Costs Of Setting Up A FBA Business

Without proper analysis around costs before you set up your FBA business, you can see your profitability fall short of projections. This guide includes helpful hints on how to calculate your costs and information on FBA-related costs so you can meet your financial expectations.

The rule of thumb for revenue for a decent FBA business is ⅓ product costs including shipping, ⅓ Amazon costs and ⅓ profit for you.

The rule of thumb for revenue for a decent FBA business is ⅓ product costs including shipping, ⅓ Amazon costs and ⅓ profit for you.

Business Costs

Amazon has a complex fee structure, but they also have tools to help you calculate your costs. To get a better understanding of the costs involved you can use the FBA revenue calculator, where all you need is the ASIM product number and price (of your product and shipping). You can also compare which option is cheaper for you FBM or FBA on a cost basis.

Amazon offers two options for sellers:

- ‘Individual’ (listing under 40 items per month)

- ‘Professional’ (listing over 40 items per month).

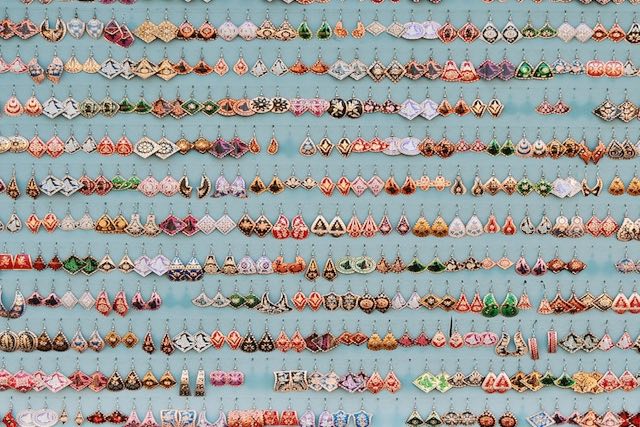

For Individuals, Amazon charges $0.99 per item to list along with a ‘referral’ fee that ranges from 6-45% depending on the item’s category. On top of that, there is a variable closing fee which, for BMDV (books, media, DVD and video) items, is not variable at all, but fixed at $1.00 per item. Jewellery and watches are fixed at $2.00 per item. Other products are charged a variable closing fee that is calculated by the item’s weight.

Sellers can list their items in 20-30 different categories (depending on whether they are selling as Individuals or as Professionals) and for BMDV sellers, have set shipping rates set and collected by Amazon. If you go the fulfilment by Amazon (FBA) route, Amazon charges an additional weight-dependant fee for picking and packing of orders, shipping and handling, customer service and they set a flat $20 fee for product returns.

Shipping Costs

In terms of logistics, understanding your cheapest route is really important as you can decrease your profit margin if you choose a poor shipping solution. Usually transferring your product to Amazon FBA warehouses via cargo ships is the cheapest option, but it’s good to do your research.

In terms of logistics, understanding your cheapest route is really important as you can decrease your profit margin if you choose a poor shipping solution. Usually transferring your product to Amazon FBA warehouses via cargo ships is the cheapest option, but it’s good to do your research.

Other costs you might like to include in your analysis is how much you’re willing to spend to drive sales.

As with any other e-commerce business, you need to work at promoting your products, particularly if you’re just starting-up. While Amazon does send more organic traffic to your product page than if you were to initially set up an e-commerce site, if you want your business to become successful, you still need to drive customers to your site.

Greater sales means the Amazon algorithm will kick in and begin helping you out. While many Amazon FBA owners rely 100% on this organic traffic to generate their revenue, with greater competition, you need to work harder to get your product in front of buyers.

Payment Cycles

Payment is generally completed by periodic bank transfers to the seller’s account and sellers are protected by Amazon’s Fraud Protection service. Usually payments are deposited every 14 days. You can work around Amazon’s bi-weekly payments by request, but it needs to be approved. Amazon doesn’t accept Paypal from buyers yet, but are reportedly in discussions to allow it.

Additional Costs and Considerations

Amazon has a multi-step procedure to setting up a seller’s account with a section for Tax Identity Information and sellers get paid via a direct deposit into their bank account.

If your account isn’t US-based then you can be subject to additional exchange rate fluctuation fees charged by Amazon and potentially your bank so it is important to be aware of potential exchange rate costs. If you want to speed up your international money transfer, read our blog on same day international money transfers.

As with any business, you should track all of your expenses thoroughly, particularly given Amazon FBA businesses can be capital intensive.

There is so much to learn about selling on Amazon.

From how to set up your business for success to insider tips and tools, these guides cover every aspect of starting and building a business in the worlds biggest marketplace.