4 Best virtual debit cards for Australians 2026

Virtual debit cards are becoming more common and popular, thanks to the convenience and security they offer. Like physical cards, virtual cards can be used to tap and pay in stores through a wallet like Apple Pay, or to spend online. However, unlike physical cards, your virtual card will live only on your phone - you won’t have a piece of plastic to carry around.

You’ll be able to get a debit card for virtual use from a specialist provider, or in some cases from a bank. Generally, your virtual card will have a different card number to any physical card you have from that bank or provider, for an added layer of security.

The best virtual debit cards available in Australia right now are:

1. Wise

2. P&N Bank

3. Revolut

4. Airwallex

| Questions | Answers |

|---|---|

| Can virtual cards be used internationally? | Yes. You can use a virtual card anywhere where the network is accepted and where a contactless payment is available. |

| Which is the best virtual card for international payments? | There’s no single best card for international use, but it’s worth looking out for a card with no foreign transaction fee - like the Wise card or a card from Revolut - to keep costs down. |

| Can I use my virtual card abroad? | Yes. Virtual cards can be used for contactless payments internationally, wherever your card network is accepted. |

Wise virtual debit card - our pick for virtual debit card in Australia

If you love to shop online with international retailers, or travel frequently for business or pleasure, the Wise virtual debit card could be the one for you. Open a personal Wise account online or in the handy Wise app, and order a physical debit card for a one time fee of 10 AUD. You’ll instantly be able to generate and use up to 3 virtual debit cards which are compatible with Apple Pay, Google Pay and other mobile wallets for contactless spending, as well as online and in-app payments.

So why’s Wise the pick for international shoppers and travellers? Wise has the edge because you can hold 40+ currencies in your account, and switch between them with the mid-market rate whenever you need to. There’s just a low, transparent fee to pay, with no ongoing costs or minimum balance.

It’s free to spend any currency you hold in your account, as long asa you have enough balance to cover the costs of your purchase, with no foreign transaction fee to worry about. And if you don’t have the currency you need, let the card’s auto convert feature take over and convert your funds for the lowest available fee. Easy.

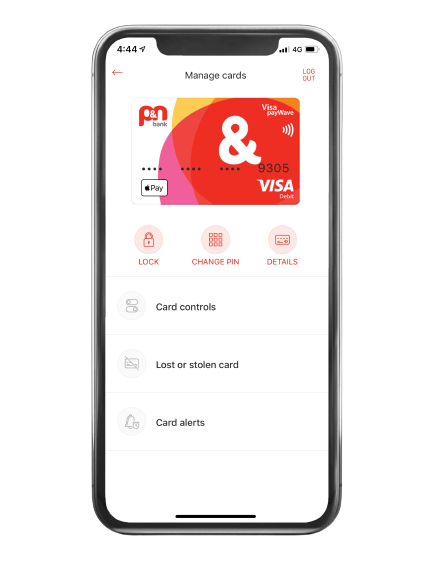

P&N Bank instant card

P&N Bank has a range of everyday banking accounts which have no monthly charges, and which come with linked physical and virtual cards. That means that when you sign up for an eligible P&N Bank account you can instantly generate a virtual Visa card for spending online, and which is compatible with popular mobile wallets for in person, contactless transactions.

The costs of using a virtual debit card with P&N will depend a little on the account you choose in the first place. Some P&N accounts come with fee free transactions, including non-standard transactions, which can be really handy to keep costs down.

It’s worth being aware though, that if you use your physical or virtual debit card abroad, you’re likely to pay a 3% foreign transaction fee, plus any charges levied by out of network ATMs. You’ll also need to keep P&N informed about your travel plans as their anti-fraud measures may otherwise mean your card is blocked for security reasons.

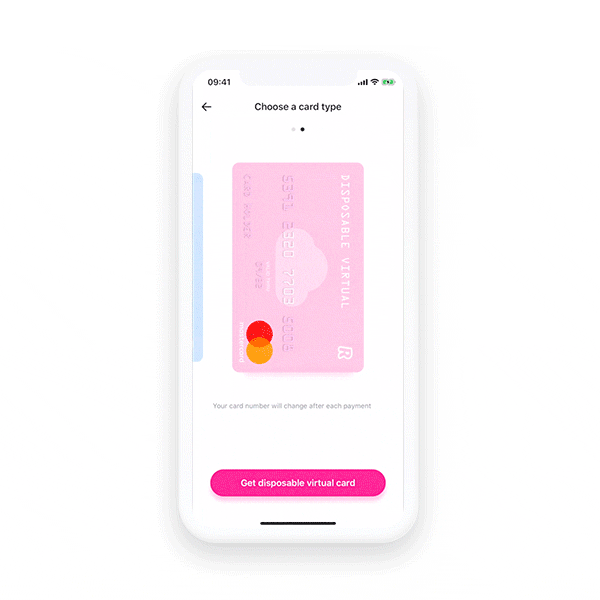

Revolut Virtual Debit Card

Open a Revolut account online, with a choice of the Standard account which has no monthly fees, or a higher tier account with charges to pay monthly. Higher tier accounts cost up to 24.99 AUD/month, with extra benefits and no fee transactions included in the price.

As soon as you sign up for a Revolut account you can generate up to 20 virtual cards, and one disposable virtual card at any one time. Disposable cards are designed to be used for a single transaction only, after which they’ll automatically stop working and be replaced the next time you need one.

All Revolut accounts offer some currency exchange which uses the Revolut rate with no additional fee during trading hours (Monday to Friday). You may find there’s a cap to how much you can exchange depending on your account type, but this can help cut the costs when you spend internationally with your Revolut instant virtual debit card. Accounts also come with options for investing, budgeting, and trading cryptocurrencies.

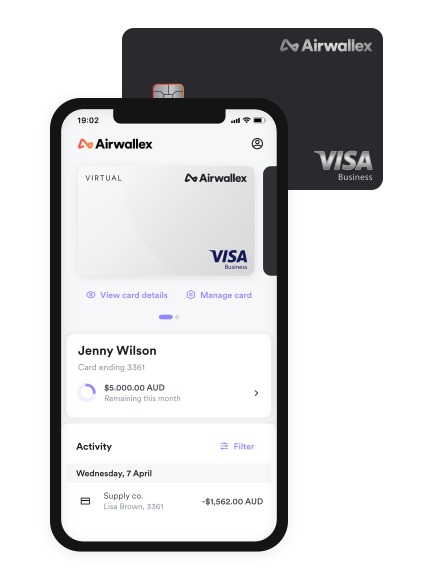

Airwallex

If you’re looking for virtual cards for your business - or virtual expense cards for employees - Airwallex may suit your needs.

With an Airwallex account you can generate virtual cards, which may have a fee depending on the account tier you hold. Cards can be used online or with popular mobile wallets, and can help you track and manage company expenses more easily. Issue expense cards to help you reconcile costs, and cut down the admin time involved in managing expense accounts.

This in-depth review of Airwallex sets out the additional features you can expect by opening an Airwallex account.

Airwallex international card spending will incur a small currency exchange fee of 0.5% or 1% in most cases, which is set according to the currency you’re spending in.

Virtual debit cards for international use: Best options compared

When you’re abroad you want to know you’re getting the best possible deal on card spending. This means the lowest possible fee, but also you’ll want to know your card can be used safely and managed easily even when you’re away from home. Here’s a summary of some key points for international virtual cards, for each of our selected providers.

| Provider | Eligibility | Monthly fee | Foreign transaction fee | Safety |

|---|---|---|---|---|

| Wise | Personal and business customers, in Australia and other countries | No fee | No fee | Manage card with app, freeze/unfreeze |

| Revolut | Personal and business customers, in Australia and other countries | 0 AUD - 24.99 AUD | No fee | Manage card with app, freeze/unfreeze |

| P&N | Personal and business customers in Australia | Variable depending on account | 3% in most cases | Manage card with app, freeze/unfreeze |

| Airwallex | Business customers in Australia | Variable depending on account plan | 0.5% - 1 % in most cases | Manage card with app, freeze/unfreeze |

What is a virtual debit card?

A virtual debit card works much like a regular debit card - but instead of being a physical card, it's a digital card and exists only online and via your smartphone.

Virtual debit cards are often linked to smart online accounts which have their own features and selling points. For example, providers like Wise and Revolut - which we’ll explore more later - offer multi-currency account access to spend with your virtual card in dozens of currencies with no foreign transaction fee.

You can usually generate digital card details instantly and freeze or dispose of them just as easily. Card details are different to your regular, physical card, but linked to the same account. That’s useful as an extra security measure when spending with new merchants - use your virtual card for a transaction and then block the card details afterwards, so you know they can’t be stolen or used inappropriately.

Use your virtual debit card for online and in-app spending, or link it to a wallet like Google Pay or Apple Pay to spend in person when you’re out and about.

Virtual vs digital card

If you’re on the lookout for a virtual card in Australia you may also have read of providers offering a digital debit card for Australian customers. But what’s the difference?

In short, there’s no difference between a virtual debit card and a digital debit card - the phrases are used interchangeably by many providers and consumers. Both describe a payment card which you can use with no physical card in your hand, for online and mobile spending. As both are debit cards, you’ll always need to hold a balance in the linked account before you can make a transaction - so there’s no danger of running up a surprise bill, getting hit by penalties for clearing your account late, or having to pay interest.

Difference between a digital debit card and credit card

efore you start using a digital card you’ll need to be absolutely sure if it’s a digital debit card or a digital credit card. Both are available from some banks.

As we described above, a digital debit card requires you to top up in advance to be able to spend - but you won’t face interest or penalty charges, and the eligibility criteria are usually very straightforward.

Digital credit cards are offered by some banks, and work like any other credit card - but without needing a physical card to authorise payments. As with other credit cards, you’ll need to apply and prove you meet certain eligibility requirements - like a set credit score - and you’ll be able to spend to your assigned credit limit monthly. Pay off your bill in full and on time to avoid interest and penalties.

Generally, debit cards are cheaper to use than credit cards - whether you pick a physical or virtual card for your transaction

How to get a virtual card

If you’re thinking of getting a digital debit card you’ll be able to choose between a specialist provider like Wise or Revolut, or a bank like P&N. This guide will help you pick which virtual debit card option might suit your needs.

Once you’ve decided on the right card for you, you’ll need to understand how to get a virtual card. While the process can vary slightly, here’s a look at how to get a Wise virtual card as an example:

- Open a Wise account online or in the Wise app - you’ll just need your phone or laptop, and some ID for verification

- Add a balance in the currency of your choice

- Order your Wise physical card for a low, one time fee, for delivery to your home address

- You can instantly generate a Wise digital debit card by tapping the Cards tab and choosing Create a digital card

- Your digital card is ready for use right away, for online shopping or to add to a mobile wallet like Apple Pay for on the go spending

How do virtual cards work?

Virtual cards are linked to digital accounts which you can view and manage online or with your phone. You’ll often find that digital account services offer you the option to have a physical debit card, and one or more virtual cards as well, all linked to the same account.

Virtual cards only live on your phone, laptop or similar device, with no physical card required. Your virtual card has different card numbers to your physical card, which is great for security.

To give an example: if you’re shopping online with a retailer you don’t know, you can use your virtual card to process the transaction then freeze or cancel the virtual card.That way if your card number has been stolen or compromised it can’t be used - but there’s no need to get a new physical card issued, and you can usually generate a new digital card instantly, often for free.

Another useful place to use virtual cards is when signing up for a subscription. If you’re worried you’ll forget an ongoing payment - say an annual fee for an app - you can use your virtual card to pay the first time, and then freeze or cancel the card. You can’t be charged again without you knowing - saving the hassle of needing to query an unwanted charge, or lose out on a subscription you didn’t want to extend.

Advantages of virtual cards

Virtual cards have a few key advantages which make them worth using alongside your physical cards:

- You can usually generate multiple virtual cards, all with different numbers, linked to the same account

- You can use your virtual card for all payments where no physical card is needed, online and through wallets like Apple Pay

- You can freeze or cancel your virtual card without impacting your physical card - carry on using it as normal

- There’s no need to carry a physical card with you - giving you one less thing to worry about losing

Are international virtual cards safe?

Digital cards and virtual cards from reputable providers should be safe to use with normal common sense precautions. Most virtual card providers in Australia offer linked apps you can use to view transactions, and get instant notifications about spending. You can also freeze or cancel the card using the app if you’re worried about security.

You won’t need to carry a physical card with you when you use a virtual card for spending - which means there’s less chance of losing it. Plus, because the virtual card has different numbers compared to any physical card you have with the same account, it’s an extra layer of security. When you use your virtual card, the merchant you spend with has no way of accessing the physical card details, so you can just freeze or cancel the virtual card if you’re ever concerned it may be compromised.

Conclusion - Best virtual cards for Australia

There’s no single best virtual card for Australian customers - but the good news is that there are several great providers which may suit your own personal needs.

You might choose a low cost digital account provider like Wise if you want to hold and exchange multiple currencies in one account, and spend globally with a physical and virtual Wise card using the mid-market rate and low fees. Or, you might prefer an option from a bank like P&N if you’re hoping to access a broad range of financial services, such as insurance and loans, alongside your virtual card. Other customers might prefer Revolut for a great choice of different digital account types - or Airwallex for business users.

This guide will help you pick the best digital debit card in Australia for your needs, so you can start spending securely online and on the go.

Read also:

Frequently Asked Questions

Can I use a virtual debit card at an ATM?

No, 99% of the time you can only use virtual cards to make card payments online and in person via mobile wallets. However, some countries are moving towards cardless ATMs which can be used with virtual cards - so keep an eye out for more developments on that front.

Why are virtual cards safer than physical cards?

When you spend in person with a virtual card you don’t need to hand over your physical card - just tap and go with your phone. That means your virtual card is never out of your sight and can’t be lost or stolen in the same way a physical card can. Virtual card details aren’t the same as your primary card details, adding another layer of security. Finally, you also have the option to freeze or dispose of virtual card details instantly, so you can make a one time transaction confident your details can’t be misused.

Can I get a virtual debit card instantly?

Yes. You can often generate a digital debit card instantly when you have an account with a provider like Wise or Revolut. You’ll need to have registered an account already - which only takes a few moments - but you can then generate, freeze and cancel virtual cards using just your phone.