Is Wise Money Transfer Safe? – Can I Really Trust them to Send Money Overseas? 2026

Wise (TransferWise) money transfers is a safe service to use. Wise send more than $8 billion around the world to 16 million people every month. Established 12 years ago, it has grown to become one of the top players in international money transfers throughout the UK, US, Australia and Europe. They have 14 offices and employee over 2,000 employees around the world.

Is Wise safe and legit?

Yes, Wise is safe and legit.

In Australia, Wise is regulated by ASIC, Australian Securities and Investments Commission. The Australian Securities and Investments Commission (ASIC) is the government body that ensures and regulates fair and transparent conduct of financial services. Every financial service must be granted an Australian Financial Service (AFS) licence by ASIC to carry out business in Australia. Their ASIC licence number is 456295.

They are also registered with the Financial Intelligence Unit (AUSTRAC) as a money remitter. Their registration number is 168331191. There are very stringent guidelines that Wise must follow in order to send your money. This makes them a safe, and trustworthy option for your international money transfers.

Where else is Wise regulated?

Being a global company, Wise is also regulated in countries in addition to Australia. These include:

United Kingdom – Financial Conduct Authority (FCA) – with registration number 900507, with passporting rights across the EEA.

Belgium and European Economic Area (EEA) – by the National Bank of Belgium (NBB) as an Authorised Payment Institution, with passporting rights across the EEA.

Canada – Financial Transactions Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business (MSB) with registration number M15193392. They also have an MSB license with the Authorité des Marchés Financiers (AMF) under license number 902804.

United States – Financial Crimes Enforcement Network (FinCEN) Regulatory authorities vary by state.

Hong Kong – Hong Kong Customs and Excise Department and is licenced as a Money Service Operator (MSO) with licence number 15-01-01584.

Singapore – The Monetary Authority of Singapore (MAS) as a major payment institution under the Payment Services Act 2019 (PSA).

India – is approved by the Reserve Bank of India (RBI) for facilitating outward remittances from India under the guidelines set out by RBI.

Learn more

Is Wise as safe as traditional banks?

Wise is not a bank – however, for the services Wise offers, they are as safe as a bank.

Banks are often subject to more regulation compared to international money transfer companies, because they also offer extra services like credit cards and loans. For international transfers, Wise is as safe as a bank, but often cheaper and faster.

Is Wise money transfer safe?

Yes, Wise is secure.

They take measures to protect the sensitive data you provide them like your personal details and identification. The company encrypt any information you give them and have a strict customer agreement. You can email Wise ([email protected]) to find out more. The encryption and data storage is handled the same way as a bank.

With the Wise multi-currency account you can send and receive money to your friends using your mobile number. To protect your privacy this feature is automatically switch off on registration and is easy to turn on following these instructions. Unlike many social media platforms, Wise never send or store your full phone’s contacts on their servers and they never get in touch with your contacts.

They employ a specialised, in-house team that look after security. They monitor all transactions for suspicious activity or fraudulent logins all around the world.

How safe are my login details when I use Wise?

In terms of online security, Wise protects your personal data from fraud and theft. Wise use 2FA, giving you extra protection. This means that when you log in, you go through two levels of verification to access your account. They will ask you to verify that it’s you by text message, fingerprint or face recognition.

They also encrypt your sensitive data and create secure connections with your website browser when you’re providing your personal details and identification. Wise adheres to a strict customer agreement. Wise never sells your data.

Learn more

How does Wise keep your money safe?

Wise uses a broad range of approaches to keep customer money safe. Here are the key features:

- Customer funds are safeguarded at top tier institutions

- Licensed and regulated around the world

- Dedicated 24/7 anti fraud technology and support team

- 2 factor authentication for your account and card

- Transaction alerts every time a payment is made with your Wise card

- Independently audited with regular testing to check and fix any vulnerabilities

- High levels of data protection

Is Wise safe to transfer money?

Wise is a safe provider to send international payments with. As well as being regulated by ASIC in Australia, and holding an AFSL, Wise has a range of security measures in place to protect customer funds and ensure payments are safe.

Click Here to Read a Full Wise Review

Is Wise safe to keep money with?

It’s safe to hold funds in your Wise account. Whenever you deposit money into your Wise account, it is safeguarded in a leading financial institution, or invested in high quality liquid assets which can be easily disposed of to release funds. This means your Wise account balance is secure and is always held entirely separately to Wise’s own money.

Is Wise safe for large amounts?

Wise is a safe way for individuals and businesses to send high value payments. Transfer limits may apply and are set according to the destination country and currency.

Before you arrange a high value payment with Wise you may want to take a few sensible steps to make sure everything goes through smoothly:

- Verify your account. If you have a new account you’ll need to complete a verification step to get started. You may also be asked to verify your account at a later stage, based on the transfer value and type.

- Confirm the recipient’s bank details. Make sure you have all of the required details to process your payment safely. You’ll always need your recipient’s full name and bank account number, along with other region specific details like an IBAN, routing number or sort code.

- Double check your transfer limits. Check your own bank’s transfer limit and whether there are any bank fees to pay for funding your Wise transfer through your bank account or card.

Is the Wise business account safe?

The Wise business account is safe to use. Wise business accounts are also managed in accordance with strict local and global regulations, with funds fully safeguarded in line with the way personal customer accounts are managed.

The main difference between using a Wise business account and a business account from a traditional bank is likely to be cost. Wise offers international transfers and currency conversion with the mid-market exchange rate and low, transparent fees, which can work out cheaper than using your regular bank.

Is Wise legit?

Wise is a legitimate, safe provider which already serves over 16 million customers around the world.

Compared with regular banks, Wise is typically cheaper. That’s because Wise takes a different approach to international payments, offering the mid-market exchange rate and low, transparent fees. No smoke and mirrors, and no shady business practices to worry about.

Customer Reviews with Trustpilot

Trustpilot is a well known review platform. A TrustScore is an overall measurement of reviewer satisfaction, based on all the service and comments a business receives.

Wise has received more than 100,000 reviews. It scores 4.4 / 5 with TrustPilot, which is a very high score.

94% of people rated Wise as ‘Excellent’ or ‘Great’ often commenting on the quick, secure and easy to use service.

“Very quick and inexpensive international transfers (most occur within a few seconds). Transfers arrive to the destination account much faster than Western Union or Xoom, both of which take at least a few hours to as much as a week. I do a lot of transfers since my kids go to school abroad, and since finding TransferWise I have never used another company for international wiring.”

Meanwhile only 5% of customers had a ‘Poor’ or ‘Bad’ experience. In most occasions Wise respond to the comment on the page to try to assist the customer further.

Finally watch our video of Wise customers giving their feedback on service, speed and exchange rates.

Can you get scammed on Wise?

Unfortunately fraudsters and scammers are active on all sorts of platforms including Wise and traditional banks, too. However, staying safe in most cases requires little more than a few sensible steps and common sense. Here are some tips:

- Never share your account details or password with anyone

- Don’t log into any site other than the Wise official homepage – check the secure site symbol before you begin

- Don’t transfer money to anyone you don’t know and trust

- Check your recipient’s account details before you make any transfer

- Be aware of common frauds and phishing scams – these evolve and change over time, so staying aware is crucial

Can I avoid falling victim to fraud?

Should you be unlucky enough to fall victim to fraud while using your Wise account, you can report the issue to both Wise and the police.

To report fraud to Wise, log into your account and make your report there. If it’s possible to stop the transaction, the Wise support team will help you.

If your payment can not be stopped or has already been received by the fraudster, you’ll need to report the fraud to the police. Wise can then pass on the transaction information to the police to support your case.

Is your personal data safe on Wise?

Wise protects customer personal data in line with local and international data protection rules, and has a duty to keep any sensitive data safe. Information is collected and used to process transfers, comply with legal requirements and improve Wise services.

What personal data does Wise collect?

Wise collects personal data from customers which can include information you give them, and information collected from you, such as your IP address and the way you use Wise services. Wise may also collect information from third parties, for example, to help in the account verification process.

You can ask Wise not to contact you for marketing purposes by changing your marketing settings within your account, or sending the customer service team an email.

Wise may be required by law to retain some information about you. The length of time that data is retained will depend on the specific information and the applicable laws. However, Wise will not hold customer data for any longer than is necessary for practical or legal purposes.

How to get started on Wise?

To use Wise you’ll need to create an account, and depending on the type of payment you want to make you might need to provide paperwork to get started. This may include:

- Proof of identity, like a passport

- Proof of address, like a utility bill in your name

You may be asked to take a selfie holding your proof of ID for verification. In some cases, you’ll be asked for further identification and paperwork when you make a transfer. This tends to happen when sending high value payments, and is often required by law.

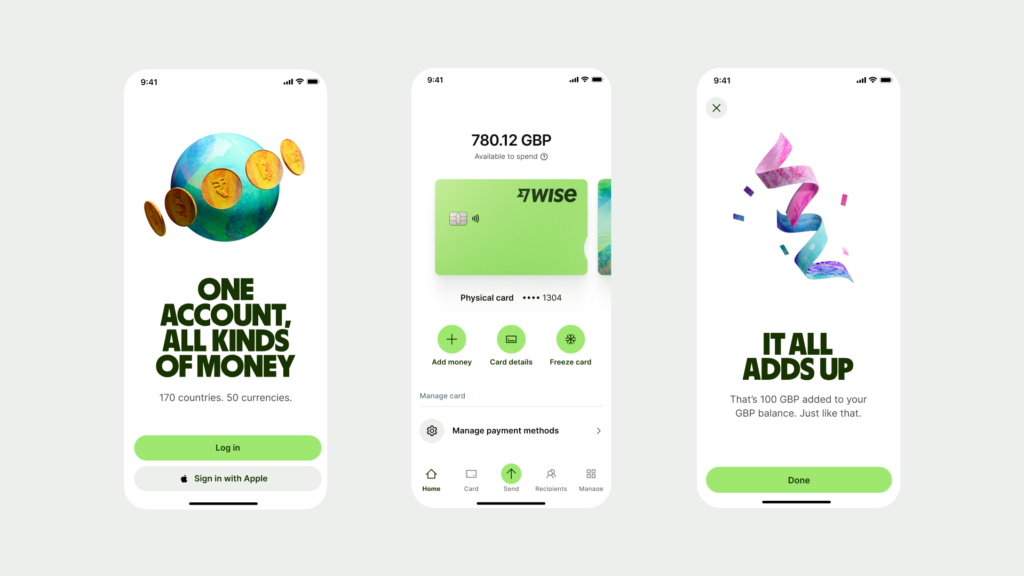

Once your account is up and running make payments online and in the Wise app:

- Log into your account

- Type in how much you want to transfer, or how much you need the recipient to get

- Enter the recipient’s details – bank account number or email

- Check over the details

- Fund your payment using a card or bank transfer

- Confirm and your money will be on the move

Ready to go?

Conclusion

Wise is a safe currency exchange and international transfer provider, which is popular thanks to its convenient service and low overall transfer fees.

Wise has a number of features to keep customer money safe, including thorough account verification, 2 factor identification for accounts and card use, and 24/7 anti fraud controls.

Like banks and most other financial service providers in Australia, Wise is regulated by ASIC and global regulatory bodies everywhere services are offered.

FAQ – Wise Safety

Is Wise safe?

Wise is a safe provider for account services and international transfers. Customer funds are safeguarded, and accounts are protected by thorough verification processes and anti fraud technology.

How is Wise regulated?

In Australia, Wise is regulated by ASIC. Wise is also authorised and regulated by other regulatory bodies around the world, including FinCEN in the US and the FCA in the UK.