Top 5 FX International Payment Services

The best way to make or receive an FX international payment is by using a money transfer service that offers the best foreign exchange rates. It can be difficult to find the best company, that's why we give you a starting point. Here is a list of 5 of the cheapest money transfer services to make it easy for your business to send FX payments for international invoices or receive money from overseas.

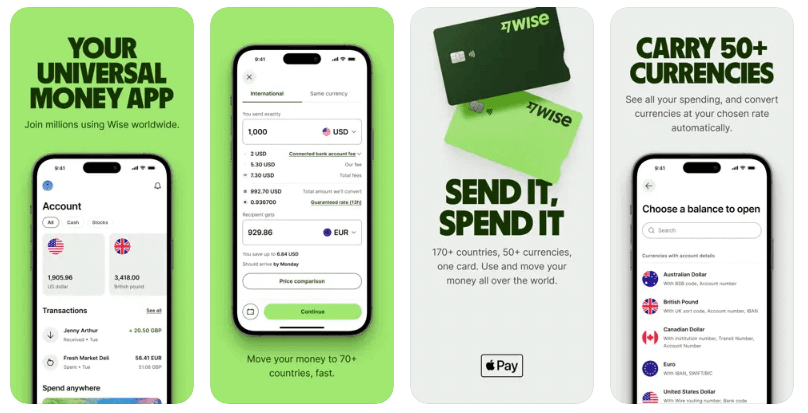

1. Best foreign currency account: Wise

2. Best for online sellers: OFX

3. Fee-free for large amounts: WorldFirst

4. Great exchange rates: InstaReM

5. Customer service: XE money transfers

If you're wondering if your business can just use your bank for your FX international payments, the answer is yes. However, it's always good to find out more information.

What's the Best Foreign Currency Account?

Wise (formerly TransferWise) offer a multi currency account in Australia. It's easy to set-up, receive and send foreign currency. The fee structure is better than any of the banks listed.

The thing that makes it different is that it allows you to up a local bank account in AUD, GBP, EUR, NZD, CAD or USD. That means if you open up a USD account, you’ll have your own ABA and account number (think BSB and account number).

Having your own local bank account makes it significantly easier, faster and cheaper to make international payments direct from your local account, without the need to exchange currency. Or for your international buyer to pay you locally.

- It’s very fast and easy to create an account

- Their service charge is low, fees and pricing are transparent

- You can pay via bank transfer, credit or debit card

- There’s no minimum transfer size

- Can't pay for your transfer via cash or cheque

- Limited customer support, interact by email or online support

- If you’re transferring over $40,000, their percentage-based fee can make them less competitive, but you might get a fee discount for larger transfers.

Looking for the Best Money Transfer Company for Online Sellers?

OFX is an Australian based money transfer company. They are particularly good at reducing the cost of FX international payments for online sellers.

What makes OFX stand out from the rest of the competition is it's customer support with 24/7 telephone support service - perfect for online merchants and suppliers transacting all day and night.

They also have a great resource hub for online sellers with plenty of helpful articles.

- Integration with Xero accounting software

- Lock in exchange rates using forward exchange contract

- Better exchange rates for larger amounts

- Licensed to give foreign currency risk management advise

- OFX Global Currency Account for online sellers

- They’re not as competitive if you’re sending less than $2,000

- Minimum transfer amount of $250

- You can’t pay for your transfer using cash, credit card or a cheque

Fee free transfer for larger amounts?

There's a lot to like about the services that WorldFirst offer. WorldFirst don’t charge any fees whether you're sending or receiving an FX international payments in foreign currency no matter the amount.

Recently WorldFirst lowered their exchange rate margins to just 0.5% or less for transfers, which certainly puts it ahead of the banks for cheap transfers for international payments.

- Better exchange rates for larger amounts

- Local currency account

- Dedicated account manager and personal FX advise

- Foreign currency receiving accounts for online sellers

- They’re not as competitive if you’re sending less than $2,000

- You can’t pay for your transfer using cash, credit card or a cheque

- Calculator on their homepage doesn't quote the actual rate you would get for your transfer

Who Offers Great Exchange Rates?

InstaReM operates globally. With competitive exchange rates and fast turnaround times, this company can be a solid financial platform for international money transfers for business. Especially for sending money to and from India.

The primary service InstaReM offers for businesses is its MassPay platform. It allows companies to configure how and when payments are disbursed to multiple recipients at once. It's useful for payrolls or to pay for large multinational product orders.

- Their website is quick and easy to use

- API integration for large corporates

- Launching business cards with personalised branding

- Great for smaller amounts of money under $1,000

- FAQs section less comprehensive than other websites

- No currency hedging tools (limit orders, spot/forward contracts)

- Doesn't specialise in personal advisory services

Awesome customer service

XE has been around since 1993, so they know a thing or two about business transfers! They provide a wealth of trusted information on exchange rates, including currency price history, news and more.

XE will also help you create a risk management strategy for currency exposures and recommend a hedging plan for your business with a dedicated account manager for business clients. What's not to like?

- XE are a worldwide, trusted authority for currency exchange

- They don’t charge any fees for sending money overseas

- It’s easy to get in touch with and use their customer service

- Their website is quick and pain-free to use

- You can’t pay for your transfer using cash or a cheque

- No foreign currency accounts

- Exchange rates not as competitive as other money transfer specialists

Can I use a bank for FX international payments?

Yes. If your business is just starting to send money overseas or receive money in other currencies, banks are worth looking at. Only because it's a good starting point. However, banks may not be cost-effective given the fees over time with international payments.

On the plus side, medium to large businesses can benefit from the whole range of complex hedging products and detailed business reports and research intel a bank can offer. Some banks like American Express even offer membership rewards points per foreign exchange international payment, minus the credit card.

Banks offer foreign currency accounts with a larger range of currencies that might be suitable for your business needs. However, these are also expensive. You can apply at a branch, but chances are banks will refer you to their business banking or corporate banking department.

When should I use a bank for my international FX payment?

There is no magic number at which point banks become useful. But if you're making 1 to 2 payments under $1,000 or receiving a small amount of money from an international buyer as a once-off, going through your bank for convenience probably is an option for you.

Bank foreign exchange rate calculators

Most banks provide a currency calculator which show exchange rates for making FX international payments on their websites. However, banks quote the market rate, not the actual rate you'll get for your international transfer.

This makes it tricky to compare the exchange rates and total costs that banks offer against other international money transfer options like specialist money transfer providers. Our comparison table accurately does this for you.

From our research, Australian banks quote exchange rates that are typically 2-3% worse than the base exchange rate.

Pros and cons of using banks

- Open a foreign currency account and save money on currency conversion fees

- International businesses can bill in foreign currency

- Relationship manager will help you manage FX rate risk

- Often a larger range of currencies available

- Bank fees are high

- Varied bank fees makes it difficult to compare

- Can be difficult to open a business account

Compare international money transfer exchange rates

Your currency knowledge centre

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

- 2 min read

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

- Read more ⟶

- 6 min read

5 Good Alternatives to OFX

While OFX is easy to use, and offer good exchange rates, other companies can do the same. In this article, we take a look at companies that offer similar services to OFX to see how they stack up.

- Read more ⟶

- 2 min read