How to Open a Wise Account: A Full Guide 2026

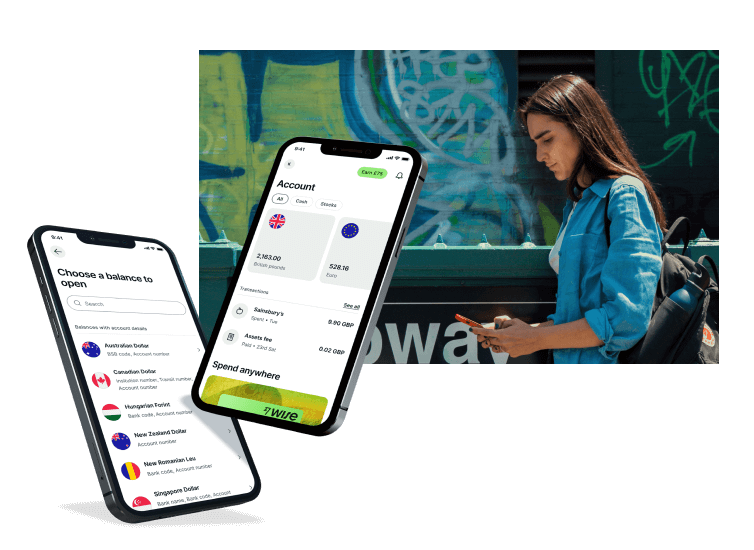

Wise offers personal and business multi-currency accounts which you can use to hold 40+ currencies, spend in 150+ countries, and get paid using local bank details for 9 major currencies. Plus, every time you need to convert from one currency to another, to send a payment or spend on your Wise card, you’ll get the mid-market exchange rate with low, transparent fees.

This guide to opening a Wise account in Australia covers all you need to know about types of Wise accounts, getting set up, making payments and more.

How to open a Wise account

Wise accounts are opened and managed online or in the Wise app, with a fully digital account registration process. Once you’ve opened your Wise account you can send payments to 160+ countries, hold a balance in 40+ currencies, and access local bank details for up to 9 currencies to receive payments. If you’d like, you can also order a Wise international debit card for convenient spending and withdrawals around the world.

Here’s how to open a Wise account step by step:

- Open the Wise desktop site or app and click on Create account

- Enter your email address, Google, Apple or FaceBook ID

- Tap the type of account you want to open – personal or business

- Follow the prompts to enter your contact information

- Verify your account, following the onscreen instructions

Can you open a Wise account without an Australian address?

You’ll be asked to prove your residential address when you open a Wise account. That means that to open a Wise account in Australia you’ll need an Australian address.

However, to open a Wise account you don’t need to be an Australian citizen or passport holder. Wise accounts can also be opened from a broad range of other countries, so if you’re a foreign resident you may still be able to open your Wise account with your local proof of address from wherever is home for you.

Eligibility requirements

To open your Wise Australia account you’ll need to be over 18, and a resident of Australia.

You can open a Wise account entirely from your computer or smart device. To open a Wise account you’ll need to have the following:

- Your personal and contact information

- Valid proof of ID

- Valid proof of address

Verification process

Wise can accept a range of documents to verify customers’ identity and address – all you’ll need to do is to take a quality image of the documents you’re using, and upload them within the Wise app. If you have any problems you can simply reach out to the Wise team using the chat feature to get advice.

Here are some common examples of the documents used to prove your ID and address when getting verified with Wise:

| Examples of valid ID documents | Examples of valid proof of address documents |

|---|---|

|

|

How to open a Wise business account

Wise business accounts have all the perks of a Wise personal account with some extra business friendly features, too. You can hold 40+ currencies, get paid by customers around the world with local bank details for 9 currencies, and pay contractors, suppliers and staff in 160+ countries. Whenever you need to convert from one currency to another you’ll get the mid-market exchange rate, with low, transparent fees.

Here’s how to open a Wise business account step by step:

- Open the Wise desktop site or app and click on Create account

- Enter your email address and confirm you’re opening a business account

- Add details about yourself and your business

- Upload any required verification documents

- Start a transfer and pay the one time fee for full Wise business account access

- Once your verification is complete, you’ll be notified and can use your account freely

Requirements to open a business account

Wise business accounts are available to Australia based freelancers, entrepreneurs and business owners. The exact documents and information you’ll need to register a Wise account can vary based on the business type. However, in general you’ll need:

- Business name and address

- Business registration information

- Information about the company directors or shareholders with a 25% or higher stake

- Details about what your business does

- A document showing who owns or controls the company

The account holders, and any team members you want to add to the account, will also need to be verified, usually by adding images of some ID and address documents. The whole process can be done online or in the Wise app, and the Wise team can always help if you’re not sure what documents or details are required in your situation.

How to send money abroad with Wise

You can send money overseas with Wise in the Wise app or, by logging into your account online. Here’s a quick step by step guide:

- Log into Wise online or in the Wise app and click Send money

- Confirm the currency you’ll pay with, and the currency you want your recipient to receive

- Enter the amount you want to send, or how much you want your receipt to get

- Choose how you’d like to pay, to view the fee options and rate

- Once you’ve checked everything, confirm and follow the prompts to get you money moving

You’ll see the fees and exchange rate available, and can instantly compare against other providers – here’s a quick example of the costs for a transfer from Australia to the UK to give an idea of how Wise works:

| Sending 1,000 AUD to GBP with: | Transfer fee | Exchange rate | Recipient gets |

|---|---|---|---|

| Wise | 5.31 AUD | 1 AUD = 0.525113 GBP | 522.32 GBP |

| NAB | No transfer fee | 1 AUD = 0.511661 GBP | 511.66 GBP |

| ANZ | 9 AUD | 1 AUD = 0.504182 GBP | 499.64 GBP |

*Data correct at time of writing – 25th October 2023

As you can see, in this comparison your recipient would get more with Wise compared to NAB and ANZ. That’s even though NAB has no stated transfer fee to pay. The difference here is in the exchange rate used to convert your currency from AUD to GBP for depositing to your recipient’s bank account. Wise uses the mid-market exchange rate with no markup, while the other providers here add a markup to the rates offered. This is an extra fee, but it’s tricky to spot – so you could be paying more than you need to overall, without even knowing it.

What is Wise?

Wise is a fintech company which exists to make it easier for individuals and businesses to hold, send, spend and receive foreign currencies. You can open a Wise account online or on the Wise app, hold 40+ currencies, and order a linked international debit card for spending in 150+ countries.

Wise stands out because of its feature packed accounts which offer flexible and low cost ways to manage your money across currencies. All Wise currency exchange uses the mid-market exchange rate, and fees which start from 0.43% – with no foreign transaction fees, minimum balances or maintenance costs to worry about.

What are the advantages of a Wise account?

Not sure if Wise is for you? Here are some of the features and benefits available with Wise, for you to consider:

Hold 40+ currencies in your Wise account

Wise accounts have powerful international features including the option to hold and exchange 40+ currencies right from your phone.

Get a Wise card for spending and withdrawals in 150+ countries

Once you’ve registered a Wise account you can order a Wise debit card to spend and make withdrawals internationally. There’s a low one time fee to get your Wise card, but no ongoing charges to worry about – plus you can get instant access to a digital Wise card for convenience.

Send payments to 160+ countries

Wise offers fast transfers in 40+ currencies, to 160+ countries. You can arrange your payment online or using the Wise app, to pay by bank transfer, card or using your Wise balance. Even better, 50% of payments arrive instantly and 90% are with the recipient in 24 hours.

Receive payments conveniently in 9 currencies

Wise accounts come with local bank details for up to 9 major global currencies, including AUD, NZD, USD, GBP and EUR. You’ll be able to give these details to others who need to send you money from abroad, so they can transfer funds to you with a local payment. Once you have a balance you can hold or exchange it within the Wise account, send it on to someone, or withdraw back to your bank account if you’d like to.

Mid-market exchange rates and low fees from 0.43%

When you convert currencies with Wise – in your account, when sending money to someone, or when you use your Wise card – your funds are exchanged using the mid-market exchange rate and a low fee from 0.43%. You’ll be able to see the costs of a transfer transparently before you initiate it, and you can easily check up on your account balance and transaction history in the Wise app.

Read more about the Wise card here.

Business accounts and expense cards available

Both personal and business customers are welcome at Wise. You can open a Wise account for your registered business or as a freelancer, and access all the perks and benefits you’d get as a personal customer, plus some time-saving extras, such as bulk payment options. Order a Wise debit card for yourself, and Wise expense cards for your team if you need them, to make spending overseas seamless.

Conclusion

Wise accounts are flexible and low cost, with great international features, which makes them a good choice for anyone who loves to travel or shop overseas, business owners paying and getting paid in foreign currencies and more.

It’s easy to open a Wise account online or in-app, to hold 40+ currencies and spend around the world with your linked Wise international debit card.

Wise converts currencies with the mid-market exchange rate, with low, transparent fees for the services you need – which can mean that you get a better deal overall.

How to open a Wise account FAQ

Can I open a Wise account in Australia if I’m not resident?

You’ll need to provide a proof of address document to verify your Wise account. That means that to open a Wise Australia account you’ll have to have an Australian address. However, Wise is also available in almost all other countries around the world, so if you’re not an Australian resident you’ll likely still be able to register a Wise account in your home country.

Does Wise work in Australia?

Yes. Wise works in Australia, and in most countries around the world. Open a Wise Australia account online or in the Wise app in just a few steps.

Does Wise offer international transfers?

Yes. Wise offers international transfers to 160+ countries which use the mid-market exchange rate and low fees from 0.43%.

How can I open a Wise account online?

Head to the Wise desktop site and click Create an account to register your Wise account. You’ll just need to add a few personal and contact details, and to complete a verification step – which can all be done right from your phone or laptop.

How much does it cost to open a Wise account?

It’s free to open a personal Wise account, with a low one time fee to open a Wise business account. There’s no maintenance charge to worry about, so you’ll only pay Wise transaction fees for the services you actually need.