How to Open a Bank Account in South Africa: A 2025 Guide

If you’re planning a move to South Africa, or you’re looking for South African banking options as a non-resident, this guide has you covered.

South Africa has plenty of different local, regional and global banking options – but you may find your choices of account type are a little limited as a foreigner or as a non-resident. We’ll look at your options and the account opening process with major South African banks in this guide – and also touch on some alternatives like Wise and Revolut as a more flexible comparison. More on that, later.

What documents do I need?

To open a bank account in South Africa – as with more or less anywhere else in the world – you’ll need to provide some paperwork for verification.

Not all accounts offered by South African banks are available to foreigners. If you’re a non-resident customer you may find you’re offered a specific non-resident account type – or you may be offered premium tier accounts as some basic account types are only available for citizens of South Africa.

While the exact documents you need for verification may vary, you’ll often be asked for the following if you open a South African bank account:

- Proof of ID like a passport or National identity card

- Proof of foreign or South African address

- Proof of income and employment

Documents may need to be certified, and for things like proof of income or residence are likely to need to be recent – dated within the last 3 months.

If you don’t have a South African address because you’ve not moved yet or because you’re non-resident you may only be eligible for a limited number of account products from South African banks – but we’ve got some smart alternatives you might want to consider instead, coming up later.

Read here the 5 best international banks

Save the paperwork with alternative solutions like Wise or Revolut

Struggling to find a ZAR account you like – or maybe you don’t have a South African proof of address just yet? Consider a non-bank alternative like Wise or Revolut.

Digital providers like these offer multi-currency accounts you can use to hold, send, and spend South African rand, alongside a range of other currencies. Plus, you’ll be able to open your account with your local Australian proof of identity and address, to get everything arranged even before you’re a South African resident.

Non-bank services like Wise and Revolut have been built with travellers, expats and digital nomads in mind, so you can set up your account online or via an app from wherever you happen to be, and complete the verification and onboarding process digitally before you travel.

How to open a South Africa bank account as a foreigner

Not all bank accounts offered by banks in South Africa can be opened as a foreigner. Some more basic accounts may only be available to local South African citizens. Other accounts are offered to foreigners – but you’ll usually need to be a South African resident with a local proof of address. If you don’t have these documents to hand you might find the process a little tougher going. You may be offered a non-resident account from a local South African bank, but these do have quite different terms compared to standard accounts offered to residents.

We’ll look at some smart alternatives – such as flexible international accounts from providers like Wise and Revolut – later. First, here’s a quick rundown of how to open a bank account in South Africa if you’re a resident:

- Choose the bank and account that you’d prefer

- Double check if you’re eligible to apply and if digital application is an option

- Gather the documents needed, usually including ID and proof of address and income

- Complete the application process online or in person at a branch

- Get verified and add money to your account

- You may be able to get your debit card instantly or you may need to have it delivered to your home later

What do I need to know before opening a bank account in South Africa?

Not all bank accounts in South Africa are available for foreigners – even if you’re living there. You may need to take an account with higher fees or stricter income requirements as basic accounts are sometimes reserved for local citizens.

If you’re not living in South Africa you may still be interested in non-resident accounts which are commonly available for people living outside of South Africa looking to bank in ZAR. Other choices include foreign and multi-currency accounts from the international divisions of major global banks – but both of these can come with higher fees.

Once you’ve found an account that works for you, be sure to double check all the documents needed, and whether or not you’re eligible to apply online or in app. You’ll also need to read through the account terms and fees carefully as they may be quite different to those you’re used to at home. We’ll look at some common fees to watch out for a bit later.

Can I open a bank account in South Africa only with my passport

No. You won’t be able to present your passport and get an account with a bank in South Africa. You’ll pretty much always need a South African proof of address and a proof of income to get an account with a bank.

Which account is best in South Africa for foreigners?

There’s no single best account in South Africa for foreigners – the best one for you will depend on your personal preferences and needs. We’ve picked out a couple of non-bank options – Wise and Revolut – to compare against a couple of major banks based in South Africa which have resident and non-resident banking services. Here’s a quick overview of some key features and fees to know about:

| Service | Wise | Revolut | Standard Bank | First National Bank |

|---|---|---|---|---|

| Currencies covered | 40+ currencies including ZAR and AUD | 30+ currencies including ZAR and AUD | ZAR | ZAR |

| Open before you arrive in South Africa | Yes | Yes | Only for non-resident banking options

Standard accounts are only offered to local citizens or residents |

Only for non-resident banking options

Standard accounts are only offered to local citizens or residents |

| Open online | Yes | Yes | In some cases | In some cases |

| Maintenance fee | No fee | Standard plans have no maintenance fee – or customers can upgrade to accounts which have a monthly charge | Very varied – you may need to pay a monthly fee and prove your income to open an account | Very varied – you may need to pay a monthly fee and prove your income to open an account |

| International transfers | Low fee, from 0.42%, varies by currency | Fee varies by currency and payment value, and the account type you have | 151 ZAR – 690 ZAR depending on value + third party and exchange costs | 100 ZAR – 550 ZAR depending on value + third party and exchange costs |

As you can see, the options on offer can vary pretty widely depending on whether you specifically want an account from a South African bank, or you’d prefer a flexible digital option from a non-bank service. There are plenty of other bank choices available for customers with a South African proof of address – or, if you’re not a resident yet, you might prefer to open a Wise or Revolut account before you move. These flexible multi-currency accounts also offer low costs and easy ways to hold, exchange, send, and spend South African rand and dollars – and other currencies – all in the same account.

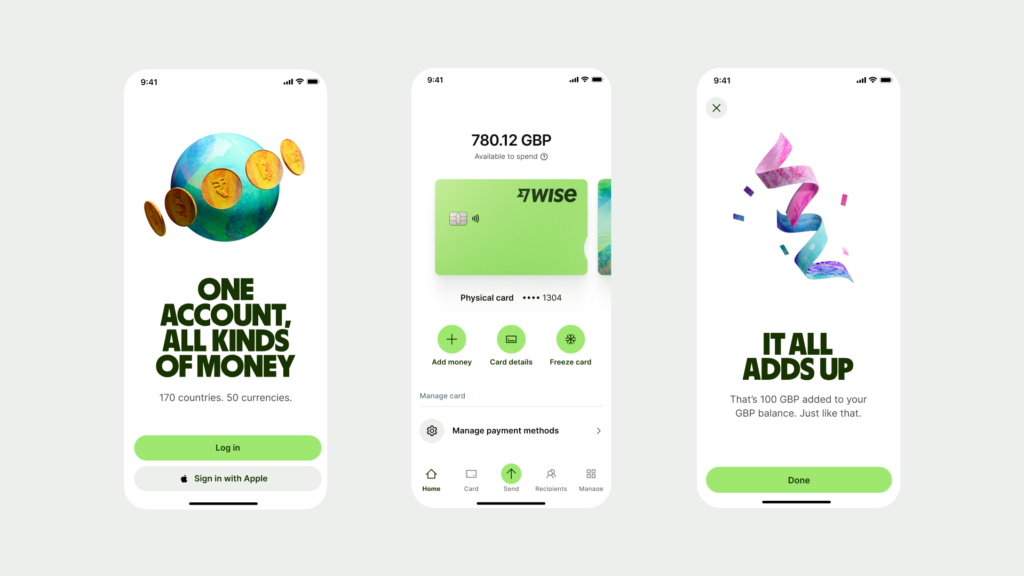

Wise

Wise accounts can hold, exchange, send, spend and manage 40+ currencies including both dollars and South African rand. You’ll also get a linked debit card, bank details for up to 10 currencies – including AUD -to receive payments, and you can send money to 160+ countries.

Wise multi-currency accounts have no minimum balance or monthly fees to pay, and all currency exchange uses the mid-market exchange rate with low fees

How to open an account with Wise

Open a Wise account online or in the Wise app. Just tap Register, and follow the prompts to create an account using your email, Google, Facebook or Apple ID. You’ll be guided through the process to get verified with your Australian ID and address documents, and can get everything done with just a phone or laptop.

Revolut

Revolut accounts can hold and exchange 25+ currencies including dollars and South African rand. Revolut standard accounts have no ongoing maintenance costs, or for more features you can upgrade to a paid plan for a monthly fee.

All accounts have a linked debit card, some weekday currency exchange which uses the mid-market rate depending on your account type, and some no fee ATM withdrawals.

How to open an account with Revolut

The easiest way to open a Revolut account is in the Revolut app. Just tap Sign up and enter your personal and contact information – select the account type you want and follow the prompts to upload your ID and address documents.

Standard Bank

Standard Bank is the largest bank in South Africa and has a huge range of banking products available. Some basic accounts are only available to South African citizens, and some of the higher tier account types require you to have a minimum income as well as a local address. There are non-resident banking options which you can open from overseas if you’d prefer, which allow you to bank in ZAR conveniently.

How to open an account with Standard Bank

Some accounts can be opened online, but these may not be available to foreigners in South Africa. Depending on your circumstances you may find you’re pointed towards one of the premium tier accounts which will require you to call or visit a branch to discuss your needs and open your account.

First National Bank

First National Bank has resident and non-resident banking options, including some which you can apply for online. The non-resident cheque account lets you get a debit card, send local and international transfers, and bank in ZAR conveniently. Or there are a broad selection of other account types if you’re a resident of South Africa with a full set of ID and address documents.

How to open an account with First National Bank

You can open some First National Bank accounts online if you have the full set of paperwork required – you can also pop into a branch to have someone guide you through the process if you’d prefer. Bear in mind that not all accounts are available to all customers, so you’ll need to go through the eligibility requirements carefully.

What is a bank account in South Africa needed for?

Having a bank account which you can use to hold and exchange South African rand can be helpful in lots of different scenarios:

- If you want to hold South African rand – saving for a trip there for example

- If you’re moving to South Africa to live or work, or if you plan to travel there extensively

- If you need to send ZAR payments to others – such as paying for an overseas mortgage

Benefits of opening a bank account in South Africa

South African bank accounts – and ZAR accounts from non-bank alternatives – have a few great benefits which may come in handy:

- Hold South African rand to save or invest

- Spend easily in South Africa without needing currency conversion

- A South African bank account is pretty essential if you live in South Africa, for setting up local services for example

Can I open a bank account in South Africa before arrival?

You won’t usually be able to open a standard account with a bank in South Africa without a local South African proof of address. Some banks which operate in South Africa do have specific non-resident account products which you may be able to open before moving – but these are likely to have their own restrictions, and fairly high fees.

If you don’t have a South African proof of address you might be better off with non-bank alternative providers, such as Wise and Revolut.

Can I open a bank account online?

South African banks do offer online account opening, but only if you have a full set of standard documents including a proof of ID, acceptable proof of address, and often proof of income. This may not be an option for all account types, so you might find that visiting a branch is your only choice.

You can still open an account with online providers such as Wise and Revolut instead. Digital services like these have been built to offer a fully in app or online account opening, verification and onboarding process which is convenient and easy to use.

How long does it take to open a bank account in South Africa?

If you have all the required paperwork you’ll be able to open a bank account in South Africa fairly quickly. If you’re following an online process you may then need to wait a few days for your debit card to arrive by mail.

What are the types of bank accounts in South Africa

The bank accounts in South Africa that are available to you will depend on the bank you pick and your residency status. If you’re a non-resident you’ll find your options may be a bit reduced as you can’t show a local South African proof of address. However, there are still a few options out there which might suit you.

If you’re a South African resident you’ll have a far greater range of account options including accounts for everyday use, savings accounts, student accounts, accounts for younger people under 30 and so on.

How to choose a bank account in South Africa

It’s worth looking at a few different account types and options before you open your bank account in South Africa – bearing in mind that the features will be different to the account you’ve been used to.

Check the bank you pick has good branch and ATM access, as well as online and mobile services. Review the fees carefully, looking out for ongoing and unavoidable costs in particular. It’s also a smart idea to double check online reviews to see what existing customers say about your preferred bank before you get started.

Compare your options for South African banks against non-bank alternatives like Wise and Revolut. The features won’t be exactly the same, but you might find you get lower overall costs and easier ways to manage your money between Australia and South Africa.

How much does it cost to open a bank account in South Africa?

Some South African bank accounts have no ongoing costs – but that doesn’t mean they’re free to use. You’ll need to check through the account terms and conditions really carefully to make sure there are no surprises when you start to transact. In particular check for:

- Monthly maintenance fees – or fall below fees

- International payment fees

- Foreign transaction fees when spending or withdrawing with your card

- Overdraft fees

- Credit card costs including cash advances and interest

- Account dormancy or early closure fees

Is it possible to open a fee-free account in South Africa?

Accounts with no maintenance fees are available in South Africa – but these may not be an option for foreign residents or non-resident customers

Even where an account does not have a maintenance fee, there will be transaction and service fees to pay – read through the fee schedule carefully before you sign up.

What are the additional costs?

So what are the common extra costs when you open an account in South Africa? Look out for these which may work differently to Australia – or be higher than you expect:

- Card fees – annual costs based on the card you select

- Withdrawal fees – local and international ATM charges

- Foreign transaction fees – fees applied if you spend in a foreign currency

- Interest or overdraft charges

- International transfer fees – particularly important when moving, as the costs of sending money abroad can be high

Tips for sending money between Australia and South Africa

If you’re planning to move to South Africa from Australia you’ll probably need to send money frequently from AUD to ZAR or vice versa. This can be pretty expensive to do when you take into account all the fees that apply. Here are a few tips to help you cut the costs overall:

- Compare the exchange rate you’re offered against the mid-market exchange rate to see if a markup is being used

- Review the terms and conditions of your specific account to see the transfer fee which will apply

- Check if there are third party fees associated with the SWIFT network – these can push up the overall costs

- Consider using a specialist service like Wise instead of your regular bank – this can keep the costs down and mean you get a faster service, too

Conclusion

You can open an account with a South African bank if you have a proof of South African residency and can hit the eligibility requirements, which often include a minimum income. Without these you’re likely to be directed to non-resident accounts which may have some restrictions – or high fees. That might mean you prefer an account from a non-bank provider like Wise or Revolut.

Options like Wise and Revolut allow customers to set up an account to hold and exchange ZAR alongside AUD and other currencies, with an Australian proof of address and ID. This means you can get everything arranged before you move, and hit the ground running once you arrive in South Africa.

FAQ – Opening a Bank Account in South Africa

- Can a foreigner non-resident open an account in South Africa?

You can open a non-resident account with a South African bank – but these options may have limits, fairly high fees, and restrictive eligibility requirements. As an alternative, you might find it easier to get set up with an online account with a specialist provider like Wise or Revolut.

- How much do I need to open a bank account in South Africa?

Some bank accounts in South Africa have minimum opening deposit requirements, or ongoing monthly or annual maintenance fees. You’ll often also need to prove employment and a minimum income. Some options, including specialist services, may be completely free to open with no minimum balance – compare a few providers to get the best deal for your needs.

- Can I open a South African bank account online?

While it’s possible to open a South African bank account online, you might find you’re limited in your options as a foreigner. Some accounts require you to call the bank or visit to discuss your needs in person. A better option might be to pick a specialist provider with a more flexible verification process, to open your account from home on your laptop or mobile device.

- How to apply for a bank account online in South Africa?

If you’re eligible to open a bank account online in South Africa you can do so by uploading an image of your proof of address and ID, and giving information about your local tax code. Your debit card will then be shipped to your home address once you’ve been verified.

- Can I open a bank account in South Africa before landing?

You won’t usually be able to get a resident bank account in South Africa until you can prove your legal residence there. As an alternative you can open a non-resident account, although specialist services like Wise or Revolut may be a better choice because they can accept international proof of address documents when you open your account.