prefer

Cons

- Exchange rate markups apply

- Fees vary and can be on the high side

- Not all services available in all countries

Why you should use Western Union over WorldRemit

Western Union is another strong WorldRemit alternative if you want to pay in cash for your transfer. Western Union has a good customer support operation and you can always walk into an agent office to get face to face help – another bonus if you’re a fan of in person customer service.

![]()

Are the alternatives safe?

Yes. Here at Currency Shop we only review providers which are properly regulated for the services they offer, and which are safe to use.

WorldRemit alternatives conclusion

WorldRemit offers some great services, but it’s not always the right option. Exchange rates include a markup which can push up the overall cost, and not all services are available in all destination countries.

Different sites similar to WorldRemit can help – which is right for you may depend on the specific service you need. We’ve looked at options like Wise which can be a great fit if you want to send money to a bank account overseas, with the mid-market exchange rate – or if you want to hold and exchange a foreign currency balance. Or if you’re looking for alternatives to WorldRemit because you prefer to transact by phone, you may like OFX or TorFX. Remitly may work if you’d consider a slower transfer for a lower fee. And finally, if you’re thinking of sending a payment to someone in cash, Western Union may be a good WorldRemit alternative to consider.

Use this guide to pick out the right WorldRemit alternative for you, based on the specific transaction type you need to make.

FAQ

- What is the cheapest way to send money internationally?

Sending money internationally with a specialist online or digital service is often cheaper than using a bank. However, different services have their own rates and fees – so to find the cheapest way to send money internationally in your specific case, you’ll want to compare a few options based on both the transfer fees and the exchange rate markups applied.

- Which is the safest mode of money transfer?

Sending your payment with a properly regulated and trusted provider is essential. Check the money transfer service you pick is reputable – in most cases these services are regulated in the same way as your bank, which makes them just as safe for the services they offer.

- What is the best company to transfer money with?

There’s no single best company to transfer money with. Comparing a few is the best way to get a good deal. Use our top picks as a starting point to find the best one for you.