Wise USD Account Review – 2026

Whether you’re travelling to the US or simply paying in US dollars for your online shopping, a USD account can make transacting internationally cheaper and more convenient. With a Wise USD account you can hold, send and spend US dollars and 40+ other currencies, plus get USD account details to get paid to your account in US dollars from others.

Read on for all you need to know about the Wise USD account, including the exchange rate used for switching Australian dollars to US dollars, the fees you’ll pay and the other handy features of a Wise multi-currency account.

Wise USD account key points

- Open your account online or using the Wise app

- Up to 20 supported currencies for top ups, including Australian dollars and US dollars

- Hold and exchange 40+ currencies – conversion fees from 0.43%

- Mid-market exchange rates every time you need to switch from one currency to another

- Send money to 140+ countries, often instantly

- Linked Wise international debit card to spend and withdraw in 150+ countries

- Get paid in US dollars, Australian dollars and 7 other currencies, right to your Wise account

- No foreign transaction fees when spending overseas

Pros and cons of Wise USD account

| Pros |

|

| Cons |

|

What is a Wise USD account?

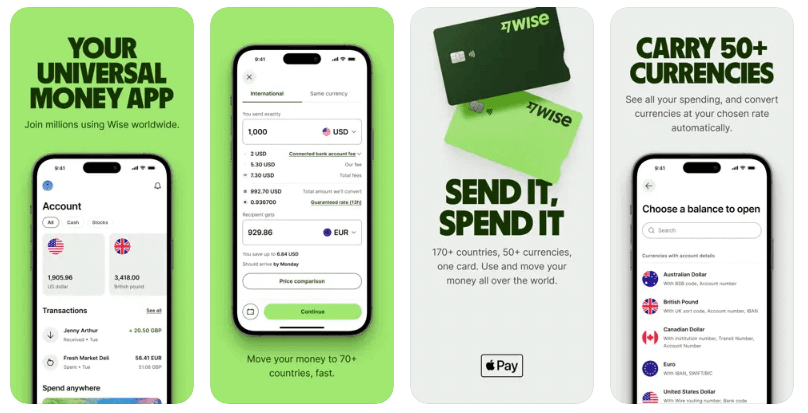

Wise offers a digital multi-currency account you can use to hold and exchange US dollars as well as 40+ other currencies, with a linked card for international payments, and easy ways to send and receive a selection of currencies.

Add money to your Wise account from your bank or card, in Australian dollars or any of around 20 other currencies including US dollars. Or have others send you payments using Wise account details available in 9 currencies.

Once you have a Wise account balance you can spend with your Wise debit card, send payments to 140+ countries, or withdraw back to your local Australian account if you’d prefer. Any time you need to switch between currencies, you’ll get the mid-market exchange rate with no markup and low fees from 0.43%. That can make Wise a cost effective way to spend when you’re overseas or when shopping online in foreign currencies.

Read a full review on Wise borderless account here.

Can I open a Wise USD account in Australia?

Yes. Open a Wise USD account in Australia online or through the Wise app. Accounts are available for both personal and business customers.

How can I activate a USD account in Wise?

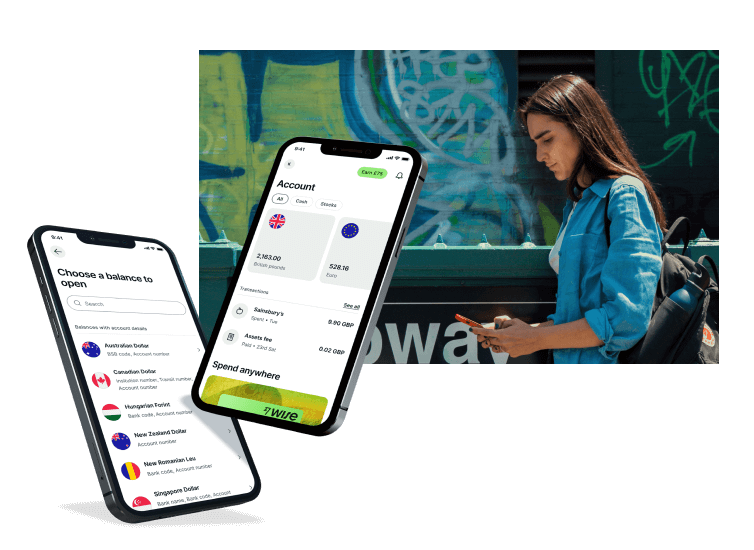

Wise accounts offer an entirely digital opening and onboarding process – so there’s no need to visit a physical location, and you can set everything up online or in the Wise app.

To start using a Wise dollar account you’ll need to register an account, get verified, and open a Wise USD currency balance. Here’s how to activate your Wise USD account:

- Download the Wise app, or open the Wise desktop site

- Register with your email address, or an Apple, Google or FaceBook account

- Follow the prompts to enter your personal details

- Upload your ID documents for verification

- Once your account is verified, tap Open in the app homepage

- Select Currency Balance and tap USD to open your USD account

- Top up your balance, complete any required security step, and start transacting

When is a Wise USD account needed?

Having a Wise USD account can make it cheaper and more convenient to receive, hold, send and spend US dollars.

If you’re a personal customer you can use your Wise USD account to pay when you travel to the US, or when you shop online and pay in US dollars. It’s also handy if you need to send payments in USD – for planned travel or as a gift for friends or family, for example. Plus if you’re a freelancer or get paid by your employer in US dollars, you can use your Wise account details to get paid easily in USD right to your account.

Business customers get all the same features personal customers do, plus some extras like batch payment solutions which can help save time by allowing you to send money to up to 1,000 people at once. Use your Wise business USD account to get paid through PSPs and marketplace platforms, send payments easily to suppliers and staff, and issue your team linked Wise expense cards to help them manage their international business spending.

How does the Wise USD account compare?

If you’re based in Australia you’ve got a few different options when it comes to opening a USD account. Shopping around is the best way to pick the right account for your needs. To start off the process, let’s take a look at the Wise USD account vs a couple of top picks: Revolut and HSBC’s Everyday Global account.

| Wise USD account | Revolut USD account | HSBC USD account | |

|---|---|---|---|

| Availability in Australia | Available to personal and business customers | Available to personal and business customers | Available to personal customers |

| Global usage | Y | Y | Y |

| Conversion fees | From 0.43% | All accounts offer some no fee conversion

0.5% fair usage fee once fee free conversion is exhausted |

No conversion fee, but exchange rates may include a markup |

| Exchange rate fees | No fees; mid-market exchange rate | Out of hours fees may apply | Exchange rates may include a markup

3% foreign transaction fee may apply when spending an unsupported currency |

| Other fees | 10 AUD fee to get a card

4.14 USD fee to receive a USD wire |

Monthly fees may apply depending on the account you pick | ATM operators may apply fees

|

| Linked Debit Card | Y | Y | Y |

| Best Features | Supports 40+ currencies

Local receiving account details for 9 currencies |

Supports 25+ currencies

Budgeting and saving tools available |

Supports 10 currencies

Huge range of HSBC products you can also choose |

Comparing a few different USD account options makes sense, so you’ll know you’re getting the best option for your specific needs. Wise offers one of the most flexible accounts on the Australian market, with 40+ currencies supported, plus exchange which uses the mid-market rate. However, Revolut is also a good pick with 25+ currencies, and mid-market exchange rates to your specific plan limit. On the other hand, if you’re looking for a USD account from a major global bank, to help you manage USD transactions alongside all your other banking needs, you might like HSBC which has everything under one brand, so you can keep all your finances in one place.

Click here to read a complete Wise Review

Wise USD account fees

Here’s a look at the costs involved in opening and using a Wise USD account.

| Features | Wise USD account |

|---|---|

| Create account | No fee for personal customers, business customers pay a one time charge of 65 AUD for full account features |

| Account monthly fee | No fee |

| Fee to receive payments in USD | No fee to receive ACH transfers

4.14 USD fee to receive a USD wire |

| Fee to spend a currency you hold | No fee |

| Exchange rate | Mid market rate, low conversion fees from 0.43% |

| Send payments | Transparent fees from 0.43% |

| Fee to receive card | 10 AUD for personal customers, 6 AUD for business customers |

| ATM fees | 2 withdrawals to the value of 350 AUD/month free, then 1.75% + 1.5 AUD per withdrawal |

| Virtual cards | No fee |

Information correct at time of writing, 13th October 2023

Wise USD exchange rate

Wise is transparent about its fees and costs. That means that when you convert currencies you’ll get the mid-market exchange rate, with any applicable fees split out so you can easily check and compare them. The mid-market rate is the one you find on Google or with a currency conversion calculator, with no extra charges rolled up in it.

How does the Wise USD account work?

Opening and using the Wise USD account is pretty straightforward and requires nothing more than your phone. Here’s how it works.

- Account Creation: Create your Wise account online or in the Wise app, upload images of your normal ID and proof of address documents and you’re ready to go

- Fund Transfers: Top up your Wise account in any of around 20 currencies, from your normal bank account or card, or with a mobile wallet like Apple Pay

- Sending and Receiving Payments: Send transfers to 140+ countries, in 40+ currencies including Australian dollars and US dollars. You can also receive payments to your Wise account in 9 currencies, including AUD and USD. It’s free to receive a USD payment by ACH, but there’s a 4.14 USD fee to receive a USD wire

How to use the USD account abroad

Wise USD accounts come with an optional linked debit card, which means you can easily spend and withdraw funds from your account at home and abroad. You’ll also be able to manage your money on the move right from the Wise app, with an account overview option and instant transaction notifications.

What is the eligibility for a Wise USD account?

Wise USD accounts are available for Australian customers aged over 18, with a valid proof of ID and address. Wise accounts are also available in a broad selection of other countries, although the features and fees may vary slightly based on your location.

Who is it good for?

Wise USD accounts can be handy for many people, including:

- Travellers looking to spend and make cash withdrawals overseas

- People who shop online with international retailers

- Contractors, freelancers, and anyone getting paid in foreign currencies

- People who need to send payments internationally

- Business owners who want to issue international expense cards to team members

Is a Wise USD account safe to use?

Yes. Wise is overseen and regulated by ASIC in Australia, and by a selection of other global regulatory bodies around the world. As a fully digital provider, Wise has also invested in industry standard security measures to keep customers and their accounts safe.

Availability

Wise USD accounts are available to customers in Australia and most other countries globally, for customers with a valid proof of address and ID. The Wise international debit card is issued on either the Visa or Mastercard network, and can be used in 150+ countries, wherever you see your card’s network logo.

Other available currencies

Wise accounts have broad multi-currency functionality, which means you can use them to hold, send, spend and exchange US dollars alongside 40+ other currencies. There’s a broad selection of global currencies on offer, including Australian, Canadian, Singapore and New Zealand US dollars, British pounds and euros.

Wise USD account limits

Most Wise Australian customers can hold as much as they like in their Wise USD accounts, without any limits imposed by Wise. However, there are Wise security limits on card spending, which can be viewed and adjusted in the Wise app.

If you have Wise USD local bank details ending in 026 there’s a limit to how much you can receive in US dollars to Wise. However, these limits are set extremely high – 20 million USD per day for a personal account holder, for example – so you can still transact freely.

Wise USD account alternatives

Having a USD account is a handy option for plenty of people, and there are a few good Australian providers which can help if you need to hold and spend US dollars frequently. Compare the Wise USD account against an alternative like Revolut for both personal and business customers, or check out the HSBC Everyday Global account if you’re a personal customer looking for an account from a major bank.

Conclusion – Wise USD account

Wise multi-currency accounts let you manage your money in Australian dollars and US dollars alongside each other, plus you can also hold, send, spend and receive a good selection of other currencies in the same account. Wise uses the mid-market exchange rate with low fees from 0.43% whenever you need to convert funds to send a payment or spend with your card, which can keep costs down. Plus accounts are entirely digital which is convenient when you’re travelling. Compare the Wise USD account against a couple of other popular Australian providers like Revolut and HSBC to see which suits you best.

FAQ – Wise USD account

How do I open a USD account with Wise?

Wise USD accounts can be opened entirely online using a laptop or smart device. Just register your account with a local Australian proof of address and ID, and open a USD balance within the Wise app.

What is the account limit for Wise in US dollars?

Wise account balances in Australia are usually unlimited, or set extremely high at 20 million USD or more. However, there are spending limits applied when you use your Wise card. These can be viewed and changed in the Wise app easily.

How do I add US dollars to Wise?

Open a Wise USD account, and simply log in and tap Add to top up in US dollars or another supported currency. You can also get local USD account details, and give them to anyone who needs to send you money in US dollars.