Guides

Dive into our detailed guides and make sound decisions when moving currency.

Popular Guides

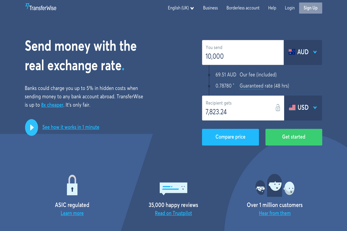

International Money Transfers

How to Transfer or Receive Money from Overseas

Forecasts

Travel Money and Cards

Couldn’t find what you are looking for? Please try our knowledge centre

Ileana Ionescu

Author

Ileana Ionescu

Content manager

With a background in business journalism, Ileana is an experienced content manager, creating content for Exiap that helps its audience make informed decisions about their finances.

Read more

Last updated

February 3rd, 2024