Revolut Limits 2026: Full Guide

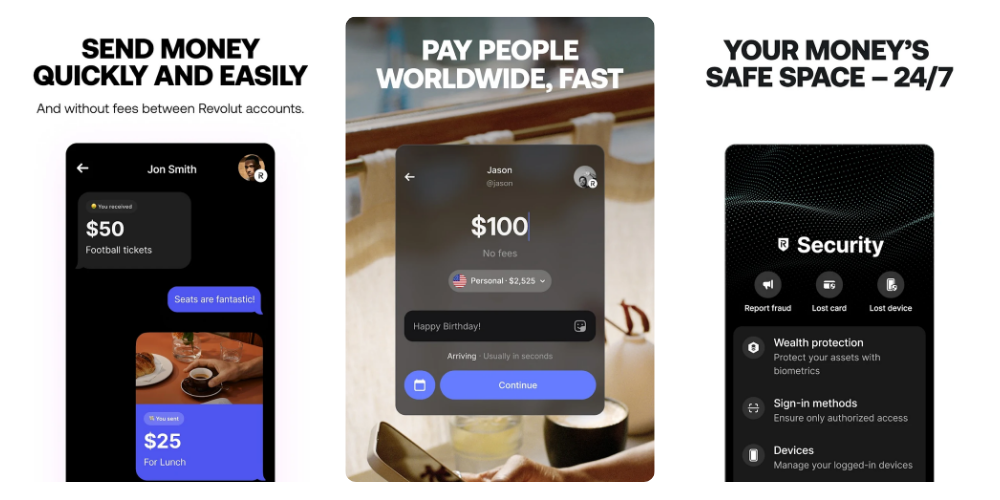

Revolut offers several different account plans for personal and business customers in Australia. Depending on the plan you select, you can get an excellent range of features including multi-currency holding, payment cards, transfers, currency exchange and travel perks.

If you use Revolut there are some important Revolut limits to know about, to ensure you can transact conveniently. This guide works through the Revolut transfer limit for payments, the Revolut withdrawal limit for card use, and other useful pointers such as the Revolut top up limit which dictates how much you can add to your account. We’ll also touch on a couple of alternative providers – Wise and OFX – which you can compare when you’re deciding which service will work best for you.

Quick summary: Revolut limits

- Revolut has a choice of 4 plans for personal customers in Australia, and 4 plans suited to business users

- Revolut limits can include caps on the amount you can send, receive and withdraw, and apply for security reasons

- Revolut payment limits may apply which can vary depending on the account plan you have and the currency you are transferring to and from

- There’s a Revolut card withdrawal limit of 3,000 GBP per day – that’s about 6,160 AUD at the time of writing

- Revolut limits can also include limits on the value of transactions you can make before fair usage fees apply

Does Revolut have limits?

Yes. Revolut has various limits on account and card usage. In some cases these limits are set and can not be changed, while in others, you may have your limits automatically or manually adjusted.

Revolut limits include a cap on the amount of money you can add or receive to your account on a daily and annual basis. This limit is automatically adjusted by Revolut depending on your account usage and is not publicly disclosed. Aside from this, there are also likely to be limits on the amount of money you can send with Revolut, which can vary based on currency, and a few other account usage limits depending on the transaction type. We’ll walk through these limits in this guide.

Is Revolut safe for large amounts?

Revolut is considered to be a safe provider to use, to hold funds and to send high value payments. Revolut thoroughly checks and verifies all account users and operates automatic and manual protocols to detect and prevent fraud. You can also easily get help from a member of the Revolut team if you’re ever concerned about a payment or transaction, offering peace of mind.

How much money can I send through Revolut?

The amount of money you can send with Revolut depends on the account type you have and the currency involved. There’s no published blanket limit on payment values, but for legal and practical reasons, limits on transfers may be applied to help keep customers and their accounts safe.

Revolut limits

As we’ve seen, there are various Revolut money limits which can vary depending on account type and usage. You can see all the limits which apply to your specific account by logging into the Revolut app. To give an idea, we’ll cover some of the commonly applied limits here.

Revolut transfer limits

There’s not a published Revolut weekly limit on payments, but the Revolut maximum transfer amount is instead set according to the currencies involved, the account type and your transaction history. If you hit the Revolut limit for your specific payment you’ll see a message in the app. You may then be able to send your money as several separate smaller payments if you would like to, or you can choose another service. There are also some popular money transfer providers which offer high or unlimited payment amounts which might be a more convenient option – more on that later.

Revolut account and card limits

Revolut customers in Australia can open a multi-currency account to hold and exchange 25+ currencies, and to spend with a linked debit card. Revolut limits apply to account and card usage.

The important limits to know about include the Revolut deposit limit, Revolut top up limit and the Revolut withdrawal limit. Here’s a summary:

| Service or feature | Revolut limit |

|---|---|

| Revolut deposit limit – maximum amount you can top up or receive per day or year | Variable, automatically adjusted by Revolut based on account usage |

| Revolut exchange limit – limit on currency exchange, cryptocurrency exchange, and commodity exchange | 100 exchanges in any 24 hour period |

| Revolut fair usage limit – exceeding this limit means paying additional fair usage fee | Fair usage limits depend on account type and transaction type – currency exchange and ATM use for example |

| Revolut withdrawal limit – for ATM use | 3,000 GBP per day – that’s about 6,160 AUD at the time of writing |

*Details correct at time of research – 14th July 2025

It’s helpful to know that Revolut limits can vary a lot based on factors including the transaction type, your account usage and the tier of account you have. You can always see the limits which apply to your specific account in the Revolut app if you’re unsure about anything.

Alternatives to Revolut with high limits

Before you send your high value payment with Revolut Australia it’s worth comparing a few alternative providers like Wise and OFX to see if you can get a higher transfer limit, better rate, or lower overall cost. Here’s a summary of these services – we’ll get into more detail about each in just a moment.

| Providers | International transfer limits | Account holding limits | Card limits | Withdrawing limits |

|---|---|---|---|---|

| Revolut | Limits vary by currency | Limits are not disclosed, and apply on an annual basis | Variable limits, available in app | 3,000 GBP/day – around 6,160 AUD |

| OFX | No limit | Not applicable | Not applicable | Not applicable |

| Wise | 1.8 million AUD from a bank | No limit in most cases | Variable limits, available in app | Variable limits, available in app |

*Details correct at time of research – 12th July 2025

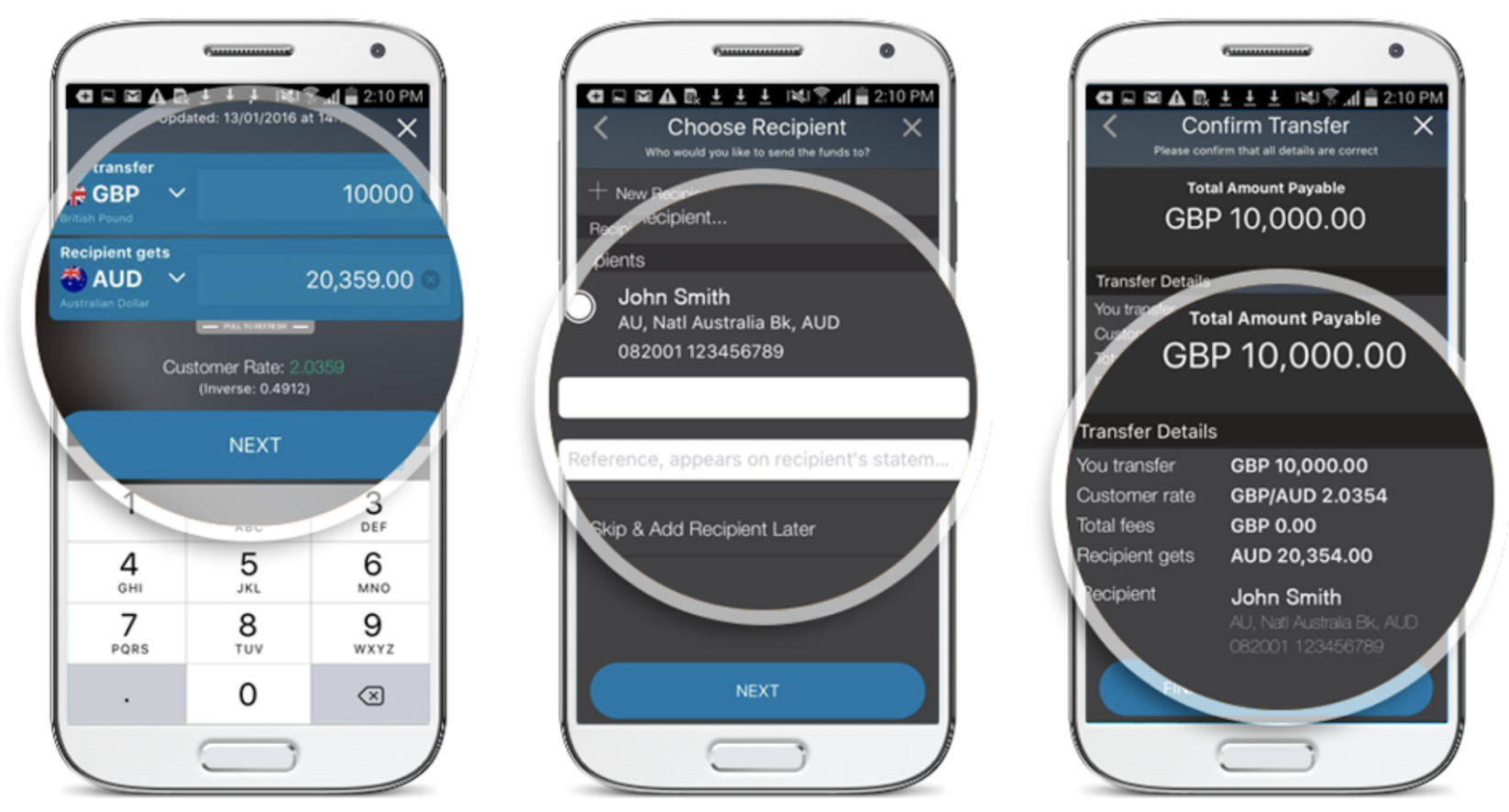

OFX

OFX supports payments for personal and business customers, in 50+ currencies. You can make your transfer online or in the OFX app, and there’s also a 24/7 phone service if you want to talk your options through with someone.

This can be very reassuring when making a higher value transfer. Generally, OFX does not have an upper limit on the value of payments you can send. Aside from transfers, OFX also offers currency risk management products for individuals and business customers. A transfer fee of 15 AUD applies if you send less than 10,000 AUD – this fee is waived for higher value payments.

Best features:

- Services for individuals and businesses

- Often no limit to the value of a payment you can send

- No transfer fee for high value payments over 10,000 AUD – although exchange rates include a markup

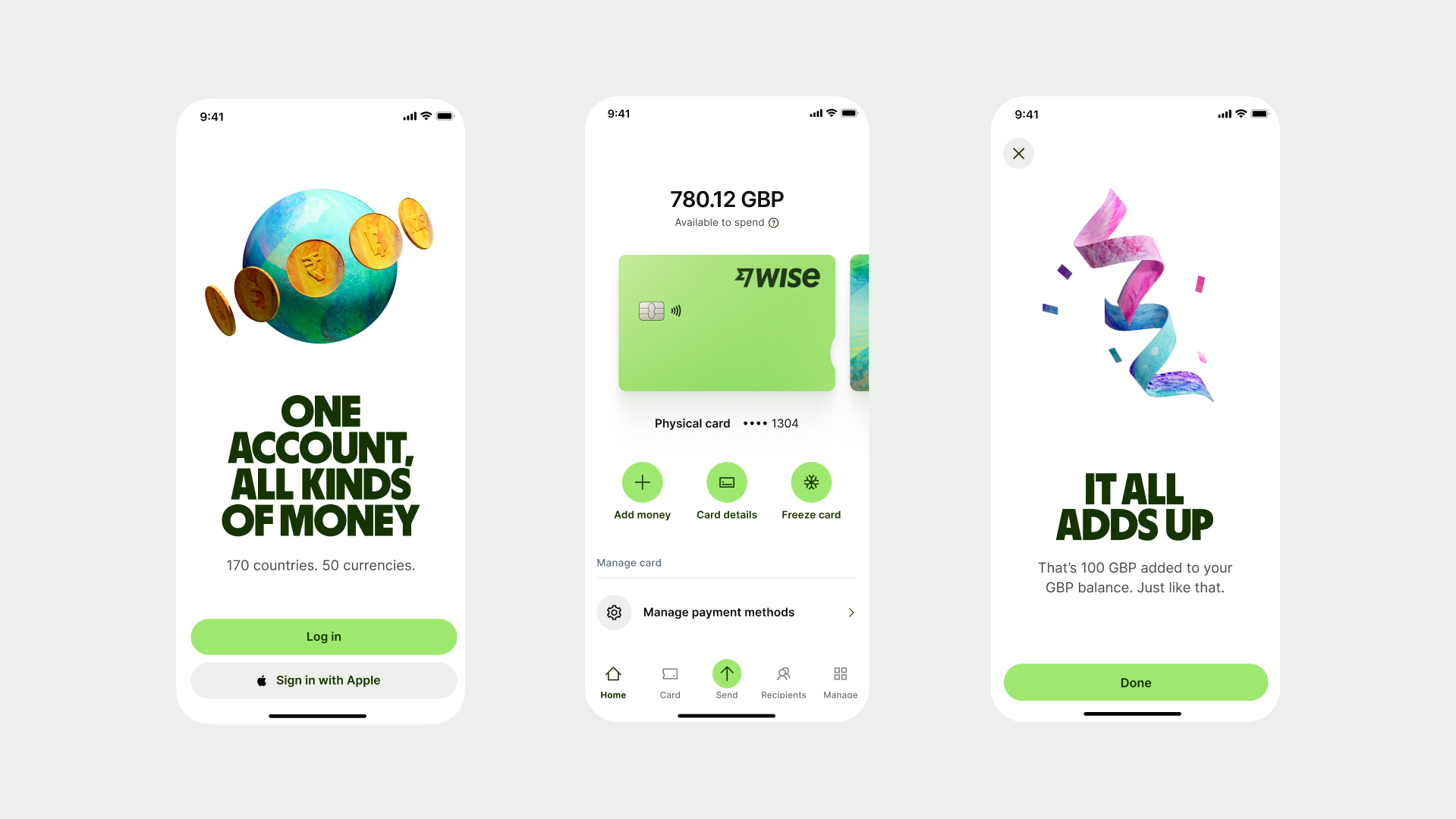

Wise

Send payments in 40+ currencies, to 140+ countries. Wise international transfers are available for individuals and business customers, and while there are some limits to the value of payments you can send, these limits are generally set very high to allow customers to transact freely. In fact, if you’re sending higher value payments you may even qualify for automatic fee discounts, making the costs even lower.

Limits vary by currency, and depend on the way you fund your transfer. We’ve got a summary of limits for Australian customers coming up in just a moment. Currency exchange uses the mid-market rate with no additional fees added, and a low conversion charge from 0.63%.

Aside from international transfers, Wise also offers multi-currency accounts which can be used to receive foreign currency payments, and which offer a linked international debit card for spending and withdrawals around the world.

Best features:

- Mid-market exchange rates and low, transparent fees

- High transfer limits, usually around 1 million GBP in value

- Account and card services also available for personal and business customers

Is it possible to increase Revolut limits?

Some Revolut limits can be changed by the customer, while others are fixed or can only be adjusted by Revolut.

For example, you could choose to set and adjust a monthly card spending limit to help you manage your budget, but you can not change the ATM withdrawal limit. This is fixed for all customers.

How to increase Revolut limits

Revolut has various limits, and you might find you can not change or increase the limits which apply to your account. Depending on the specific limit you wish to change you can look at the option of upgrading your account to a higher tier which might have higher limits – or you can reach out to the Revolut customer service team to ask for advice. We’ve got the contact information for Revolut Australia coming up in a moment in case you need more help.

Revolut large transfer fees

Comparing the costs of sending a large payment can be tricky as different services use their own approaches to pricing. Some providers have fees included in the exchange rate, while others split out costs so they’re easy to see. This means that the easiest way to see what a payment is costing you in the end is usually to look at what the recipient will get in their bank once the transfer is processed.

To illustrate, let’s look at the costs and final received amount for an example transfer, using Revolut, Wise and OFX.

| Sending 30,000 AUD to GBP | |||

|---|---|---|---|

| Providers | Total fees | Exchange rate | Total received in GBP |

| Wise | 117.39 AUD | 1 AUD = 0.486551 GBP | 14,539.41 GBP |

| Revolut (Standard Plan) | 185 AUD | 1 AUD = 0.48600 GBP | 14,490.05 GBP |

| OFX | 0 AUD | 1 AUD = 0.482869 GBP | 14,486.06 GBP |

*Details correct at time of research – 14th July 2025

As you can see, these providers have quite different fees and exchange rates available. Revolut offers different account types which each have their own pricing structures. In the example above we have taken data for a Standard plan which has no monthly fee but also quite low limits on the amount you can convert without paying a fair usage fee. As an alternative you could also choose to upgrade to a different Revolut account tier which has a monthly fee but which gives you additional discounts on transfer fees, or higher levels of currency conversion before fair usage fees kick in.

In our example, the recipient gets more in the end if you use Wise. Comparing several providers is the best way to make sure you’re getting the lowest overall cost for your transfer, no matter where you’re sending money to.

Revolut exchange rate and limits for international transfers

All Revolut account plans offer some weekday currency conversion which uses the Revolut exchange rate with no additional fee. Once you have exhausted the Revolut limit associated with your account, there’s a fair usage fee to pay. There may also be an extra fee to pay if you choose to exchange your currency at weekends, depending on the account plan you choose. Here’s a summary:

- Revolut exchange limit before fair usage fees (Standard Account) – 2,000 AUD/month

- Revolut exchange limit before fair usage fees (Premium Account) – 20,000 AUD/month

- Revolut exchange limit before fair usage fees (Metal Account) – no limit

Because the limits and costs of using Revolut can vary depending on the specific account you have it is important to check the fees for your own plan, and compare them to an alternative provider before you make your transfer or exchange.

How to send high amount transfers with Revolut

Revolut operates in app and through a website – there’s no need to visit a physical branch location, which allows you to transact at your convenience. Here’s how to send high amount transfers with Revolut:

- Download the Revolut app or open the desktop site

- Click Send Now and follow the steps to register your account

- Get verified by adding an image of your ID and any other documents requested

- Set up your transfer by entering the details of amount and currency

- Choose the payment method and how the money should be received

- Follow the prompts to pay and your money is on the way

Go to Revolut

How to receive large transfers with Revolut

Revolut’s limits for receiving transfers aren’t disclosed. There’s not a specific maximum amount you can receive to your account per transfer, but there is an annual limit on the total value you can receive and top up to your account. This limit is set by Revolut and can not be checked or altered. If you hit your limit you’ll need to get in touch with Revolut customer service to ask what your options are.

If you know you’re going to receive a large amount of money to your Revolut account you might want to check with the Revolut team whether any additional documents might be needed. This is sometimes necessary to demonstrate the source of the funds, so Revolut can complete legal compliance checks in place to prevent financial crime.

How long do large transfers take with Revolut?

The length of time it takes for your payment to be delivered with Revolut depends on the transfer type and destination. You can get a delivery estimate when you set up your payment, and then check and track the transfer in the Revolut app if you need to. Here’s a summary of average delivery times:

- Local AUD transfers through New Payments Platform (NPP) or Osko usually arrive within minutes

- Local AUD Direct Entry (DE) transfers can take up to 3 business days

- SEPA Instant transfers made in EUR should arrive within a few minutes

- Regular SEPA transfers in EUR can take up to 2 business days.

- International transfers processed through SWIFT can take up to 2 business days to arrive

Revolut customer support for high amount transfers

Revolut offers customer support in 100+ languages, 24/7, through secure in app chat. Here’s how to ask a question about your high value payment with Revolut:

- Log into the Revolut app and tap your profile in the top-left corner

- Select Help and then Chat with us to be connected to an agent

Revolut business limits

Revolut business customers in Australia can open a multi-currency account and get debit cards for payments and withdrawals. Several limits do apply, usually set according to the specific account type – to see the limits that apply to your account you’ll need to log into the app to get all the details you need.

Some general limits can also apply on business payments. The amount of money you can send with a Revolut business account depends on the currency you’re sending to. Some examples are given below – if you exceed this amount your transfer will be rejected and you’ll need to choose a different provider or split your payment into several smaller transfers.

- Limit to payments in GBP to a UK account: 250,000 GBP

- Limit to SEPA instant payments: 100,000 EUR

- Limit to INR transfers to India: equivalent of GBP 5,000

- Limit to MYR transfers to Malaysia: equivalent of GBP 15,000

Other limits also apply, which are shown in the Revolut app when you set up your transfer.

Conclusion: Does Revolut have limits?

Revolut Australia has various limits on the amount you can hold and send from your account, and the amount you can withdraw from an ATM. Some limits can be adjusted by the customer, but others are fixed or can only be changed by the Revolut team.

Revolut money transfer limits depend on the currency you’re sending – if you hit a limit you’ll be shown a notice in the app and can either split your payment down to smaller transfers, or select a different provider like OFX or Wise which might have a higher limit.

Revolut international transfer limits FAQs

How much can I transfer with Revolut internationally online?

All Revolut transfers are set up online or in the Revolut app. The amount you can send depends on the currency and your specific account type. Limits are shown in the app when you arrange your transfer.

What is the maximum amount you can transfer abroad with Revolut?

Revolut limits depend on the payment details and are shown in the app when you arrange your payment. If you can’t send the transfer you’re making with Revolut you might prefer an alternative like Wise or OFX which have high limits, and low overall costs.

How can I increase the Revolut maximum transfer limit?

There’s no advertised way to increase the Revolut maximum transfer limit. If you need to send a high value payment you can either split your transfer into several smaller payments to cover the full amount, or choose a provider with a higher limit like Wise or OFX.

Are there any limits on Revolut?

Yes. Revolut has various limits on the amount you can receive or top up to your account, the value of transfers you can send and the amount you can withdraw from an ATM.

What is my daily limit on Revolut?

There’s a daily limit of 3,000 GBP for cash withdrawals with Revolut – that’s just over 6,000 AUD. Other limits might also apply on transfers from your Revolut account – you can see these limits in the Revolut app when you log in.

What is Revolut’s monthly limit?

Revolut does not disclose any monthly limit on the amount you can hold or send. However, there are some annual and daily limits on the amount of money you can top up or receive to your Revolut account. If you hit one of these limits you will be notified in the Revolut app.