Remitly Limits 2026: Full Guide

Remitly lets customers in Australia send money in 100+ currencies, to bank and mobile money accounts, and for cash collection. The exact services available can vary, depending on where you’re sending money to. It’s also helpful to know that Remitly transfer limits apply to the amount of money you can send, for customer safety and to comply with local and international law.

This guide covers all you need to know about Remitly’s limits for customers in Australia, and some alternatives like Wise and OFX that you may want to consider for high value or business transfers.

Quick summary: Remitly limits

-

- Remitly offers most customers in Australia a maximum per payment limit of 45,000 AUD

- Remitly limits may also apply to the amount of money a customer can receive

- To qualify for the highest available limit you’ll need to be verified by Remitly, including giving some information about your account use, and uploading your ID

- You can send Remitly payments to bank and mobile money accounts, for cash collection or home delivery, depending on the destination country

- Remitly does not offer business transfers in Australia, and does not have accounts for holding a balance in foreign currencies

Does Remitly have limits?

Yes, Remitly has limits on the amount of money you can send and receive.

The Remitly bank transfer limit varies according to the country you live in, and is a blanket per payment cap.

Aside from the Remitly sending limit, other limits may apply which can vary based on the destination you’re sending money to, as well as the pay out method you select. Remitly’s limits are in place to ensure customer accounts and payments are secure.

If you need to send a higher amount you may want to split your transfer into several payments – but this may mean paying the transfer fee several times as well. Or you could choose a different provider if the Remitly payment limits are too low for your needs. We’ll look at some options in a moment.

Is Remitly safe for large amounts?

Remitly is considered to be a safe provider for international transfers. When you sign up for a Remitly account you will need to complete a verification process, and set a password. This helps secure your account. Remitly also runs automatic and manual risk management processes to detect and avoid fraud, and keep customers and their money safe.

There’s extensive advice on the Remitly website to help you spot and avoid scams and fraud if you’re ever concerned.

How much money can I send through Remitly?

There’s a Remitly limit per transaction which applies based on your country of residence, and the specific details of your payment. To qualify for the highest available Remitly limit you will need to have a fully verified account, which means providing some ID and information about yourself.

There’s no specific Remitly transfer limit per day or Remitly transfer limit per month, so if you need to send a high value payment you might be able to do so by splitting your transfer into several individual smaller payments. This may mean incurring additional fees, though – so choosing a provider with a higher limit might be a more cost effective solution.

Remitly limits

Let’s look at the Remitly money limits, and what might influence the Remitly transfer limits applied to your account.

Remitly transfer limits

The Remitly transfer limit which applies depends on the country you reside in – for customers in Australia, the Remitly maximum transfer amount is 45,000 AUD or the equivalent in a foreign currency.

While there’s a Remitly limit per transaction, there’s no specified Remitly daily limit, or Remitly transfer limit per month – this means you can send several payments in a day, week or month if you need to.

Alternatives to Remitly with high limits

Remitly’s 45,000 AUD payment limit is relatively low compared to some other services. If you’re looking to send a higher value payment, you may need to pick a different provider.

Options like Wise and OFX may be able to help. Here’s a summary of these services – we’ll get into more detail about each in just a moment.

| Providers | International transfer limits | Account holding limits | Card limits | Withdrawing limits |

|---|---|---|---|---|

| Remitly | 45,000 AUD | Not applicable | Not applicable | Not applicable |

| OFX | No limit | Not applicable | Not applicable | Not applicable |

| Wise | 1.8 million AUD from a bank | No limit in most cases | Variable limits, available in app | Variable limits, available in app |

Source: Provider websites, July 2025

OFX

OFX supports payments for personal and business customers, in 50+ currencies. You can make your transfer online or in the OFX app, and there’s also a 24/7 phone service if you want to talk your options through with someone.

This can be very reassuring when making a higher value transfer. Generally, OFX does not have an upper limit on the value of payments you can send. Aside from transfers, OFX also offers currency risk management products for individuals and business customers. A transfer fee of 15 AUD applies if you send less than 10,000 AUD – this fee is waived for higher value payments.

Best features:

- Services for individuals and businesses

- Often no limit to the value of a payment you can send

- No transfer fee for high value payments over 10,000 AUD – although exchange rates include a markup

Wise

Send payments in 40+ currencies, to 140+ countries. Wise international transfers are available for individuals and business customers, and while there are some limits to the value of payments you can send, these limits are generally set very high to allow customers to transact freely. In fact, if you’re sending higher value payments you may even qualify for automatic fee discounts, making the costs even lower.

Limits vary by currency, and depend on the way you fund your transfer. We’ve got a summary of limits for Australian customers coming up in just a moment. Currency exchange uses the mid-market rate with no additional fees added, and a low conversion charge from 0.63%.

Aside from international transfers, Wise also offers multi-currency accounts which can be used to receive foreign currency payments, and which offer a linked international debit card for spending and withdrawals around the world.

Best features:

- Mid-market exchange rates and low, transparent fees

- High transfer limits, usually around 1 million GBP in value

- Account and card services also available for personal and business customers

Is it possible to increase Remitly limits?

To qualify for the Remitly transfer limit of 45,000 AUD you’ll need to provide some information and documents for verification.

It’s possible that you’ll be asked for details about a payment you’re making, such as your reasons for sending, source of income, and your current occupation. This process is part of the Remitly verification and required to keep accounts and customers safe.

How to increase Remitly limits

You’ll be prompted online or in the Remitly app, if you need to complete verification to raise your sending limits or to process a specific payment.

You may be asked:

- To confirm your name, date of birth, and address

- To upload an image of your passport, or other government-issued ID

- To give information about the reason for the payment

- To provide bank statements or pay stubs to show the source of the payment you’re sending

Remitly large transfer fees

Let’s look at a comparison to give a sense of how much the costs of Remitly higher value payments may be. We’ve shown the fees and rates available – and the amount a recipient might get in the end, to help you compare different services.

| Sending 30,000 AUD to GBP | |||

|---|---|---|---|

| Providers | Total fees | Exchange rate | Total received in GBP |

| Remitly | 0.99 AUD | 1 AUD = 0.4892 GBP (Promotional rate for new customers) | 14,564.85 GBP |

| Wise | 117.39 AUD | 1 AUD = 0.487419 GBP | 14,525.07 GBP |

| OFX | 0 AUD | 1 AUD = 0.480800 GBP | 14,424.00 GBP |

Source: Provider websites, July 2025. Values shown are based on rates available at time of research and may vary. This comparison is provided for informational purposes only.

As you can see, the charging methods for different providers can vary a lot. Remitly has a low fee, and may offer a promotional rate for new customers. Wise uses the mid-market rate on all transfers, with a transparent fee. OFX has no fee for high value payments, with a small markup on the rate used. Comparing the amount your recipient will get in the end for any given payment is usually the best way to decide which is the most cost effective for you.

Remitly exchange rate for international transfers

The Remitly exchange rate for international transfers may include a markup – this is a fee added to the mid-market rate you might find on Google.

Remitly does often offer some promotional exchange rates for new customers, although these might only apply to smaller amount payments. That can make it an attractive option, but you’ll still want to compare the market to check. Exchange rate markups can push up the overall costs of transactions a lot – even a small markup can mean a big cost in the end, so checking out different services can save you money.

How to send high amount transfers with Remitly

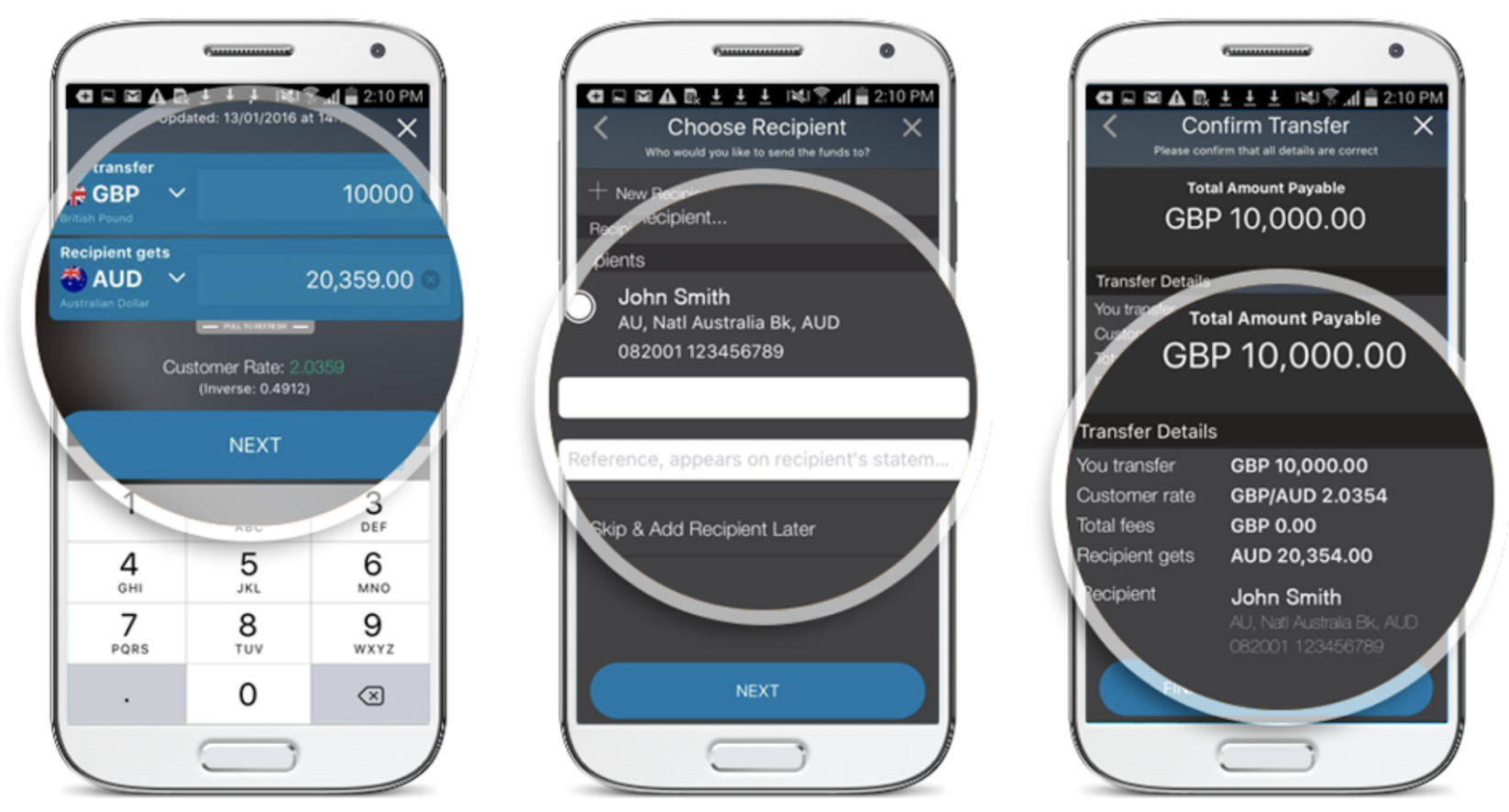

You can send a payment with Remitly by registering an account online or in app, getting verified and setting up your transfer digitally. Here are the steps you need to take:

- Download the Remitly app or open the desktop site

- Click Send Now and follow the steps to register your account

- Get verified by adding an image of your ID and any other documents requested

- Set up your transfer by entering the details of amount and currency

- Choose the payment method and how the money should be received

- Follow the prompts to pay and your money is on the way

How to receive large transfers with Remitly

If someone else is sending you a payment with Remitly you’ll need to agree with the sender how you want to receive your money. Usually your options can include a deposit to your bank account or cash collection through an agent locally.

If you are receiving money as cash you need to make sure the sender has your correct name as shown on your government ID document. For deposits to your bank account you will need to give the sender your full banking information including account number and BSB. Double check with the sender what information they need based on the payment details.

How long do large transfers take with Remitly?

The Remitly transfer speed for high value transfers might be different for different payment and delivery methods. You’ll be shown a delivery estimate when you initiate your transfer, so you know what to expect. Often payments funded by card, and collected as cash, can be very fast, while bank deposits might take a little longer.

Remitly customer support for high amount transfers

If you ever find you need help with a Remitly transfer, you can get in touch 24/7 in a very wide range of languages. Here are your key options:

- Open an in app chat by logging into your account

- Call Remitly on +61 2 8311 6331

Remitly business limits

Remitly is not available for business payments from Australia. While Remitly does offer business services this is only for eligible business customers in the US.

Conclusion: Does Remitly have limits?

Remitly has transfer limits which may vary based on the country or currency you’re sending to, as well as which documents you’ve provided for verification purposes.

Remitly has a flat transfer limit of 45,000 AUD per transfer from Australia. This limit is lower than many other providers, because Remitly is intended for payments to friends, family and loved ones rather than for business or commercial purposes.

If you need to send a high value payment – or if you’re transacting for your business – you may need to choose a Remitly alternative, such as OFX or Wise.

Remitly international transfer limits FAQs

How much can I transfer with Remitly internationally online?

You can set up a Remitly international transfer online or in the Remitly app. The Remitly limit for customers in Australia is 45,000 AUD per payment. The Remitly transfer limit may also vary depending on factors like the country you’re based in and the currency you want to send.

What is the maximum amount you can transfer abroad with Remitly?

The Remitly bank transfer limit for payments from Australia is 45,000 AUD per transfer. If you need to send more you can split your payment into several smaller transfers, or choose a different provider which has higher limits.

How can I increase the Remitly maximum transfer limit?

You can not change the Remitly transfer limit. To get the highest Remitly payment limit of 45,000 AUD you need to have a fully verified account, which means uploading some ID and entering some personal details.

Is Remitly safe for large amounts of money?

The Remitly maximum transfer amount is 45,000 AUD – and Remitly is considered to be a safe provider for higher payments, with normal safety precautions. You can get more information about the security features Remitly uses in the Remitly app, or on their desktop site.

Can I send $1000 through Remitly?

Yes. You can send payments of up to 45,000 AUD using Remitly, online and in app. Compare your options with Remitly against alternatives like OFX and Wise to see which is best for you.

How much does Remitly charge for transfers?

Remitly has variable transfer fees and may also use a markup on the exchange rate available to customers. New customers may benefit from promotional rates and free waivers for their first few payments.