How to open a bank account in the US from Australia [2023]

If you’re Australian, but need a US bank account to hold and handle US dollars, you’ll find there are limited options from US banks.

Many banks only offer accounts to US citizens and residents, and require a US address to get started – tricky if you’re not living in the US just yet, or even if you’ve just arrived and don’t have a local proof of address document available.

This guide walks through your options from some major US banks – and some alternatives like Wise and Revolut. More on that, later.

What documents do I need?

Most US banks only offer accounts and services to US citizens and residents. However, there are a few account options for non-residents, which may be suitable for Australian citizens and residents, such as the Bank of America Advantage SafeBalance Account.

Let’s take a look at the eligibility and document requirements for this account as an example. Here are the Bank of America eligibility requirements for this account:

- You must not be a US citizen or permanent resident

- You must have a physical US address

- You must be able to apply in person for an account, at a Bank of America Financial Center

When you go along to the Bank of America location, you’ll need to take along:

- Details of your non-US permanent address

- Proof of your US address – such as a utility bill in your name or a rental agreement

- One primary ID document – like a passport or national identity card

- One secondary ID document – such as a driver’s license or a credit or debit card

- Your foreign tax identification number from your home country

Once you’ve gathered all the information and documents needed you’ll be able to schedule an appointment with Bank of America to visit and get your account opened.

Save the paperwork with alternative solutions like Wise or Revolut

If you’re still in Australia, if you’re new to the US, or if you simply don’t have a US residence in your name, you may struggle to open an account from a US bank. However, that doesn’t mean you’re out of luck.

Instead of turning to a bank, take a look at an online alternative like Wise or Revolut.

Providers like these offer accounts which can hold, send, spend and receive US dollars, alongside a range of other currencies, which can be opened using your regular ID even if the US isn’t your home just yet.

Set up your account online and upload your proof of ID. If you need a proof of address you’ll be able to use details of your Australian address easily, and the verification process is entirely done online or in the provider’s app. That means no need to schedule a bank appointment, and no need to stand in line to get started.

How to open a US bank account as a foreigner

If you have a US proof of address, and a valid government issued ID document you might be able to open a US bank account online. However, this isn’t universally available, and it does get harder to arrange if you’re a non-resident. As we’ve seen in the example above, even the Bank of America account offered for non-resident aliens requires you to have a physical address – and proof – in the US.

In most cases you’ll be asked to attend a branch in person to apply for your account and show your paperwork – you may also need to take along a minimum deposit amount depending on the account type and provider.

What do I need to know before opening a bank account in the US?

If you’re not a US resident you might have a tricky time getting a US bank account. If you are a non-resident alien with a property in the US – for example, because you spend part of the year there – you will find some options, but otherwise, you’ll likely need to step away from banks and look at alternatives like Wise or Revolut.

The other alternative – which we’ll explore later – is to open a bank account with the expat banking division of a large global banking brand. However, in this case, you’ll usually find there’s a high minimum deposit amount to pay.

Read also:

- What do I need to open a bank account in Australia

Can I open a bank account in the US only with my passport?

It’s not possible to open a US bank account with just a passport. Other paperwork will always be requested, including a proof of address or a proof of legal residency in the US, for example. If you don’t have an address in the US, look at online banking alternatives like Wise and Revolut which allow customers to hold and spend USD without needing to be a US resident.

Which account is best in the US for foreigners?

The US has a well developed financial sector as you may expect – but for regular day to day accounts you may struggle if you’re looking at banks, and you’re not a US resident.

In this case, you might be better off looking at specialist financial technology companies. These tend to be cheaper and more flexible than banks, although the availability of accounts, and the features on offer may vary based on where in the world you are based.

Let’s take a look at a few examples:

| Service | Wise | Revolut | Bank of America* | HSBC International* |

| Currencies covered | 40+ currencies including USD, GBP and EUR | 25 currencies | USD | USD |

| Open before you arrive in the US | Yes | Yes | No | If you’re in an eligible country |

| Open online | No fee | No fee | No | Maybe possible, based on customer’s location and circumstances |

| Opening fee | No fee | No fee | Minimum opening balance 25 USD | No fee |

| Maintenance fee | No fee | Up to 24.99 AUD/month | 4.95 USD/month – can be waived by fulfilling eligibility criteria | To waive maintenance fees you’ll need to fulfill one of several eligibility criteria including holding a 150,000 AUD minimum deposit |

| International transfers | Low fee, varies by currency | Variable fee based on destination | 16 USD incoming wire fee. No transfer fee for wires sent in a foreign currency – exchange rate markups are likely to apply | No transfer fee for Global transfer payments sent in a foreign currency – exchange rate markups are likely to apply |

*Bank of America account profiled – Bank of America Advantage SafeBalance Account. HSBC account profiled – HSBC International Premier account. Other accounts from these providers have varied terms and conditions

US banks mainly serve people who already live in the country – if you’re still living in Australia, you’ll be limited to non-resident account types. Non-residents are more likely to be directed to a limited range of accounts, or the bank’s own international and expat operation. That can mean you don’t have many options from banks, or you need to maintain a high balance to dodge extra fees.

If you don’t have a valid US proof of address document you may be better off with an online specialist provider. Specialists often provide more flexible multi-currency accounts which are cheaper and easier to open.

Wise

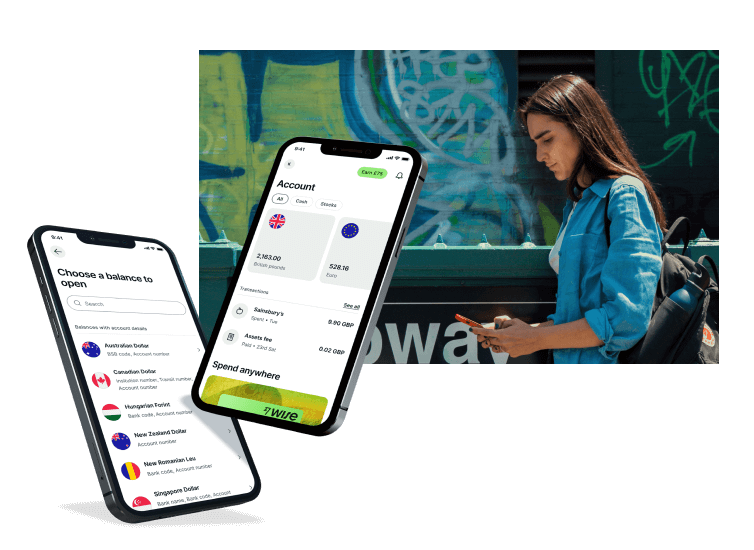

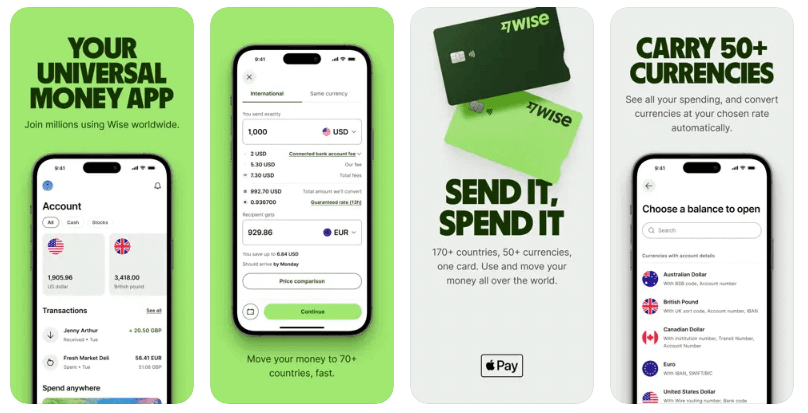

Wise offers multi-currency accounts which can be used to hold, exchange, send, spend and manage 40+ currencies including USD.

Accounts are entirely digital, so you can make payments, convert currencies and check your balance right from your phone or laptop.

And with a Wise Account you’ll also get US bank details including an account and routing number, to receive local USD payments, plus a linked Wise debit card for easy spending around the world.

Account types: Both personal and business customers can open a Wise multi-currency account with no minimum balance or monthly fees to pay. You just pay a low, transparent fee for the services you use.

Eligibility: Accounts are offered in most countries around the world – you’ll need a government issued ID and in some cases a proof of address or tax number to apply. Full details of availability by location available on the Wise website.

Is Wise safe? Yes. Wise is also overseen by a range of global regulatory bodies around the world, and trades under its own licenses and partnerships with banking providers in the US.

How to open an account with Wise

To open a Wise account:

- Download the Wise app or open the Wise desktop site

- Click Sign up and create an account with your email, Facebook, Google or Apple ID

- Follow the prompts to enter the details needed

- Upload a snap of your ID and address documents

- Once your account has been verified you’re good to go

Revolut

Revolut multi-currency accounts are managed primarily through the Revolut app, and offer multi-currency functionality with some fee free currency exchange, linked debit cards, as well as saving and investment products in many regions.

Exactly what’s available from Revolut will depend on where in the world you are, but you’ll always be able to get a standard plan which has no monthly fees, or choose to upgrade to pay a monthly fee and get more perks and higher fee free transaction levels.

It’s worth knowing that while Revolut does offer accounts to customers from most of Europe and a reasonable number of other large economies like Australia and Japan, the US is the only country in the Americas where it’s currently available.

Account types: Standard account plans are free or you can upgrade to a paid plan on a variety of different tiers – prices vary depending on your location.

Eligibility: Available to customers with addresses in the UK, the EEA, Australia, Singapore, Switzerland, Japan, and the US.

Is it safe? Yes. Revolut operates safely in the countries it serves, with oversight from a range of global bodies.

How to open an account with Revolut

To open an account with Revolut:

- Download the Revolut app

- Enter your phone number and set a PIN – you’ll get a verification message from Revolut

- Use the verification code to access the app and enter the details needed to create your account

- Upload the required documents for verification

- You can deposit funds and use your account once verified

Bank of America

Bank of America has a broad range of account options, and extra services like cards, loans and overdrafts for eligible customers. Some of the accounts on offer won’t be available for non-resident customers – however, one which is available is the Bank of America Advantage SafeBalance Account.

This account doesn’t have a linked check book, but you will be able to manage your money in person, online or in the Bank of America app, with extra perks like payments with Zelle thrown in. You can customize elements of the account to add in cashback, or set savings goals too. There’s a monthly fee to pay, but this can be waived if you enroll in the Bank of America Preferred Rewards program.

Account types: Bank of America has a broad range of accounts on offer, including the Advantage SafeBalance Account for non-resident customers.

Eligibility: For the Advantage SafeBalance Account you’ll need a US and foreign address, 2 forms of ID and a foreign tax number.

Is it safe? Yes – Bank of America is a large and trusted bank which operates securely.

How to open a non-resident account with Bank of America

- Check eligibility for the account you want to open

- Assemble the required paperwork

- Visit a branch of financial center to open your account

HSBC International

One option for US accounts you can open from Australia is to turn to the international or expat banking division of one of the world’s huge banking giants like HSBC. Accounts from international banks like these tend to have a focus on high wealth individuals with high maintenance fees if you don’t maintain a minimum balance in the account. In this case, you’ll need around 150,000 AUD to avoid the charges.

In return you’ll get a fairly flexible and often personal service, including easy online and mobile global transfers and currency exchange.

Account types: HSBC’s International accounts tend to be aimed at high wealth individuals and have high minimum balance requirements – but they can be opened by non-US residents

Eligibility: Customers must be based in an eligible country

Is it safe? Yes – HSBC International is the international and expat banking service of global finance giant HSBC, a trusted provider

How to open an account with HSBC International

- Check you meet the eligibility criteria

- Assemble the required paperwork

- Find your preferred account and select Apply now on the HSBC International website

- Follow the prompts to enter your details and upload images of documents

- Your account will be opened once verified

What is a bank account in the US needed for?

If you’re Australian, having a USD bank account can still be very helpful. Here are a few ways you can use a USD account as a non-US resident:

- Cut the costs of spending in person and online, in USD

- Prepare for your move if you’re planning to relocate to the US

- Convert funds from your home currency for investing in USD or to diversify your savings

- If you need to send payments to individuals and businesses in the US – such as paying for travel or an overseas mortgage

Benefits of opening a bank account in the US

Here are a few of the benefits you can expect if you choose to open a non-resident account in the US:

- Cut down the costs of converting and spending in US dollars

- Avoid foreign transaction fees when spending in the US, online and in person

- Get paid by others in USD and hold your funds in these currencies without needing to convert back to Australian dollars

- Send money to others in the US, for personal or business purposes, with lower overall costs

Can I open a bank account in the US before arrival?

You’ll probably find it hard to open an account with a US bank before you are physically in the country. However, that’s not your only option.

Online specialist providers can step in to help, with accounts which can be verified online using a foreign ID and an Australian proof of address.

Depending on the provider you pick you may still be able to receive and spend US dollars just like a local can and you may also be able to access currency exchange with the mid-market exchange rate to help you manage your money across currencies. Check out Wise and Revolut as good examples of online account providers which may suit your needs.

Can I open a bank account online

If you want to open a US bank account but you live in Australia, you’ll usually find it tricky. Banks tend to ask customers to attend in person when they do not have the full suite of standard documents used for online opening. However, you could get an account set up fully online or through an app by picking a specialist alternative service from a provider like Wise or Revolut.

How long does it take to open a bank account in the US?

The amount of time it takes to get your US bank account opened depends on how easily the bank you pick can verify your identity. You’ll need to provide or show your documents for this – and having paperwork issued outside the US may mean the verification process takes a few days.

What are the types of bank accounts in the US

As we’ve seen, there are both resident and non-resident accounts offered for the US. If you’re in Australia you’ll be treated as a non-resident by the bank. With a non-resident account you may find that the services you can access are somewhat limited compared to regular resident accounts – or you might face higher fees or minimum deposit requirements.

Once you have a US proof of address and can open a resident account, you’ll be able to pick from a selection of different account types including checking accounts and savings accounts,depending on your requirements.

How much does it cost to open a bank account in the US?

Opening an account at a US bank is normally free. However, it’s common to need to make an initial deposit – which can be very low for resident accounts, but may be pretty high for non-resident account options. To give an idea, the HSBC International account we profiled earlier requires a minimum deposit of 150,000 AUD or the currency equivalent, to avoid high fall below fees.

If you want an account to hold USD without these high deposit requirements, check out Wise and Revolut which both have free-to-open accounts with USD holding options.

Is it possible to open a fee-free account in the US?

You’ll often find US resident accounts that have ways to waive the maintenance fee, by signing up for additional services, or by holding a minimum balance at all times. However, all accounts are likely to have service or transaction charges – it’s unusual to find any truly fee free bank account, anywhere in the world.

What are the additional costs?

You won’t usually need to pay any fee to open an account in the first place – but some accounts, and particularly those targeted at expats and high wealth individuals, do have pretty hefty minimum balance and minimum deposit requirements.

It’s worth reading through the terms of different accounts carefully to make sure you don’t get hit with high fall below fees.

No matter what account type you pick, you’ll also run into transaction fees, especially for out of network withdrawals, international payments and currency conversion.

Tips for sending money between Australia and the US

One common transaction needed by new arrivals and people living between countries is international payments.

Unfortunately, US banks usually send transfers overseas by bank wire – which means payments are processed using the SWIFT network. SWIFT payments can be pretty slow and expensive, with several different fees to look out for.

Here are some tips to cut the costs on international wire transfer fees:

- Compare the exchange rate you’re offered against the mid-market exchange rate to see if a markup is being used

- Look carefully at the costs if you’re sending a payment overseas in USD – this is often more expensive than sending foreign currency

- Review the terms and conditions of your specific account to see the transfer fee which will apply

- Check if there are third party fees associated with the SWIFT network – these can push up the overall costs

Conclusion

Most banks in the US only have a limited service for non-US residents, or for people who can’t prove their residency in the US. There are a few options from banks, but it’s also common for customers to be directed towards expat banking services which typically have restrictions and higher fees.

A great alternative if you’re looking for an everyday USD account you can open from Australia is to look for a specialist provider like Wise or Revolut, to get an account opened and verified online, with USD banking details and a linked payment card.

FAQ – How to open a bank account in the US

Can a foreigner open an account in the US?

Yes, foreigners can open US bank accounts. However, it’s much easier – with a better range of products available – if you have a US proof of address. If you don’t, a flexible account from a specialist provider may be a better option.

How much do I need to open a bank account in the US?

It’s usually free to open a US bank account, but there may be a minimum initial deposit, or a minimum balance requirement to waive monthly fees. Minimum balance requirements can be fairly high if you’re looking at expat bank accounts, with hefty monthly fees if you don’t hold enough in your account.

Can I open a US bank account online?

If you’re a non-resident you’ll probably struggle to open an account with a bank online. A better alternative is probably to look at online specialists, which have fully digital onboarding and verification processes, with USD details to send and receive payments.

How to apply for a bank account online in the US?

If you have a US proof of address and a SSN or ITIN you may be able to apply for a US bank account online. However, if you don’t have these, you’ll usually be asked to visit a bank branch to get verified. Instead, for an onboarding process you can manage entirely from home, check out alternatives like Wise and Revolut.

Can I open a bank account in the US before landing?

It’s hard to open a regular US bank account without a proof of address in the country – which may make it impossible to open your US bank account before you arrive. However, online and digital specialist services like Wise and Revolut may be more flexible, with accounts you can open with proof of address from your home country instead.