Your Complete Guide to Paying Overseas Contractors and Employees

If you own an Australian business you may need to make foreign currency payments to international bank accounts if you have hired employees overseas, deployed an Australian employee overseas for a while, or if you use independent contractors who are abroad.

Whether you're regularly making payments to foreign contractors, or doing so as a one off activity, it's important to select the right international transfer method to avoid paying unnecessary fees.

Here is a guide showing you 3 of the best ways to make payments to contractors outside of Australia:

- A multi-currency account

- Your bank account

- PayPal

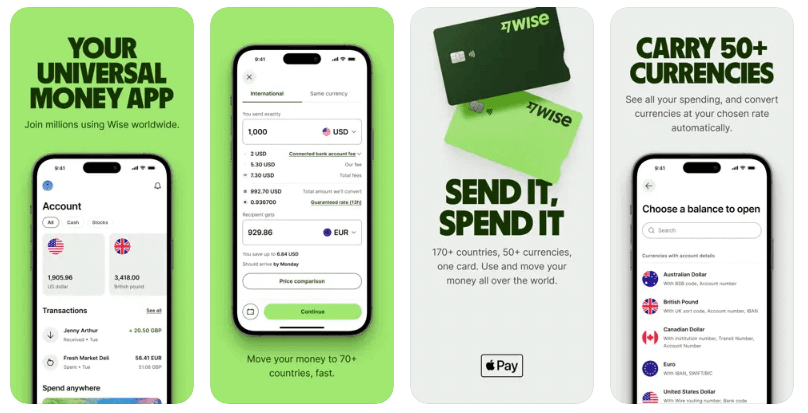

Use a multi-currency account

Sending a payment abroad with a multi-currency account can help cut down on unnecessary currency exchange fees, and allow you to send transfers quickly in a selection of foreign currencies.

Multi-currency business accounts from services like Wise let you get paid in foreign currencies and hold a balance in that foreign currency. If you need to pay a contractor overseas you can do so from your foreign currency balance without needing to convert back and forth between currencies, incurring costs. Providers like Wise offer low cost business account services for many major currencies, with low fees and great exchange rates.

Send money from your bank

If you have a business bank account you’ll also be able to use this to send payments internationally to many different countries. Bank international money transfers may come with low or no transfer fees when you arrange your payment online, but there’s usually a fee added to the exchange rate used.

If your bank processes the payment you send through SWIFT there are also often correspondent bank fees to pay. These go to other banks involved in the payment processing. Some Australian banks will waive these charges - but where they apply they can push up your costs significantly.

Pay through PayPal

Finally, you may be wondering about paying independent contractors through PayPal. PayPal offers instant payments to other PayPal accounts pretty much anywhere in the world, in 25 currencies. However it’s important to note that high transfer and currency conversion fees can apply.

You can often send money to someone overseas in AUD using PayPal -in this case you probably won’t pay the conversion fee. However, when your contractor comes to withdraw their money to a local bank account in another currency, the chances are that they’ll bear a fee there instead.

How to Pay Overseas Contractors and Employees

Paying your employees or contractors located overseas, while ensuring your company remains compliant with tax and social security can be challenging. Below are 4 steps you can take to successfully employ people overseas:

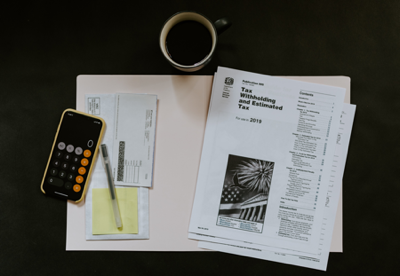

1. Taxes for Overseas Contractors and Employees

If you are an Australian company and you are recruiting a person who is overseas, either as a worker or as an independent contractor, you need to understand how Australian tax obligations apply to you.

How this works depends on whether you’re taking on an employee or an independent contractor, and also where the individual is based. In some circumstances it also matters what type of work they’re doing.

Broadly, if you’re employing someone, you must withhold tax, pay super, and report and pay fringe benefits tax if relevant. If you are working with a contractor who has given you their ABN, they will usually be responsible for their own tax affairs. However, bear in mind that falsely classifying someone as a contractor to avoid your duties when it comes to tax isn’t allowed.

The information available from the ATO makes it easier for you to decide whether your relationship with the person doing business with you is your employee or a contractor for tax and super purposes.

It’s helpful to note that your overseas employees could also be subject to local employment laws. It is therefore important to check whether any conflicting provisions exist. For example, if your overseas employee faces double withholding tax, you may be able to find out whether there is a tax agreement between Australia and the country where your employee lives.

Australia has ‘double tax agreements’ with over 40 countries. The terms and conditions of these agreements can change in any given year, so it is important to be aware of any changes.

Tax for overseas independent contractors - where withholding applies

We mentioned that in most cases your contractor will be liable for arranging their own tax affairs. However, as we said there are a few exceptions.

In Australia, you usually need to withhold taxes from payments made to foreign contractors if the payments made are for interest, unfranked dividends or royalties. You may also have to withhold additional tax if any of these payment types have been reinvested or capitalised on behalf of the non-resident.

In addition, you will need to withhold tax from payments made to non-Australian resident employees if they are promoting or operating casino gaming junket arrangements in Australia; promoting or operating entertainment or sports activities in Australia; promoting or operating construction, installation or upgrading of buildings, plants and fixtures and for other works and related activities in Australia.

Tax matters are important to get right - and they’re complicated. Get professional advice if you’re not sure of how your own obligations, and any obligations your contractor may have in their home country, work.

More Help - visit these Australian Tax Office websites:

2. Superannuation for Overseas Contractors and Employees

As an Australian business, you may also have superannuation obligations which can vary based on whether you have contractors or employees.

You may need to pay super for independent contractors but this depends on the nature of their contract.

As an Australian business, you have superannuation obligations for employees, which can include employees who are overseas if they are residents of Australia for tax purposes. The foreign country your employee works at may also require you to make superannuation contributions. This means you need to be aware of any domestic schemes, otherwise you may end up paying superannuation twice (known as double superannuation).

Australia has agreements with other countries to prevent double superannuation from happening. Take advice from the ATO BEFORE your employee leaves Australia to understand what is needed from your side for the employee to be exempt from compulsory contribution in the other country.

Get specific advice to make sure you understand how to manage super payments at home and abroad - and to avoid falling foul of the law.

3. What to do next

Once you’ve determined whether you need to withhold tax or make super payments made to your foreign resident employee or contractor you’ll need to understand the next steps to provide your overseas team member with all the relevant paperwork. You can get ATO forms and documents here to issue the individual with the relevant summary based on the specific situation. This will likely include a summary of the income paid, and the tax withheld during the tax year.

You may also need to send the ATO original copies of your paperwork, and keep your copy of documents for at least 5 years.

4. How You Transfer Money Overseas

Now that you’re ready to pay your overseas employee or independent contractor you need to think of how to best transfer the money. Here are some helpful hints to ensure you choose the best currency transfer service option for your business needs.

a) Use a specialist currency transfer company

While using your bank might be a more convenient option, it may also be more expensive. It is worthwhile to get in touch with businesses specifically set up to provide low cost money exchange at good exchange rates.

Companies like Wise, OFX, World First, TorFX, XE, and CurrencyFair allow you to transfer money directly into the recipient’s bank account using their online services and call centres. Some currency exchange providers like Western Union and MoneyGram let the recipient collect their funds in cash.

We recommend using our comparison tables for international money transfers or currency exchange to help you with your decision.

b) Be aware of any costs

There are many costs that could impact how much your overseas contractor or employee will receive when you send money to them. Any hidden costs charged by your money transfer provider could be a big hit to your bottom line and operating expenses. Especially if you are making recurring overseas money transfers.

Here is a simplified list of the key costs involved when you send money overseas:

- The currencies and countries you are moving currency between — different currency pairs have different exchange rates.

- Fees levied by the currency exchange provider — different banks and providers will levy different fees.

- The difference between the base exchange rate and what the currency provider offers you — you are unlikely to get the “mid-market / interbank” exchange rate. Instead, the rate you will get is often one or two percentage points worse than that rate.

- Fees levied depending on how the exchange is funded — some providers will charge you a fee if you fund the transfer in certain ways.

- Recipient bank fees — some banks charge additional fees when funds from a money transfer are paid into an account.

- The fees charged by the money transfer provider — different providers charge different fees, both as a flat rate and as commissions.

c) Reliable customer support for your business

A reliable service is an important consideration when you transfer money overseas. Especially if you do multiple transactions to pay your international employee or contractor. Your provider should be flexible, responsive, and receptive to your specific needs. They should be able to actively demonstrate how important your business is to them. There are many advantages of using a specialist service to transfer your money internationally including:

- Fast transfers, money can sometimes be transferred within one working day.

- Dedicated customer support and advice.

- Online options for sending money through their website or apps.

- Forward or limit orders to manage currency risk and reduce market fluctuations.

- Mobile apps and other tools to manage the money transfer processes.

With so many considerations, we've put together guides and reviews to help you make the right decision when you pay your overseas contractor or employee.

Can I pay an overseas contractor without ABN in Australia?

While you can pay an overseas contractor without an ABN, you may need to withhold tax under the PAYG withholding agreements. If this is required, you’ll need to get advice from a professional and from the ATO to make sure you cover all the requirements in Australia and in the country your contractor is from. Double taxation treaties may apply which can vary depending on the country involved, and which may mean you have to apply different tax treatments.

Benefits of hiring international contractors

It’s increasingly common to use overseas contractors, and countries become more connected and more and more work is delivered online and through digital communications. Hiring international contractors can come with a lot of benefits, including:

Flexibility of workforce

Using contractors means you can grow and shape your overall team according to your company needs. Take on a contractor for a specific project or during a busy time, with no need to set up a permanent desk for them in your office.

Recruit from a wider talent pool

Getting the right talent into your business is key to success, and using independent contractors from anywhere in the world gives you the chance to find the perfect fit for your specific needs. Don’t be limited by searching for people who can pop into your work location - hire the very best wherever they may be.

Expand your business and services globally

Having contractors in different geographic locations and time zones also helps you to reach different markets. You’ll find your new contractors bring local market knowledge, and if you’re a service orientated organisation, having people in different time zones can also help to allow for broader live support for customers based in different places around the world.

Cost-efficiencies

Using contractors in different countries can be cost efficient. You may find you save on the cost of labour, but you’ll also save on fixed costs of office rental and the other factors built into hiring a local permanent employee.

Conclusion

Hiring people based internationally is far more common now, and can bring a whole host of benefits to your business. However, you’ll need to make sure you understand the tax and super obligations you have as an Australian business owner - and you’ll also need to work out the best way to pay employees and contractors based overseas. This guide gives you a few things to think about, to kick start your journey to hiring the very best from all over the globe, without unnecessary costs for running payroll.

Disclaimer

General advice: The information on this site is of a general nature only for paying wages to overseas employees. It does not take your specific needs or circumstances into consideration. You should look at your own personal situation and requirements before making any legal, accounting or financial decisions.

Wise Money Transfers Reviewed

Wise (formerly known as TransferWise) are one of the fastest growing online money transfer services in the world. But are they the right option for you? Read about the type of customers that like Wise to find out.

- Read more ⟶

- 5 min read

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

- Read more ⟶

- 6 min read

Full Review of InstaReM

Our simple InstaReM review helps you learn all the important things about using InstaReM for international money transfers.

- Read more ⟶

- 5 min read