Wise GBP Account Review 2026

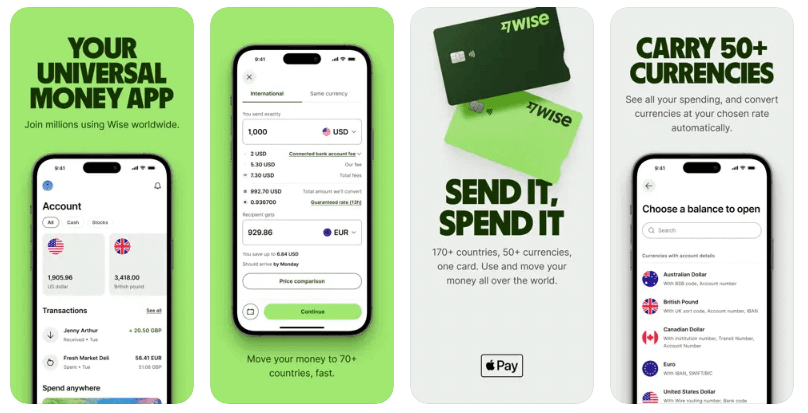

Wise customers can open a fully digital Wise account with a linked debit card which offers easy ways to hold, send, receive and spend pounds. Plus, as Wise accounts have great international features, you’ll also be able to hold a balance in 40+ other currencies, get paid from others in around 8+ currencies, and send money to 140+ countries.

Read on for more about how the Wise GBP account works, including the fees, set up process, safety and more.

Wise GBP account key points

- Wise accounts can be opened and managed with just a phone or laptop

- Hold and spend pounds alongside 40+ other currencies

- Add money in Australian dollars, pounds or any of around 20 supported currencies

- Switch your dollars to foreign currencies for spending, with the mid-market exchange rate and low conversion fees from 0.43%

- Get a linked Wise debit card to spend globally, with low cost currency conversion

- Send money to 140+ countries, often instantly

- Get local bank details to receive payments to Wise in pounds or up to 8 other currencies

- No foreign transaction fees when spending overseas

Pros and cons of Wise GBP account

| Pros |

|

| Cons |

|

What is a Wise GBP account?

If you’re in Australia and looking for a digital account you can use to hold, receive, send and spend pounds, the Wise GBP account can help. Wise GBP accounts can also be opened by customers based in other countries, although some of the fees and features you get may vary slightly. This guide focuses on opening a GBP Wise account in Australia, but you’ll be able to get all the local details for Wise GBP accounts wherever you are, over on the Wise desktop site.

Wise GBP accounts can be used to hold and exchange pounds as well as 40+ other currencies, and come with a debit card for international payments. You can either add money to Wise yourself from your regular bank account or card, or give your local Wise GBP bank details to anyone else who’s sending you money. Once you’ve got money in your account you can make fast – or even instant – payments to others in 140+ countries, and spend with your Wise card with no foreign transaction fees.

Wise isn’t a bank, it’s a financial technology company with a focus on making it cheaper, easier and faster to manage your money across different currencies. That means that while Wise doesn’t offer all the same services as a bank might, you will find some powerful international features such as currency exchange which uses the mid-market rate, and low conversion fees from 0.43%.

Read a full review on Wise borderless account here.

Can I open a Wise GBP account in Australia?

Yes. Wise operates in Australia and in almost all other countries globally. You’ll be able to open a Wise GBP account in Australia with a local proof of address and ID document, or you can check out the details for opening a Wise GBP account locally wherever you are, on the Wise desktop site.

How can I activate a GBP account in Wise?

Open your Wise account online or by downloading the Wise app. All you’ll need is your normal ID document and a proof of address for verification purposes.

Here’s how to activate your Wise GBP account:

- Download the Wise app, or open the Wise desktop site

- Register with your email address, or an Apple, Google or FaceBook account

- Follow the prompts to enter your personal details

- Upload your ID documents for verification

- Once your account is verified, tap Open in the app homepage

- Select Currency Balance and tap GBP to open your GBP account

- Top up your balance, complete any required security step, and start transacting

When is a Wise GBP account needed?

Wise GBP accounts are especially helpful for anyone who needs to hold, send, receive, spend and exchange dollars, pounds and other major foreign currencies. You can use your Wise GBP account to receive money in pounds, or top up your account yourself from your regular bank account, and then spend with no foreign transaction fee when you travel or shop online in foreign currencies.

If you’re planning a UK holiday you can use Wise to set your spending budget in advance, by topping up in dollars and converting over to British pounds before you travel. Or just let the Wise card automatically convert for you at the point of spending. In either case, you’ll get the mid-market exchange rate with no markup added, plus low fees from 0.43%, which can cut the costs compared to spending with your normal bank card overseas.

Business customers can also open a Wise account to send and receive payments in pounds alongside other currencies, making it easier to connect with contractors, customers and suppliers based overseas. You can use local Wise bank account details to get paid through PSPs and marketplaces in up to 8+ currencies, or simply add the details to your invoices to make it convenient for customers to pay in their preferred currency.

How does the Wise GBP account compare?

Customers in Australia have plenty of choice for GBP accounts. You could use a high street bank, or try a digital provider.

To start off the process, let’s take a look at the Wise GBP account vs a couple of top picks: Revolut and HSBC’s Everyday Global account.

| Wise GBP account | Revolut GBP account | HSBC GBP account | |

|---|---|---|---|

| Availability in Australia | Available to personal and business customers | Available to personal and business customers | Available to personal customers |

| Global usage | Y | Y | Y |

| Conversion fees | From 0.43% | All accounts offer some no fee conversion

0.5% fair usage fee once fee free conversion is exhausted |

No conversion fee, but exchange rates may include a markup |

| Exchange rate fees | No fees; mid-market exchange rate | Out of hours fees may apply | Exchange rates may include a markup

3% foreign transaction fee may apply when spending an unsupported currency |

| Other fees | 10 AUD fee to get a card

|

Monthly fees may apply depending on the account you pick | ATM operators may apply fees

|

| Linked Debit Card | Y | Y | Y |

| Best Features | Supports 40+ currencies

Local receiving account details for 8+ currencies |

Supports 25+ currencies

Budgeting and saving tools available |

Supports 10 currencies

Huge range of HSBC products you can also choose |

Comparing a few different GBP account options makes sense, so you’ll know you’re getting the best option for your specific needs.

Wise offers one of the most flexible accounts on the Australian market, with 40+ currencies supported, plus exchange which uses the mid-market rate.

However, Revolut is also a good pick with 25+ currencies, and mid-market exchange rates to your specific plan limit. On the other hand, if you’re looking for a GBP account from a major global bank, to help you manage GBP transactions alongside all your other banking needs, you might like HSBC which has everything under one brand, so you can keep all your finances in one place.

Click here to read a complete Wise Review

Wise GBP account fees

Here’s a look at the costs involved in opening and using a Wise GBP account.

| Features | Wise GBP account |

|---|---|

| Create account | No fee for personal customers, business customers pay a one time charge of 65 AUD for full account features |

| Account monthly fee | No fee |

| Fee to receive payments in GBP | No fee |

| Fee to spend a currency you hold | No fee |

| Exchange rate | Mid market rate, low conversion fees from 0.43% |

| Send payments | Transparent fees from 0.43% |

| Fee to receive card | 10 AUD for personal customers, 6 AUD for business customers |

| ATM fees | 2 withdrawals to the value of 350 AUD/month free, then 1.75% + 1.5 AUD per withdrawal |

| Virtual cards | No fee |

Information correct at time of writing, 13th October 2023

Wise GBP exchange rate

One of the most helpful features of the Wise account is that you can use it to hold not only pounds, but a broad selection of 40+ other currencies, too. Whenever you switch from one currency to another – to send a payment or spend on your card for example – you get the mid-market exchange rate with no markup, and a low conversion fee from 0.43%.

There’s no foreign transaction fee to pay when spending overseas – whereas with banks you’ll often find an extra charge of around 3% added for spending in a foreign currency when you travel or shop online with an international retailer.

Overall, this can mean using Wise for your foreign currency transactions can work out cheaper compared to sticking with your bank.

How does the Wise GBP account work?

Here’s how to create and use a Wise GBP account with just your phone or a laptop:

- Account Creation: Download the Wise app or visit the Wise desktop site, register with a few personal details and add an image of your ID and proof of address documents – once your account has been verified you can start to transact

- Fund Transfers: Add Australian dollars, pounds or any of around 20 supported currencies to your Wise account online or in the Wise app. You can pay by bank transfer, with a card, or with a mobile wallet like Apple Pay

- Sending and Receiving Payments: Send transfers to 140+ countries, in 40+ currencies. You can also receive payments to your Wise account in 8+ currencies, including GBP. There’s no fee to receive GBP transfers to your account

How to use the GBP account abroad

Because you’ll be able to view and manage your Wise account with just your phone, you can easily keep an eye on your finances when you’re abroad. Use your linked Wise card to spend and make withdrawals, and get an account overview and instant transaction notifications in the Wise app. You’ll also be able to add money to your account, switch between currencies, and send easy, fast, local and international payments.

What is the eligibility for a Wise GBP account?

This guide focuses on getting a Wise GBP account in Australia – but you can also open a Wise account to hold, send, spend and receive pounds from a broad selection of other countries too. To open a Wise account in Australia or overseas you’ll need a proof of ID and address, and you’ll also need to be over 18. Check all the details for your location on the Wise desktop site.

Who is it good for?

You might want to open a Wise GBP account for local and international spending. Wise GBP accounts are good for:

- Australians who travel to the UK or elsewhere and want to spend with no foreign transaction fees overseas

- Customers looking for a way to receive and hold pounds

- Anyone who shops online with UK based retailers

- People who need to pay bills overseas, such as a mortgage on a holiday home

- Freelancers and contractors getting paid in pounds or foreign currencies

- Business owners who want to manage their money across currencies digitally

Is a Wise GBP account safe to use?

Yes. Wise isn’t a bank, but it’s overseen by the ASIC in Australia, and holds an Australian Financial Services License. Plus, as a global company, Wise is also overseen and regulated by the FCA in the UK and a range of other bodies overseas, which means it’s safe to use in Australia and when you’re abroad.

Availability

Wise GBP accounts are available to customers in Australia and most other countries globally, for customers with a valid proof of address and ID. If you’re not in Australia, check out the Wise desktop site for details of account features and fees wherever you are, as they can vary slightly.

The Wise international debit card is issued on either the Visa or Mastercard network, and can be used in 150+ countries, wherever you see your card’s network logo.

Other available currencies

Wise accounts can hold, send, spend and exchange pounds alongside 40+ other currencies. You’ll also get local bank details to get paid in pounds and 8 other currencies.

Wise GBP account limits

If you’re based in Australia there’s no holding limit on your Wise GBP accounts. However, limits do apply on a per transaction, daily and monthly level on card spending. These limits are for account security, and can be viewed and adjusted in the Wise app.

Wise GBP account alternatives

If you’re in Australia you’ve got plenty of choice for GBP accounts, including brick and mortar banks and digital services like Wise and Revolut. There’s a lot of variation in the sorts of services and features you can get from different providers, and the fees you pay can vary a lot as well. That means it’s well worth comparing a few options, including normal banks, digital banks, and fintech companies, to see which suits you best.

Conclusion

Wise GBP accounts are available to customers in Australia and a broad selection of other countries globally. You’ll be able to hold and receive pounds, with 40+ other currencies also supported. That can make a Wise GBP account particularly suited to anyone who travels to the UK a lot, or people who shop online and pay in pounds. You can add money to your account in AUD, and manually or automatically convert to GBP for spending, with the mid-market exchange rate, no foreign transaction fee, and low conversion costs from 0.43%.

FAQ – Wise GBP account

How do I open a GBP account with Wise?

Register for a Wise GBP account online or through the Wise app using a local Australian proof of address and ID. Then all you need to do is tap to open a GBP balance within the Wise app, to start spending, sending and receiving pounds easily.

What is the account limit for Wise in pounds?

There’s no limit for Wise GBP account balances for Australian customers. However, adjustable spending limits apply when you use your Wise card.

How do I add pounds to Wise?

Open a Wise GBP account, and simply log in and tap Add to top up in pounds from your bank account or with a card or mobile wallet. You can also get local GBP account details, and give them to anyone who needs to send you money in pounds.