How to receive money from overseas to Australia: Best and cheap ways

Waiting for an overseas payment? You might need to receive money from overseas to Australia from a friend or family member, or from a client or customer if you’re a freelancer or business owner, for example.

As the world is more and more connected across national borders, having smart ways to receive money from abroad is more important than ever. You could receive an international money transfer from abroad to Australia using a multi-currency account from Wise, your bank, in cash, or with a wallet provider like PayPal. All these options have their own features and fees – this guide covers what you need to know.

How to receive money from overseas: step-by-step

This guide explores how to receive money from overseas using several different methods, so you can pick the best option for your needs based on costs and convenience.

As an outline, here’s how to receive money internationally – we’ve got more detail on different payment methods coming right up:

- Research and choose the best method to receive the funds: You might want to receive a payment to a dedicated multi-currency account without currency conversion, to your Australian bank in AUD, to an ewallet or as cash for example.

- Share details with the sender: Depending on the method you select you’ll need to share some personal information with the sender, such as your bank account number or full name.

- Gather and provide any additional documents required: Particularly for higher value payments you might have to provide some extra information to receive your payment, such as proving the source of the funds or the reason for the payment.

- Withdraw the money, or keep it in your account: Once your payment has arrived you can choose to hold, spend or withdraw it as needed.

What documents are needed to receive money from abroad to Australia?

When you receive a payment – particularly a high value payment – you might have to provide some extra paperwork to show the money has been obtained legally. The sender might also have to give some extra paperwork to their bank or the money transfer service they choose to use. The exact documents needed depends on where their money has come from, but some examples can include:

| Reason for payment | Examples of documents needed |

|---|---|

| Sending money from a property sale |

|

| Sending money from an inheritance |

|

| Sending money from your salary |

|

| Sending money from investments |

|

| Sending money from a loan |

|

Best ways to receive money from overseas to Australia – Fees overview

Before you choose the best way to receive money from overseas it’s worth comparing a few options to see which is cheapest and most convenient for your specific payment. Some example options are outlined below, such as receiving a payment to a Wise multi-currency account in AUD or a foreign currency – or as a bank transfer in AUD. We’ll look at each of these options in more detail right after.

| Method | Receiving fee | Exchange rate | Allow holding USD | Sending fee |

|---|---|---|---|---|

| Wise multi-currency account | No fee to receive with local account details

Small fees to receive using SWIFT details |

Mid-market exchange rate | Yes | Variable fees from 0.63% |

| Bank transfer | Variable fee set by your own bank | Exchange rate may include a markup | Not usually available | Variable fees set by your bank |

| Receive cash | No fee for receiver in most cases | Exchange rate may include a markup | Not usually available | Variable fees set by the individual provider |

| Paypal | No fee to receive where no currency conversion is needed | Currency conversion fee of 4% applies | Yes | International transfer fee from Australia of 5%, from 0.99 AUD to 5.99 AUD

Extra charges of 2.6% + fixed fee based on currency if you pay with card |

*Details correct at time of research – 14th July 2025 – Account information refers to Australian registered accounts

If you receive a payment in cash or to your Australian bank the chances are that you’ll have to receive your money in AUD. This means that currency conversion is required, which usually incurs a fee. This fee might not be obvious, as it can be included in the exchange rate the sender is offered.

Wise and PayPal both allow you to receive payments in foreign currencies. If you receive a payment to Wise there’s no fee if the sender uses your local account information in your preferred currency. You can then exchange your funds and spend or withdraw them as you choose to. PayPal allows you to spend your balance or withdraw your money – but a pretty high currency conversion fee of 4% can apply if you need to switch currencies to perform your transaction.

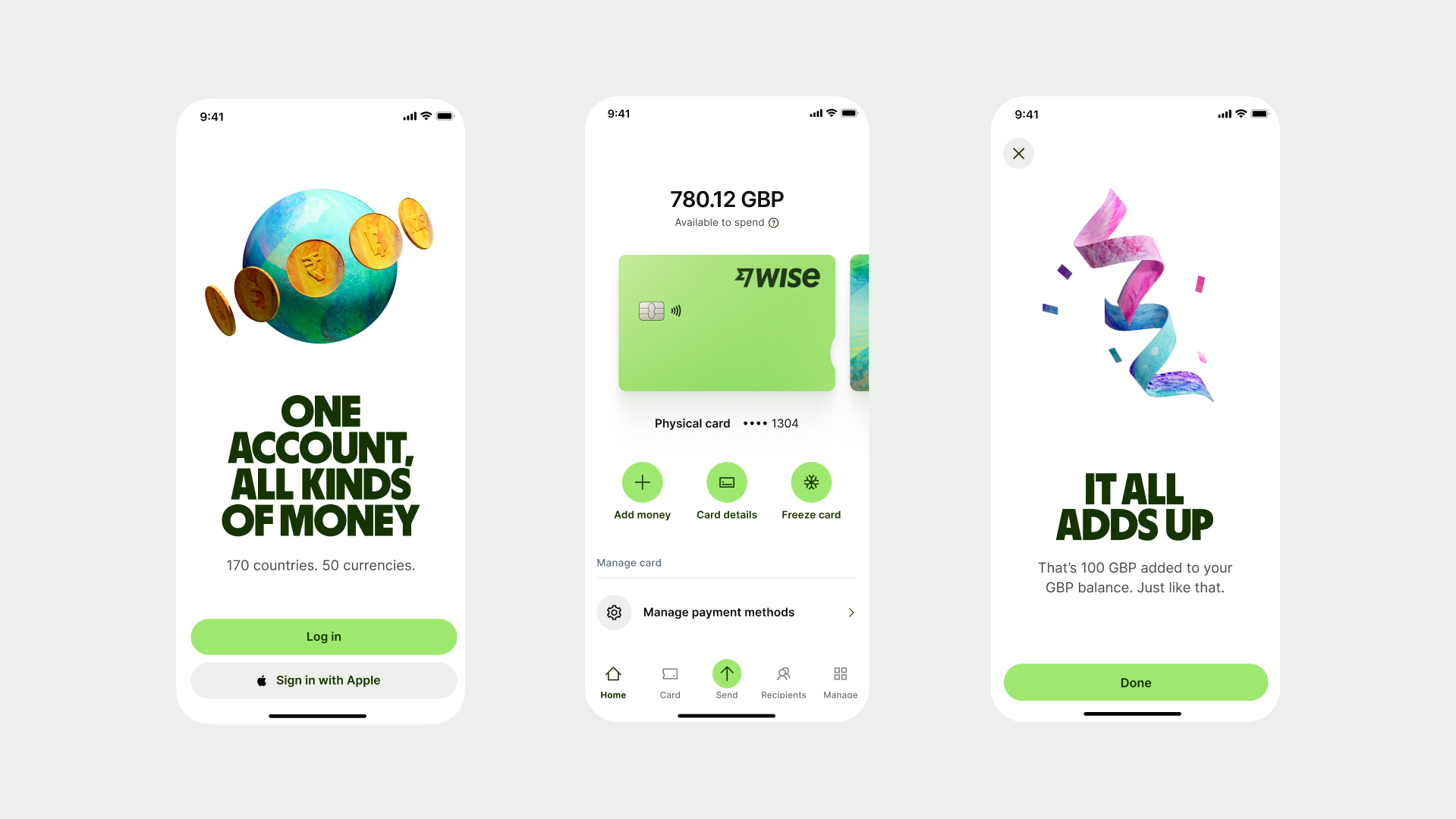

Receiving money from abroad with Wise multi-currency account

Wise offers customers in Australia the option to receive, hold, send and spend a very broad range of currencies. You can get paid from overseas in 8+ currencies with either local or SWIFT account information and hold your payment in the foreign currency until you need it. That means you don’t have to convert back to AUD if you don’t want to, which can help to keep down your costs overall.

You can receive money to Wise from overseas with no fee if the sender uses your local account information. Or you’ll pay a small fee if they use your SWIFT account details. If you choose to convert your balance to a different currency – like AUD – you get the mid-market exchange rate with no fee added, and a low conversion charge from 0.63%.

How to receive money with Wise

You can register for a Wise account for yourself or your business online or in the Wise app. You’ll need to upload images of a couple of documents for verification purposes and can then start to transact. To receive a payment to Wise all you need to do is get your account information for the currency you need, available in the Wise app, and pass it on to your sender.

The app gives you all you need to get paid in 8+ foreign currencies, such as an account number and local details like a sort code for the UK or a routing number for payments in USD. Give these details to the person sending you money, and the funds are deposited to your Wise account conveniently once the payment is processed.

How much does it cost to receive money with Wise from abroad?

You can get account details in AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY, and USD to receive non-SWIFT, non-wire payments with no Wise fees. There are low per payment fees to receive SWIFT transfers and USD wires, which depend on the currency in question. Here are a few examples:

- Receiving USD wire and Swift payments – 6.11 USD

- Receiving GBP Swift payments – 2.16 GBP

- Receiving EUR Swift payments – 2.39 EUR

Once you have a balance in a foreign currency in Wise you can hold it, spend it or convert it using the mid-market rate and low fees.

A bank-to-bank transfer from abroad to Australia

If you’d prefer to receive money to your local Australian bank, you can have the person sending your payment make a deposit to your regular AUD account. This requires you to give the sender your bank name, account number and BSB – you might also need a SWIFT/BIC code.

The drawback to receiving a bank-to-bank transfer from abroad to Australia is the cost. The sender might have to pay a fee to arrange the transfer, and there may also be additional costs which are deducted by third party banks involved in processing the transfer. Your own bank might have a receiving fee – and somewhere along the line the funds need to be converted from the foreign currency back to AUD for deposit, which can incur yet another fee. All in all this can be pretty expensive – and might mean you get less in the end than the sender expected.

How can I receive money in my bank account

If you’re an Australian resident you can open a bank account with your preferred bank, often online or in the bank’s app. You’ll be asked to provide some personal information and ID, and you might also need to make an initial opening deposit to get your account up and running. Before you open a bank account do shop around as some accounts have monthly fees which can end up pretty costly. Once you have your account ready, give the sender your bank account number, BSB and SWIFT/BIC code, and the funds are deposited to your account once the payment has cleared.

How much does it cost to receive money with my bank

The costs of receiving a payment from overseas with your bank can depend on the bank you use, the value of the transfer and how the money is processed. Fees can apply to both the sender and the recipient, which add up pretty quickly. The sender might have to pay a transfer fee, while you may also see fees deducted by third party intermediary banks and your own bank. There may also be costs associated with currency conversion.

Here’s a summary of the receiving fee applied by a couple of major banks in Australia to give a flavour:

| Bank | Receive money fee |

|---|---|

| Commbank | Up to 11 AUD |

| Westpac | 12 AUD – waived for payments under 100 AUD |

Details correct at time of research – 12th July 2025. Fees and rates may vary. Check with providers for current rates.

Receiving cash from abroad to Australia

If you would prefer to get your money in cash, you might be able to ask the sender to arrange a cash collection payment with a provider like Western Union. In this case you’ll then just need to visit an agent close to your home, to collect your payment in AUD cash.

This method can be pretty quick and convenient but usually comes with high overall fees due to the labour required. There are also usually pretty low limits on the amount of money you can transfer for cash collection which means this is not a suitable option for high value payments.

How to receive cash from abroad

To receive an overseas payment in cash you will need to agree with the person sending you money which provider to use – Western Union is one popular choice which we’ll use as an example. The sender can then visit a Western Union branch or set up the transfer oline, and pay using cash, bank transfer or card. The sender is given a reference number – with Western Union this is called a MTCN – and will pass this on to you.

When the payment is ready for collection you will need to visit a local Western Union agent with your government issued ID and the MTCN. Give these to the agent and you’ll be passed your funds in cash.

How much does it cost to receive money in cash

When you receive a payment in cash the chances are that you won’t need to pay anything at the time of receiving the money. However, the costs overall can be pretty steep. The person sending the payment will usually need to pay a fee, which varies depending on the country they’re in and the provider you agree to use. There’s also likely to be a fee added to the exchange rate that’s used to convert the original currency to AUD for you to collect it. This can be hard to spot, but can push up the costs significantly.

Generally cash transactions are one of the more expensive options available to receive money from overseas because of the amount of work required by the agents processing the transfer.

Receiving money from abroad with PayPal

PayPal accounts can receive and hold payments in 25+ currencies which can make them a convenient way to get paid from abroad. However, the fees involved with PayPal international transfers can be on the high side. The exact amount a payment costs depends on the country the sender is based in – if you’re sending a payment overseas from Australia for example, you’ll pay up to 5.99 AUD, plus extra fees for some card payments. There’s then a currency conversion cost if you need to convert a payment to send it, or after you receive a foreign currency. Again this cost varies a bit, but is 4% in Australia.

If you’re wondering: how long does it take to receive money from PayPal internationally, the good news is that the funds can often be deposited pretty much instantly to your PayPal account if the sender pays with a card or from their own PayPal balance. However, if you then choose to withdraw the money to your bank, this might take a day or two depending on your account type.

Because the overall cost of using PayPal tends to be pretty high, you’ll need to weigh up the convenience and discuss with the person sending you money to decide if it’s the right option for your payment.

How to receive money with PayPal from abroad

To receive a payment with PayPal from overseas you’ll need to register a PayPal account which can be done online or in the PayPal app. You’ll be asked for some personal information and then to link a bank account or card for verification purposes.

Once you have a PayPal account you can then have someone send you money simply using your email address or phone number. This can be more convenient than needing to give out your full bank account information.

How much does it cost to receive money with PayPal

There’s no fee to receive a payment with payPal as long as no currency conversion is needed. Currency conversion fees in Australia are 4% of the converted amount. Bear in mind that the sender may also need to pay fees, depending on where they are based and how they pay for the transfer.

Best ways to receive money from overseas – pros and cons

Not sure how to receive your next payment from overseas? Here are some pros and cons to consider for each of the methods we’ve looked at in this guide, to help you choose.

| Method | Pros | Cons |

|---|---|---|

| Wise multi-currency account | ✅ Receive in 8+ currencies

✅ Mid market exchange rate ✅No ongoing account fees |

❌ Small fees apply when receive SWIFT payments

❌Currency conversion costs from 0.63% apply if needed |

| Bank transfer | ✅ Receive payments in AUD to your bank

✅Convenient for the recipient |

❌ Bank transfer and receiving fees can be costly

❌Transfers can take several days to arrive |

| Receive cash | ✅ Fast if the sender uses a card or cash to pay

✅No need to give your bank details to anyone |

❌ Overall costs can be very high

❌Exchange rates usually include a markup |

| Paypal | ✅ Receive a payment with just your phone numbeer or email

✅Spend your balance or withdraw to your bank later |

❌4% currency conversion fees

❌Variable transfer fees which are covered by the sender |

How much does it cost to receive money from abroad?

Different payment methods can have their own costs, which aren’t always easy to see. There may be an upfront transfer fee, but you might also find costs for currency exchange and to receive your payment, as well as third party fees which are passed to other banks involved in processing the transaction. Here’s a summary of what to look out for.

| Method | Receiving fee | Exchange rate | Sending fee |

|---|---|---|---|

| Wise multi-currency account | No fee to receive with local account details

Small fees to receive using SWIFT details |

Mid-market exchange rate | Variable fees from 0.63% |

| Bank transfer | Variable fee set by your own bank | Exchange rate may include a markup | Variable fees set by your bank |

| Receive cash | No fee for receiver in most cases | Exchange rate may include a markup | Variable fees set by the individual provider |

| Paypal | No fee to receive where no currency conversion is needed | Currency conversion fee of 4% applies | International transfer fee from Australia of 5%, from 0.99 AUD to 5.99 AUD

Extra charges of 2.6% + fixed fee if you pay with card |

Details correct at time of research – 14th July 2025 – Account information refers to Australian registered accounts. Fees and rates may vary. Check with providers for current rates.

Ultimately the cost of receiving an international transfer can vary a lot depending on the method and provider selected. You may also need to pay extra to expedite a payment for example, or to cover the costs of intermediary or third party fees. Make sure you’re aware of all possible costs before you initiate a transfer, so there are no surprise costs.

How much money can be received from overseas?

Ultimately there’s no legal limit on the amount of money you can get from abroad – but the provider you’re using to either send or receive a payment might have their own limits which impact the options available to you. To give an example, banks and money transfer services usually have maximum payment amounts which will mean the sender can only transfer a fixed amount per payment, per day, per week or per month. Your own account might also have maximum holding amounts which limit the amount you can have deposited.

If you run into a limit set by either the payment provider or your own bank, you’ll be notified and can choose a different way to arrange your payment.

How long does it take to receive money from overseas?

How long it takes to receive money from overseas depends on the method selected and other factors like the currency and value of the transfer.

Here are the typical transfer times for the different methods we’ve looked at so far, as an example:

- Wise multi-currency account – Wise payments can sometimes be completed quickly, but timing depends on various factors including payment method and recipient country

- Bank-to-bank transfers – bank transfers using SWIFT can arrive in 1 – 5 business days in most cases, depending on the currency

- Cash pickup – if the sender pays in cash or with a card, cash payments can often be available in minutes – transfers funded from a bank might take a few days

- PayPal – PayPal transfers are often deposited to PayPal accounts instantly but it may then take a day or two to withdraw the money to your bank

Factors that can influence the speed of the transfer include the provider used, the transfer amount, currency conversion processes, and any holidays or weekends that might delay processing in both Australia and abroad.

How to send money to someone without a bank account

You can send money to someone without a bank account in a few different ways. For example, the recipient can open a Wise account, you could send to PayPal, or you might prefer cash pick up services.

- Send to a Wise account – recipient will need to create and verify a Wise account online or in app, and can then receive payments for free with local account details.

- Send to PayPal – payments may be instant if you have a PayPal account already – fees can be high to convert currencies.

- Send for cash pick up – relatively expensive option, but can be very quick if you’re close to an agent to get your money.

What details are needed to receive money internationally without a bank?

If you’re receiving money from overseas for cash collection, the sender needs your full name. For payments to PayPal, the sender usually only needs your email or phone number.

For payments made to banks, or to a Wise account you could need some or all of the following:

- Recipient’s full name

- Recipient’s bank or Wise account number

- Recipient’s bank SWIFT/BIC code

- Recipient’s bank’s name and address

Other information might be needed depending on the details and the source of the payment.

Providing incorrect information can mean your payment is delayed, rejected, or sent to the wrong place. Double check account numbers and names, and verify the information with the recipient’s bank before you make your payment, to avoid delays or errors.

Is money received from overseas taxable in Australia?

Whether or not the payment you receive is taxable depends on what the money is for, and where it comes from. If you receive a payment that’s considered income – from freelance work, rent or dividends earned overseas – you might have to pay income tax for example.

As tax can be a complex area, it’s important to get personal advice as soon as possible if you’re not sure what you need to report or pay to the ATO.

You can learn more about tax implications of receiving money from overseas to understand your obligations better.

This information is general in nature only. Tax laws are complex and you should consult a qualified tax professional about your specific circumstances.

What to consider before receiving money from abroad?

Before you get started with your overseas payment, here are a few final pointers to consider:

- Compare the fees and exchange rates offered by several different providers to allow you to choose the right one for your needs

- Check the delivery times if you’re making an urgent transfer – some providers can take several days to process a payment

- Look out for a provider with a good reputation for customer service so you’ll be able to get help if you need it

- Only use secure transfer services to keep your money safe

Conclusion – Best ways to send and receive money from abroad

There are several different ways to receive a payment from overseas to Australia, depending on your needs and preferences. You could have the money deposited to your bank in AUD, pick it up as cash at an agent location close to you, or get it as a deposit to a PayPal account, for example.

For many people, receiving a payment from abroad to a multi-currency account like the Wise account can prove a cost effective and simple solution which cuts the costs of transacting internationally and puts you in charge of the currency conversion process. Compare a few options using this guide to pick the right way to get your money from overseas.

FAQ – How to receive money from abroad

1. What is the first thing you do when you receive money?

To receive a payment from abroad you’ll need to give the person sending the payment some information, depending on the way you want to get the money. You might need to give bank account information for example, or your PayPal details.

2. What’s the best app to send and receive money internationally?

There’s no single best app for international payments – the best option is to compare a free to see which works for your specific transfer. Try providers like Wise and OFX as good choices for low cost, efficient and secure transfer services.

You can check out our guide on the 5 best international money transfer apps for more detailed information.

3. What is the cheapest way to receive international payments in AUD?

If you want to receive a payment from abroad in AUD you’ll need to choose a bank or provider with low or no receiving fees, and a fair exchange rate. Wise accounts offer currency conversion with no hidden fees and the mid-market rate, and can present a good value option to receive payments in dollars and other currencies.

4. How much can I get paid from overseas in Australia?

There’s no legal limit on the amount you can get paid from abroad to Australia but providers and banks do usually have their own limits which can vary a lot. Check the limits of the transfer service you use, and the bank or account you use to receive the funds.

If you’re planning on transferring large sums of money, it’s important to understand the specific requirements and potential limitations.

5. What exchange rate does PayPal have?

PayPal sets its own exchange rates and also charges for currency conversion. Conversion fees depend on the country and currency, but in Australia you’ll pay 4% of the converted amount.

6. How much money can I receive as a gift from overseas in Australia?

If you’re receiving a gift of money from abroad you’ll need to confirm with the ATO and your own bank whether your payment can be received and whether you need to report it or pay any tax.

7. How can I receive money from overseas?

You can receive money from overseas using several different options including a multi-currency account from a provider like Wise, your own bank, a cash transfer service, or PayPal.