How to receive money from overseas using Wise: A Complete Guide – 2026

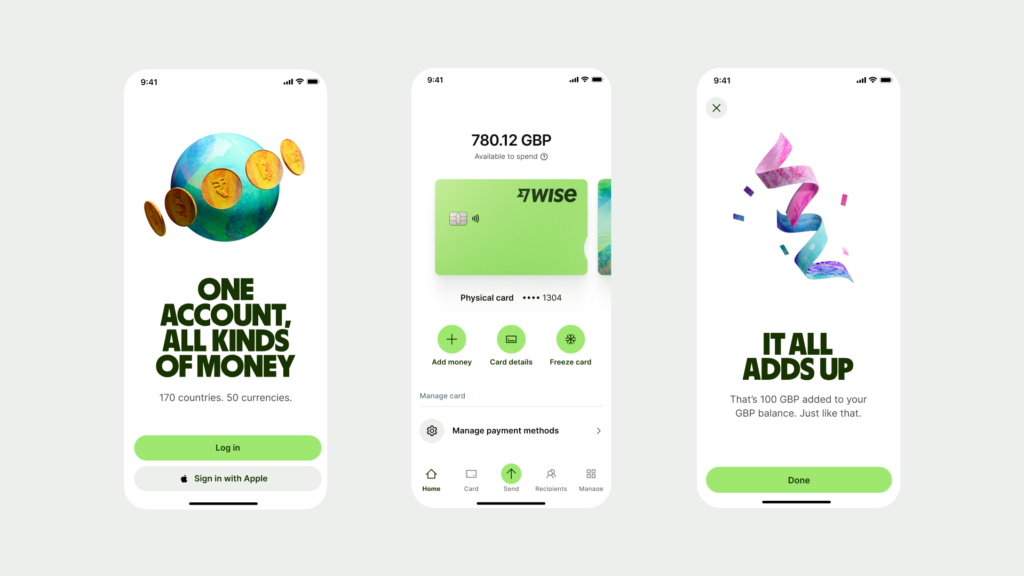

Wise launched in the UK in 2011, and has been on a mission to make it easier, faster and cheaper to send and receive international payments, and access international account services – no matter where in the world you are. Today, Wise offers personal and business multi-currency accounts (previously known as Borderless account) to customers in almost every country on the planet.

Wondering how to get paid with Wise (formerly TransferWise)? This guide is for you. We’ll walk through how Wise international payments work, using Wise to receive international payments to your normal bank account, and how to use the Wise app to receive money to a dedicated Wise multi-currency account, too.

What is Wise?

Wise is a financial technology company which specializes in international payments and multi-currency accounts for individual and business customers.

You can use Wise (formerly TransferWise) to send a one off or recurring payment to 70+ countries with the mid-market exchange rate and low, transparent fees – or choose to open a Wise multi-currency account to hold and exchange 50+ currencies all in the same place. Wise accounts offer a broad range of features to suit anyone living an international lifestyle – including an international debit card and local bank details to get paid fee free from 30+ countries.

How to Use Wise

There’s a lot you can do with a Wise Account. This guide will focus on how to use Wise to receive international payments. But first, a quick step by step to setting up a Wise account.

Here’s how to open a Wise Account:

- Download the Wise app or head to the Wise desktop site

- Tap register

- Create an account using your email, Apple ID, Google ID or Facebook details

- Add your personal information, following the onscreen prompts

- Get verified

- Top up your account, order an international debit card or set up your first transfer

- You’re ready to go

Once you have your Wise account all set up and verified you’ll be able to arrange international payments, or add and convert funds in your Wise multi-currency account. Wise multi-currency accounts also allow customers to send and receive international payments, and spend using a linked Wise debit card.

Here’s a rundown of the key features you’ll get with Wise:

- Send money transfers from your Wise account or another bank account using the Wise app, to 70+ countries

- Order a Wise debit card, make in-store and online purchases in 170+ countries, create virtual cards for free

- Receive money into your Wise account, by sharing your local account details with the sender and get paid like a local in 10 currencies

- Hold and exchange 50+ currencies in your Wise account using mid-market exchange rates

- Open a business account to send, receive and exchange 50+ currencies

We’ll cover how to receive money with Wise in full detail, in just a moment.

How to receive money from overseas with Wise (formerly known as TransferWise)

1. Set up a Wise account

You need to be a customer of Wise to use their services. Wise accounts can be created online.

- You will need to provide your name, address, contact details and email.

- Verify your identity. This means providing proof of ID and proof of address, both of which can be uploaded through their website.

- Proof of ID is provided by a recognised photo ID like a driver’s license, national ID card or passport.

- Proof of address is provided by official correspondence from a reputable organisation.

- Wise may require certain other types of verification, for example for a business account.

2. Use your Wise account (Borderless Account) to receive money

Once your account with Wise has been set up, you are ready to receive money. Here’s how to do it:

- Login and go to the balances section of the Wise account (Borderless).

- “Add” the balance in the currency you want to receive the money to.

- Get your bank details by clicking on the currency and give them to the person that is paying you.

Learn more about how it works

1. How to set up a Wise account to receive money [personal customers]

You can set up a Wise account to receive money transfers in 10 currencies including AUD, USD, EUR and GBP. With your Wise account, you can get local account details for these currencies, and receive transfers with those details.

Here’s how to get your Wise local account details, to receive money to your Wise account:

- Log into your account on the Wise app or desktop site

- Within your Wise account, tap open a balance, and select the currency you need

- Tap Get account details, then copy the account information for the currency you’re receiving

- Send these account details to the person making the payment, to receive funds into Wise

How does a Wise account work?

Once you’ve opened your Wise account you can hold a balance in any of 50+ currencies, and exchange currencies between them with the mid-market exchange rate and low, transparent fees whenever you need to.

You can also send fast and efficient payments to 70+ countries from your account, and spend internationally from your Wise balance with a linked Wise card.

Wise accounts come with local bank details for up to 10 currencies, so you can get paid fee free from 30+ countries.

Do I need a Wise account to receive a money transfer?

You don’t need a Wise account to receive money from Wise. You can simply have your Wise payment sent to your normal bank account in the currency of your choice. Or, if you’d prefer, you can open a Wise account yourself, to get paid like a local in up to 10 currencies.

How do I get verified?

To keep customers and their money safe, Wise has to complete a verification step when you open an account or set up an international payment. This is to comply with legislation around the world and prevent fraudulent or illegal account use – banks need to do this when customers set up accounts too.

However, while you might have to visit a branch to verify your bank account, the good news is that you’ll be able to complete the Wise account verification process entirely online or in the Wise app. All you’ll need to do is upload images of:

- Proof of your identity – like a photo of your passport or driving license

- Proof of your address – such as a recent utility bill or bank statement in your name

What details does the sender need?

To receive a payment to a Wise account, you’ll need to give the sender your Wise local currency account details, including:

- Your name as it appears on your Wise account

- Your Wise bank account number and details, for the currency you’re receiving

- Depending on the specific payment you may also need to give extra information, like a reason for the payment

How to set up Wise account to receive money [business]

Wise business accounts come with pretty much all the benefits of a Wise personal account, and a few extras too – like batch payments and cloud accounting integrations.

You’ll be able to get local bank details for up to 10 currencies with your Wise business account, to get paid by local transfer from 30+ currencies easily. Just give the sender your Wise account details for the currency you’ll receive money in, which you can find on the Wise app, and wait for the payment to be deposited. The process to get your account details is the same as for a personal Wise account. All you need to do is:

- Log into your business account on the Wise app or desktop site

- Within your Wise account, tap open a balance, and select the currency you need

- Tap Get account details, then copy the account information for the currency you’re receiving

- Send these account details to the person making the payment, to receive funds into Wise

How does my business get verified?

For a Wise business account you’ll normally need the above, plus:

- Business documentation which can vary based on entity type

- Names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business

How do I deposit money into my Wise account?

Add funds to your Wise multi-currency account in dollars – or any of the other 50+ supported currencies, to make payments and spend on your linked debit card anywhere in the world.

You’ll be able to select your preferred payment method, including using a bank transfer or adding funds with your debit or credit card. The fees for different payment methods vary, so you can pick the one which suits you best.

Here’s how to deposit money to your Wise account:

- Open the Wise app or website

- Choose the currency you want to add

- Enter the amount you want to top up

- Select your preferred payment method

- Check, confirm and make the payment

Read also: Wise Promo Code [Valid]

How much does it cost to receive money to your Wise account?

Wise fees are easy to understand. If someone is sending you a payment to your Wise account you can give them your local Wise bank details for any of the 10 supported currencies. These are free ways to receive payments in all these currencies – and because your sender will be making a local transfer, it’s often the cheapest option for them too.

If you’re topping up your Wise account yourself you can also often do so fee free using a bank transfer. Some currencies and payment methods do have a small top up fee – especially if you’re looking to get the top up processed as fast as possible. However, you can see all your options on the Wise app or desktop site, using the calculator tools available there.

Will you have to pay any fees as the receiver?

You don’t pay any fee to receive funds to your Wise account using the local bank details that come with your account. The only exception is if someone sends you a USD wire payment – in this case there’s a small charge. However, you can get a USD payment for free if it’s sent using an ACH instead.

What currencies can you receive to Wise for free?

Use your Wise account to receive these currencies using the local bank account details that are available for free:

- US Dollars (USD)

- Euros (EUR)

- British Pounds (GBP)

- Australian Dollars (AUD)

- New Zealand Dollars (NZD)

- Singapore Dollars (SGD)

- Polish Zloty (PLN)

- Romanian Lei (RON)

- Hungarian Forint (HUF)

In these currencies, you can send your Wise account bank details to the person sending you the money. They can then pay the currency into your account, free of charge and without any currency conversion fees.

One important note – there’s a 4.14 USD fee to receive USD by wire transfer to your Wise account. It’s free to receive an ACH though, so you may want to ask the sander to transfer using an ACH instead if possible.

Advantages and disadvantages of receiving and sending money with Wise

Pros:

- Wise accounts have free ways to get paid in 10 currencies

- If you need to switch currencies at any point, you get the Google exchange rate and low, transparent fees

- Wise deposits can arrive very quickly

- You’ll get instant notifications once money arrives into your account, through the Wise app

Cons:

- USD wire payments have a 4.14 USD receiving fee

- You may pay a small fee for topping up your account yourself, depending on the currency and payment method

Additional information for receiving money with Wise

There are a lot of numbers and information you hear about when it comes to international money transfers. Here are a few things you may be asked for if you’re receiving a payment with Wise.

Wise IBAN number

IBAN is an account format used by European banks. Australian banks do not use this format and an IBAN is not required to send money to an Australian bank account via Wise. Other parties with an IBAN field on their overseas payment form can simply leave this field blank. If you’re receiving money from Europe using Wise, you may need an IBAN. Wise will provide this for you.

Wise routing number

Depending on the currency you’re receiving to your Wise account, the sender may request a National Clearing Code, Routing Number, BSB Number or Sort Code. In this case you can simply get the Wise account details for the currency you’re receiving from the app – following the steps set out above – and you’ll find all you need.

Currency exchange rates for Wise

- Rates for transferring funds internationally through Wise are available through their currency converter.

- The currency exchange rate your sender will get does vary from moment to moment.

- They will get the up-to-date, dynamic rate when you are booking your transfer.

2. How to receive money to your bank account

You do not need a Wise account to receive a money transfer sent with Wise. If you’d rather, you can simply receive the money directly to your normal bank account.

If you’re expecting to get a Wise payment to your regular bank account, just give your bank details to the person sending the money and wait for the money to arrive in your bank account. More than 50% of Wise transfers are instant – and the vast majority arrive in 24 hours.

What details do I need to give the sender?

To receive a payment to be sent through Wise, you’ll need to give the sender your account details, including:

- Your name as it appears on your bank account

- Your bank account number

- Your account BSB number

- Depending on the specific payment you may also need to give your address, or a reason for the payment

How much does it cost to receive money into my bank account?

Your own bank may charge a receiving fee when you get a payment deposited into your bank account. To check if this will apply you’ll need to take a look at your specific account’s terms and conditions document.

Read also: How to send money from PayPal to Wise

Advantages and disadvantages of receiving money to your bank account

Pros:

- Wise uses the Google exchange rate to convert currencies, which may mean the sender pays less, and you get more in the end

- Wise payments are deposited quickly – or even instantly

- Wise payments can be sent to 70+ countries, in 50+ currencies

Cons:

- Your own bank may charge a receiving fee

- The sender will pay a Wise fee which varies based on the way they pay and the value of the transfer

FAQ: How do I receive money internationally from Wise?

How much does it cost to open a Wise account?

There’s no fee to open a Wise personal account. If you’re opening a Wise business account you’ll pay a one time low fee to get full account features. Wise personal and business accounts have no ongoing fees and no minimum balance requirements.

How long does it take to receive money with Wise?

Wise transfers are often fast. 50% arrive instantly or within a few seconds, and 90% are there in 24 hours. Ultimately how long your Wise payment takes will depend on the transfer currency and value, and how the person sending it chooses to pay.