How to Send Money Overseas with OFX: A Beginners Guide

Learn how to transfer money overseas with OFX in our easy to read guide.

- If you’re transferring money overseas for the first time, you might be a bit overwhelmed with the process so watch our 'How to' video.

- Alternatively, read our summarised steps on how to transfer money overseas with OFX.

- Finally you can go to our step by step pictorial guide below.

It’s the perfect resource if you haven’t used OFX before, or if you are new to sending money overseas.

Overview of transferring money overseas using OFX

Let's have a brief look at the steps involved in transferring money overseas with OFX.

1. Create an OFX account

You can easily apply for an OFX account online and it shouldn’t take longer than ten minutes.

Here’s how you can set one up:

- Register and fill in your personal details online.

- You will need your full name, date of birth, address, occupation, email and a contact number.

- Once you have registered, OFX will call you to complete the registration process.

- In some cases you may need to provide additional verification details like proof of address or a passport.

- Your account will be created and ready to send and receive money.

2. Fill in the details of your recipient.

These details will include their name, contact details, currency and the details of the account where they want to receive the money.

3. Pay for your transfer

With OFX you can pay for your transfer by bank transfer or BPay. Once this is done, your recipient should receive the money in 2 to 5 business days.

Ready to go?

How to transfer money overseas with OFX

Now that we know the process, we have broken it down into detailed steps so you can effectively get on your way.

Step 1: OFX Website

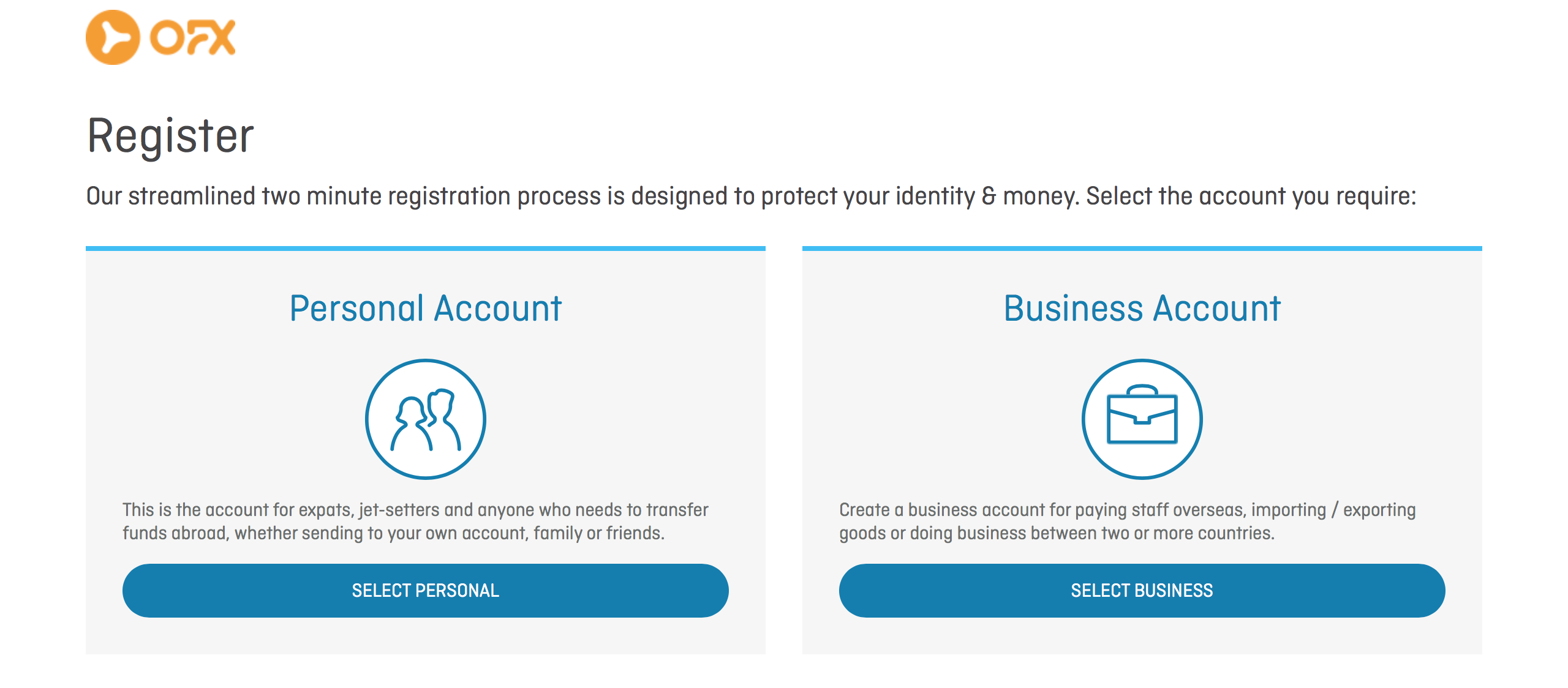

Click through to the OFX website. Once you’re here, select ‘Get Started’ and you’ll be taken to a page asking the nature of your transfer. Here you’ll let OFX know whether you’re going to be making a transfer for personal or business reasons.

Step 2: Registration

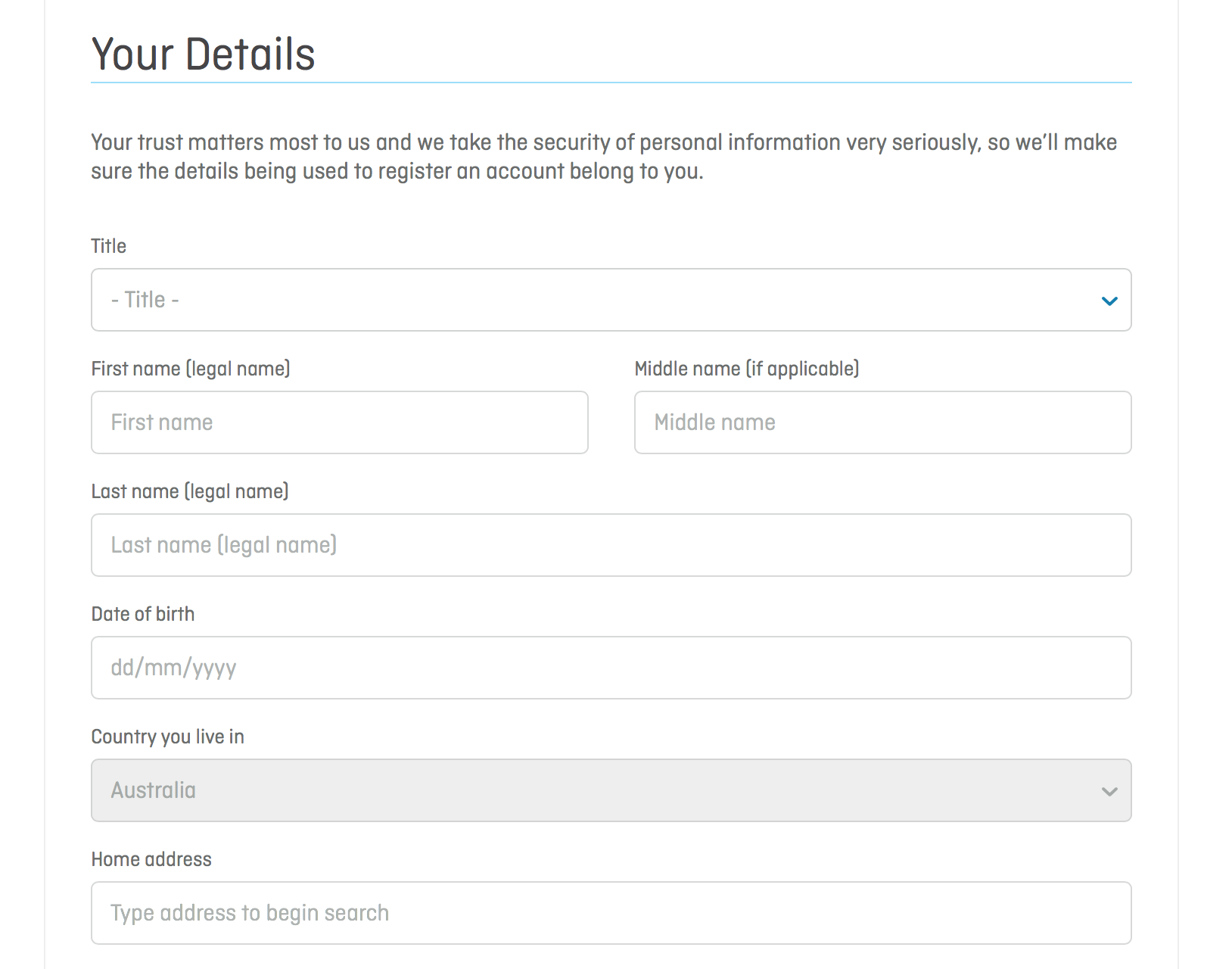

This is where you’ll fill in details about yourself, and provide your identification. In your registration you’ll need to fill in details such as where you live, and your email address. From here you’ll start to fill in some more specific details, such as the currency you’re transferring from and to and the amount you estimate you will send each year. After you’ve answered these querstions you’ll need to fill in all the details about yourself. You can see these below.

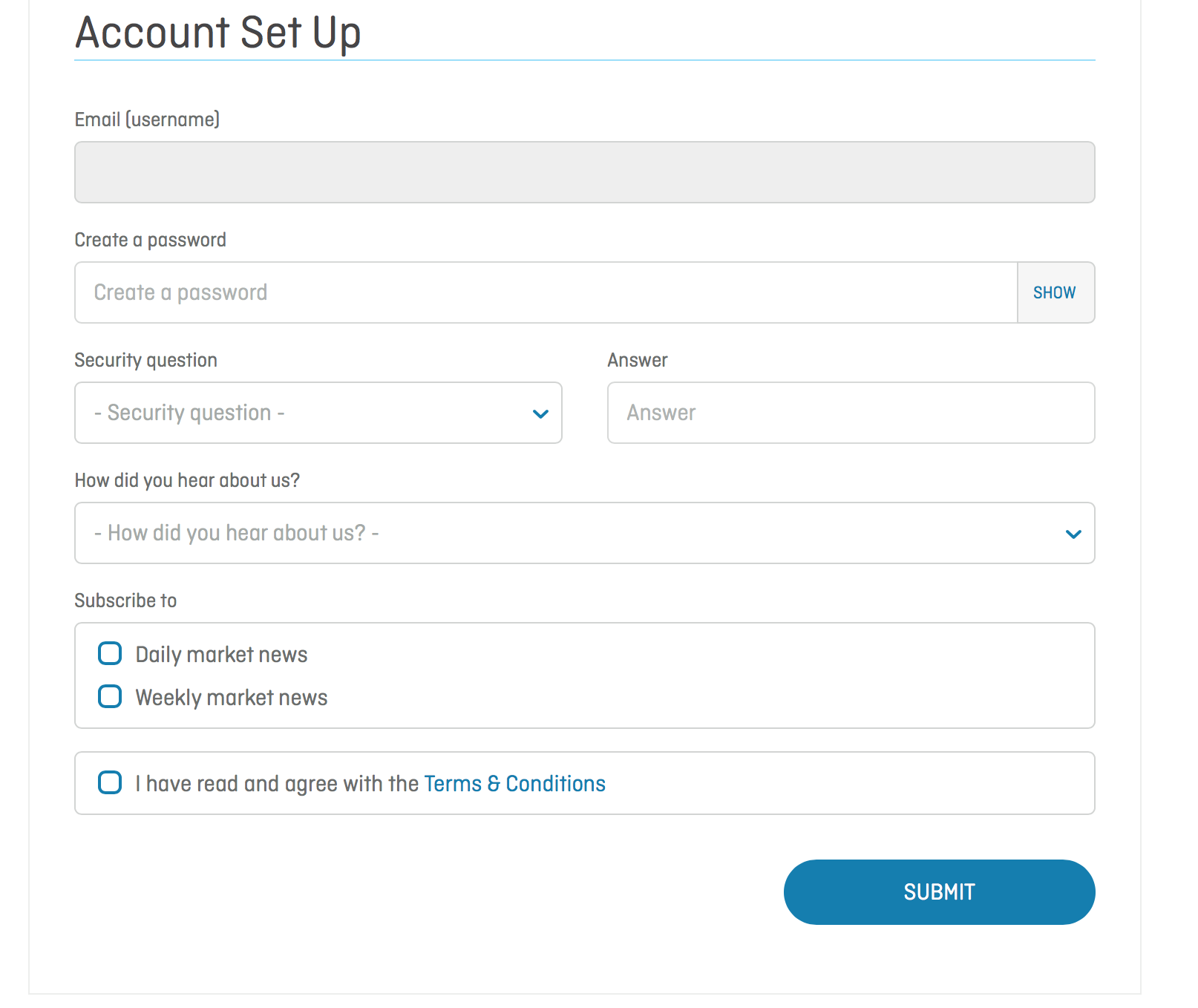

Step 3: Account Set Up

This is where you’ll organise your login details so you can access your account in the future. You’ll use your email address as your username, and create a secure password. OFX will also ask how you heard about them. Here you can also customise the kind of information you would like to receive from OFX such as email newsletters and industry news.

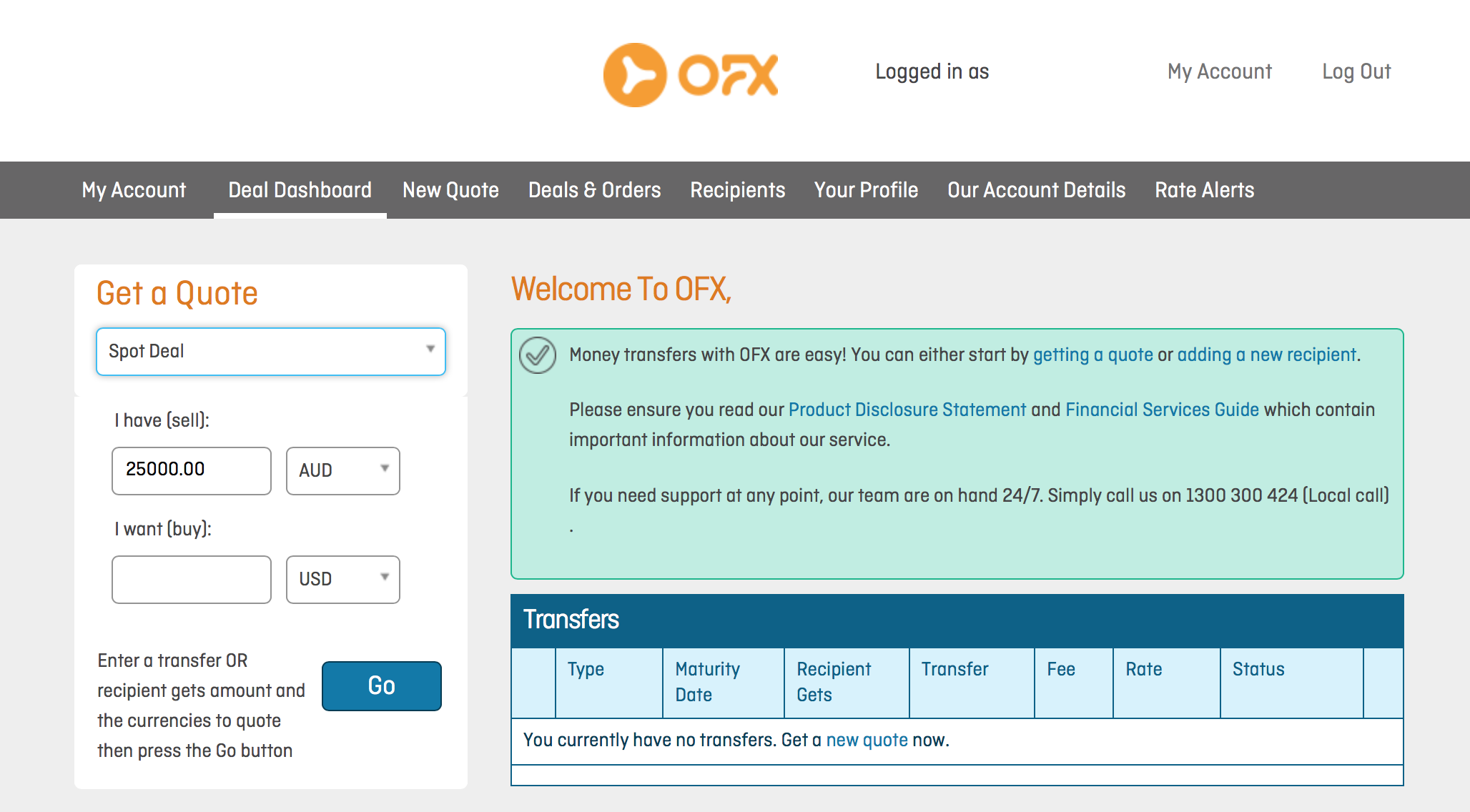

Step 4: Account Access

Once your account is verified, you’ll have access to your customer portal. On the left hand side you can see where you’ll be able to get a quote for the transfer you wish to make. You’ll also be able to see your pending transactions, if you have any.

Step 5: Beginning Your Transfer

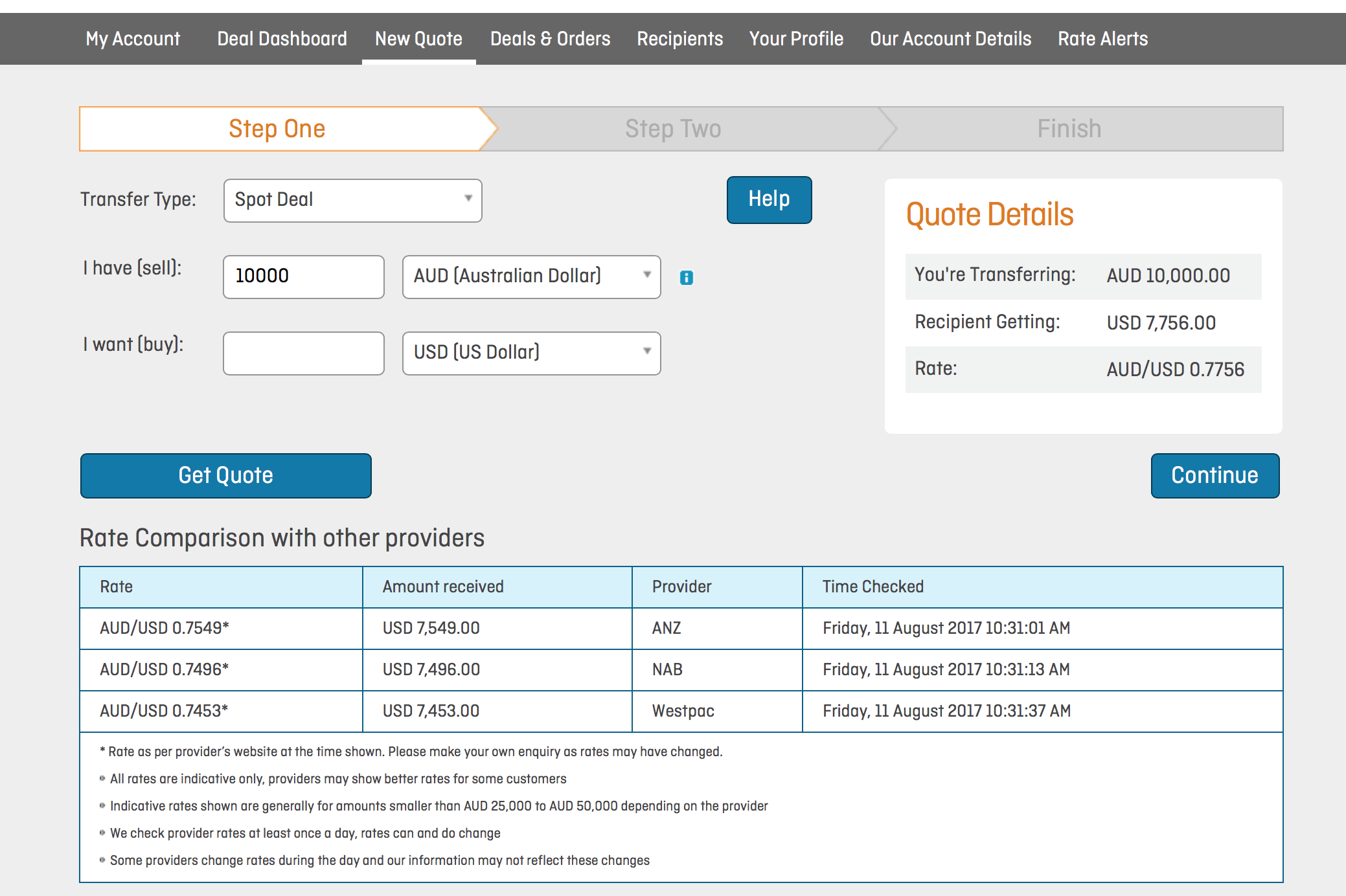

This is where you’ll enter the details of your currency to obtain a quote. You’ll enter the currency you currently have and the currency you’re transferring to. OFX also provide a comparison with Australian banks to show you the benefits of the rate they are providing.

Step 6: Recipient

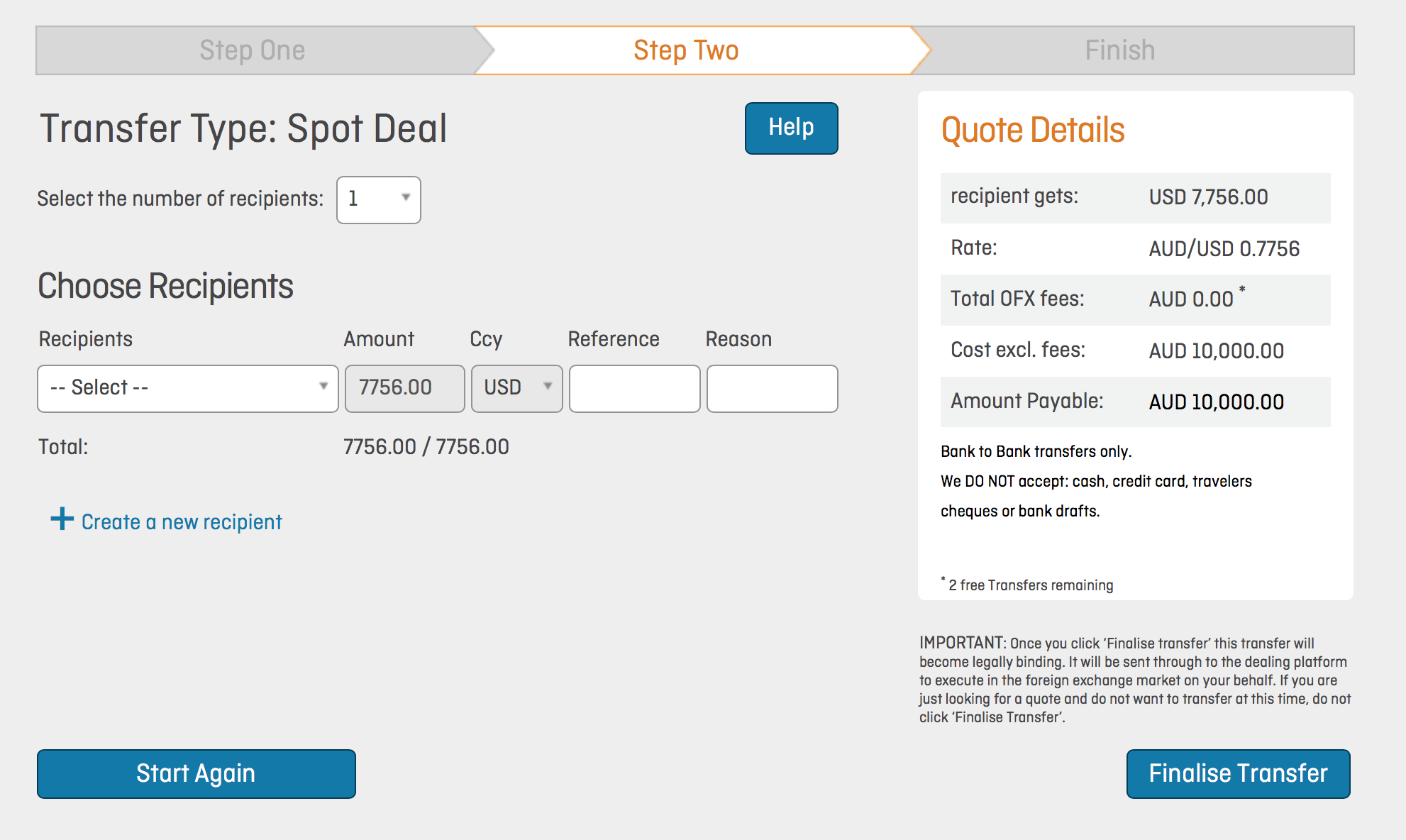

This step is so you can specify who will be receiving the funds. Selecting “new recipient” will allow you to input details for them, or if you have transferred to them before you can select an existing one from the drop down menu.

Step 7: Confirmation

Once you have entered all the details, select “Finalise Transfer”. This will take you through to a confirmation page and provide you with information on how you can transfer your funds to OFX. They have a number of payment options available to you. These include;

- Electronic Funds Transfer (EFT)

- Internet or phone banking

- BPay

Here, OFX will also provide final information about their fees and charges.

How much it costs

There is no transfer fee from OFX to send money overseas, but they do have a $250 minimum transfer amount.

Receiving bank fees — International money transfers sent to or from an overseas bank may be subject to commissions, fees and other charges applied by that bank. These are typically deducted by the overseas bank from the funds paid to your recipient.

Fee Free Offer

The Currency Shop has partnered with OFX to offer fee free money transfers. Click on this offer, register your details and avoid paying a fee to transfer money overseas.

- After 20 years, OFX is one of the oldest money transfer companies and they have the expertise to go with it.

- Their rates are often better than the banks, especially for larger transfers.

- 24/7 phone support.

- They have a minimum transfer amount of $250

- Receiving or intermediary banks may charge fees on transactions

Learn More About OFX

Money transfers can be made in these currencies:

Europe and UK

- British Pound

- Euro

- Danish Krone

- Norwegian Krone

- Swedish Krona

- Swiss Franc

- Azerbaijani Minat

- Czech Koruna

- Hungarian Forint

- Polish Zloty

- Russian Ruble

- Turkish Lira

Asia

- Chinese Yuan Renminbi

- Hong Kong Dollars

- Indonesian Rupiah

- Indian Rupees

- Japanese Yen

- Malaysian Ringgit

- Pakistan Rupee

- Philippine Peso

- Singapore Dollars

- South Korean Won

- Sri Lankan Rupee

- Taiwanese Dollars

- Thailand Baht

- Vietnamese Dong

Americas

- United Dollars

- Canada Dollars

- Mexican Peso

- Peruvian Nuevo Sol

- Venezuelan Bolivar Fuerte

- Vanuatu Vatu

Oceania

- Australia Dollar

- Fiji Dollar

- New Zealand Dollar

- Papua New Guinea Kina

- Solomon Island Dollar

- Tongan Pa anga

- Samoan Talar

Middle East

- Bahraini Dinar

- Brunei Dollar

- Israeli Shekel

- Kuwaiti Dinar

- Omani Rial

- Saudi Riyal

- United Arab Emirates Dirham

Africa

- Egyptian Pound

- Malagasy Ariary

- Moroccan Dirham

- Tanzanian Shilling

- Seychelles Rupee

- South African Rand

- CFA Franc

- CFP Franc

View currency exchange rates for OFX

- Rates for transferring funds internationally through OFX are available through their currency converter. But be careful, this shows the interbank rate.

- The currency exchange rate you will get does vary from moment to moment.

- You will get the up-to-date, dynamic rate when they are booking the transfer.

Additional information for sending money with OFX

There is a lot of numbers and pieces of information you hear about when it comes to international money transfers. Below there are some extra details you might need and the things you don't.

OFX IBAN number

IBAN is an account format used by European banks. Australian banks do not use this format and an IBAN but if you are sending money to a bank account in Europe you will need one. Other parties with an IBAN field on their overseas payment form can simply leave this field blank.

OFX routing number

You may require a National Clearing Code, Routing Number, BSB Number or Sort Code depending on where you are sending the money to. You should request the first six digits (bank and branch codes) of the recipient's account number for which they wish to receive the payment into. For example, if the account number is 01-0123-0123456-00 use 010123.

Further OFX information from The Currency Shop

- You can also check the status of you transfer online together with your transfer history.

- If your bank has daily transfer limits, OFX can take partial payment as long as you tell OFX upfront.

- The maximum amount of money you can transfer with OFX depends on where they are sending the money to and can also depend on government regulations in the receiving country. OFX do not place arbitrary limits on how much you can send.

- The minimum transfer amount with OFX is $250 AUD.

- OFX also provides a mobile app where you can make and track your transfers. You can get it on Apple or Android devices.

- You can setup recurring payments with OFX if you want to send you similar amounts on a regular basis.

- You can set a “Target Rate” for the exchange rate they want for transferring money. Once that rate is reached, OFX will contact you and prompt them to carry out the transfer.

- OFX offers a “Buy Now, Transfer Later” tool (also known as a “Forward Contract”) so you can lock in an exchange rate for a small fee.

To find out more about the company, you can read our OFX review.

OFX disclaimers

OFX does not check payment details.

If payment details are incorrect it may result in an unsuccessful transfer or the wrong account receiving funds. It is pivotal that you provide the correct details to the person making the payment. This will save time for both parties and ensure your payment is received without any issues.

How OFX can help you send more money

You might wonder why you wouldn’t send money via your bank instead of a dedicated money transfer provider and the answer is a simple one — cost. Currency exchange specialists like OFX are able to give better exchange rates and lower fees than banks, resulting in you being able to send more money.

As an example, here’s how much more they will receive if you send money using OFX rather than a couple of popular Australian banks.

Converting $10,000 AUD to USD

- With OFX they get the most money — $7,077 USD.

- With NAB they get $6,877 USD — $200 USD more expensive.

- With Westpac they get $6,771 AUD — $306 USD more expensive.

*All details shown above are correct as of August 2020.

If you use a dedicated money transfer service like WorldRemit, Wise, OFX, or another dedicated currency exchange provider, you could save hundreds of dollars on a transaction. To see how much you could save, have a look at our free online comparison tool.