The Best Online Currency Exchange Services in Australia – 2026

Generally, getting things done online – from paying bills, to buying things, to sorting out your travel money – is a big time saver. When it comes to exchanging currencies for a payment, or for travel money if you’re heading abroad, getting everything sorted online can also save money.

Looking into your options for online currency exchange in advance is the best way to make sure you find a service that suits your needs – and helps you avoid tourist trap exchange offices once you’re abroad, or punitive exchange rates if you end up needing to make an online payment without checking your options first. This guide walks through some of the best options out there for online currency exchange in Australia, based on different customer needs.

Online currency exchange providers:

- Wise – exchange online to send or spend with the mid market exchange rate

- OFX – online exchange options with no fees for transfers over $10,000

- Travelex – order travel money in advance with home delivery or pick-up option

- Revolut – exchange currencies in your account online, to hold, send and spend

- S-money – online currency exchange provider with home delivery of travel money

Wise

Wise is a non bank provider of online international money transfers and multi-currency accounts for personal and business customers.Wise allows you to send payments to 160+ countries, in 40+ currencies, with online currency exchange which uses the mid-market exchange rate and low, transparent transfer fees. You can also get a linked debit card for easy spending and withdrawals, which automatically exchanges your currency with the mid-market rate and the lowest possible fee when you spend.

Wise is a non bank provider of online international money transfers and multi-currency accounts for personal and business customers.Wise allows you to send payments to 160+ countries, in 40+ currencies, with online currency exchange which uses the mid-market exchange rate and low, transparent transfer fees. You can also get a linked debit card for easy spending and withdrawals, which automatically exchanges your currency with the mid-market rate and the lowest possible fee when you spend.

How to exchange money online with Wise

Set up a Wise account online or in the Wise app to exchange currencies in a few clicks. Use Wise for online currency conversion if you need to send a foreign currency payment, or arrange travel money. Add money to your account and make ATM withdrawals in your destination to get the cash you need securely and conveniently.

- Exchange rates: mid-market exchange rates apply

- Card availability: linked debit cards available for personal and business customers

- Safety: safe and regulated provider

- Speed: conversion in your account, or when you pay with your Wise card, is instant

- Customer reviews: 4.7 out of 5 stars on Google Play, from 740,000+ reviews; 4.6 out of 5 stars on App store, from 41,000 reviews

Wise pros and cons

| Pros | Cons |

|---|---|

|

|

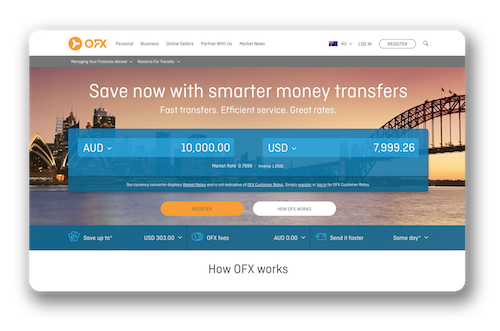

OFX

OFX offers online currency exchange to 50+ currencies, for payments to 170+ countries from Australia. Individuals and business customers can also get currency risk management solutions which may require digital currency exchange, and businesses and online sellers can hold and exchange 7 currencies in a Global Currency Account.

OFX is known for its excellent customer service, which includes a 24/7 phone line if you ever want to talk your transaction through with someone – but most transactions can also be arranged online or in app for convenience.

How to exchange money online with OFX

Use OFX for digital currency exchange if you’re sending a global payment, or to hold and exchange currencies in your Global Currency Account if you’re a business customer.

- Exchange rates: exchange rates include a markup

- Card availability: cards are not available

- Safety: safe and licensed provider

- Speed: currency exchange can be instant – payments may take a day or two to arrive

- Customer reviews: 4.5 out of 5 stars on Google Play, from 3,800+ reviews; 4.8 out of 5 stars on App store, from 2,500 reviews

OFX pros and cons

| Pros | Cons |

|---|---|

|

|

Travelex

Travelex offers international transfers, travel money cards and an online travel money exchange service with the option to collect your cash at a Travelex branch, Australia Post, or at the airport. If you order your money online for collection, you’ll know exactly what rate you’re getting so you can set your travel money budget easily. Plus you’ll usually get a better exchange rate by arranging your transfer or travel money online compared to doing a spot exchange, which is also offered in Travelex branches.

Travelex also has a travel money card which supports 10 currencies, which lets you exchange currencies online within your linked multi-currency account.

How to exchange money online with Travelex

Exchange money online with Travelex to send a payment overseas, or to get your travel money. You can then collect your cash in person, from a Travelex or Australia Post branch, or at an ATM at the airport. You can also order a Travelex travel money card which is a helpful option to hold 10 currencies and spend with no extra fees once you’re abroad.

- Exchange rates: exchange rates include a markup

- Card availability: travel money card available

- Safety: safe and licensed provider

- Speed: currency exchange within your digital account is instant

- Customer reviews: 3 out of 5 stars on Google Play, from 1,900+ reviews; 4.5 out of 5 stars on App store, from 5,500 reviews

Travelex pros and cons

| Pros | Cons |

|---|---|

|

|

Revolut

Revolut offers account services through its app, including 3 different account tiers to suit different customer and transaction needs. You can get a basic account with no ongoing fees, or trade up for a monthly fee to get more no fee transaction options. Online currency exchange applies if you need to send a payment in a currency you don’t hold in your account, if you spend overseas with your card, or if you want to change the balance of your account to one of the other 30+ supported currencies for any reason.

How to exchange money online with Revolut

Exchange money online with Revolut, with no fee for weekday exchange to your plans limits. You can exchange money to send a payment, within your account or when you spend with your card, with 30+ currencies supported.

- Exchange rates: no fee weekday exchange available to plan limits, fair usage fees apply after that

- Card availability: card available with all account types – features may vary

- Safety: safe and licensed provider

- Speed: currency exchange within your digital account or for card spending, is instant

- Customer reviews: 4.5 out of 5 stars on Google Play, from 2.6 million+ reviews; 4.7 out of 5 stars on App store, from 41,100 reviews

Revolut pros and cons

| Pros | Cons |

|---|---|

|

|

Smoney

You can order currency online from S-Money and get it within a few days either by having it delivered to your door, or by collecting your cash in a store or Australia Post branch. Store collection services are available in NSW, VIC, QLD, WA & SA only, but delivery could be arranged elsewhere.

How to exchange money online with S-money

S-money is a specialist in travel money, offering online currency conversion from AUD to the currency you need in your destination. You order online and then get your cash in person – either by picking it up or having it delivered to your door.

- Exchange rates: exchange rates include a markup

- Card availability: cards are not available

- Safety: safe and licensed provider

- Speed: currency exchange can be instant when you order online

- Customer reviews: not applicable

S-money pros and cons

| Pros | Cons |

|---|---|

|

|

How to exchange currency online?

Quite often, ordering online is the cheapest and easiest way to buy currency if you need cash for an upcoming trip. If you want to get cash in your pocket before you leave Australia, bear in mind that it usually takes between 2 and 5 business days before the currency is ready, so you can’t do it last minute. However, you can also choose to order a travel money card from some providers like Wise, Revolut or Travelex, which you can use to exchange currency online and then make ATM withdrawals once you arrive in your destination. This means less to do in advance.

If you want to get cash in your pocket before you get on your flight, you’ll usually need to:

- Select your currency and the amount you want to exchange, generate a fee and rate quote and compare it with some other options to make sure it’s right for you

- Pay with your card or by making a bank transfer. Fees may apply, and your card provider may also charge you for the transaction

- Get your cash in a branch or delivered to your home – options vary by provider and fees may apply

Things to consider when choosing an online currency exchange service

It pays to get everything set up in advance if you need foreign currency – but there are a few things that are worth considering when choosing a provider to make sure you get the very best deal for your specific needs. Here are a couple of pointers:

- Generate a few quotes online to see the available rates and fees for your specific online exchange – this allows you to compare and pick the best one

- Choose a provider with convenient service options – either getting cash delivered to home, or having a card you can use in an ATM on arrival may be the easiest way to go

- If you need travel money, consider having more than one payment plan – such as a travel money card and some cash – just in case one method can’t be used for some reason

- Make sure the provider you pick is regulated and has a good reputation with customers – Trustpilot reviews can be handy her

- Check if the provider’s app is easy to use if you’ll have a digital account linked to your payment card – Google Play and App store reviews give some good insight into what customers are saying

Understanding exchange rates

Before you exchange currency online it’s useful to compare both the fee you’ll pay and the exchange rate you’ll get for conversion. That’s because many banks and providers add a fee into the exchange rate used, which is hard to see and which can push up the costs of transacting in the end. Look out for a service which uses the mid-market rate – like Wise or Revolut – as these usually have transparent charging structures which make it easier to see what you’re paying for your online currency conversion.

Where to avoid exchanging currency

Generally, exchanging currency anywhere that has a lot of passing trade, or where there’s a captive market, is a bad idea. For example, exchanging in the airports often means a high markup fee added to the exchange rate as exchange services aren’t looking for repeat business from travellers simply passing through. Similarly, if you leave the exchange to the last minute and try to change money with your hotel, this is likely to be expensive as the hotel knows you have no other options and you’ll accept a poor rate to get your hands on cash.

When should I use my bank to exchange currency?

Contrary to popular belief, using an Australian bank to buy your overseas holiday cash isn’t always the most expensive option. In fact it can sometimes be the cheapest way to buy it.

Foreign exchange rates from banks for common currencies, such as the US dollar (USD), Euro and British Pound (GBP) aren’t particularly competitive when compared to other currency exchange services. Especially when exchanging money at an airport.

However, banks can be the best option for less common currencies such as the Chinese Yuan (CNY) the South African Rand (ZAR) or the Malaysian Ringgit (MYR).

Alternatives to online currency exchange providers

If you haven’t arranged your currency conversion online – or if you’d prefer to transact in person, you may be considering using a bank or visiting an exchange store. This means you can pay in cash and get your travel money instantly – which is handy and quick. However, there are a few downsides. Rates and fees are unlikely to be all that great, and you run the risk of the provider not having the currency you need, when you need it. Plus, if you exchange all your travel money in advance of leaving, you’ll find yourself carrying around more that is sensible – a risk when in a foreign country, as tourists are often easy prey for petty criminals.

Conclusion – Best Online Currency Exchange Services

Online currency exchange is handy for sending payments, exchanging in a digital account or getting travel cash. If you need travel money you can either convert online and get the cash before you leave, or you can order a travel money card to exchange online and make secure ATM withdrawals in the destination to get all the foreign currency cash you need. Services, features and fees vary a lot between different online currency exchange services, so comparing a few is the best way to get the perfect match for your needs. Consider Wise or Revolut for a smart and simple travel money card for spending and withdrawals, or Travelex or S-money if you want to have cash in your pocket before you fly.

FAQ – Best Online Currency Exchange Services

1. What is the cheapest way to get foreign currency in Australia?

The cheapest way to exchange currency really depends on what currency you are buying, how much and where you are.

It’s usually cheapest to buy foreign currency at your destination, but not as convenient. If you’re more prepared, there is very little difference between buying currency in-store or online. For in-store currency exchanges, you’ll get better rates in the CBD than further out. The most expensive option is to exchange your currency at the airport – so don’t do it! There are smarter ways to buy currency.

Related reviews: Compare foreign exchange rates for cash; How to Get the Best Currency Exchange Rate

2. Where can I get money exchanged at the best exchange rate?

Wondering where to exchange currency in a store? Use these city (CBD) and suburb guides to help you get the best exchange rates deals:

3. Where is the best place to exchange money overseas?

You’ll get the best exchange rates if you buy foreign currency at your destination rather than at home, but it might not be as convenient. If you’re looking for information on the best ways to take travel money for a specific destination check out the following country guides:

4. What is the best travel card?

We recommend 5 top travel money cards for Australians going overseas:

- Wise is our best value travel debit card

- Revolut is our best multi-currency travel card

- Citibank Saver Plus is our best bank travel debit card

- 28 Degrees Platinum Mastercard is our best travel credit card

- Travelex Money Card is our best prepaid travel card

Related reviews: Wise Debit Card vs Revolut; 28 Degrees MasterCard vs Citibank Plus Transaction Account vs NAB Traveller; List: The best and worst travel cards in Australia

5. What currencies can I buy online?

Brazilian Real (BRL), British Pounds (GBP), Canadian Dollar (CAD), Chilean Peso (CLP) , Chinese Yuan Renminbi (CNY), Croatian Kuna (HRK), Czech Republic Koruna (CZK), Danish Krone (DKK), Euro (EUR), Fijian Dollar (FJD), Hong Kong Dollar (HKD), Hungarian Forint (HUF), Indonesian Rupiah (IDR), Japanese Yen (JPY), Malaysian Ringgit (MYR), New Caledonia CFP Franc (XPF), New Zealand Dollars (NZD), Norwegian Krone (NOK), Philippine Peso (PHP), Polish Zloty (PLN), Russian Ruble (RUB), Saudi Arabia Riyal (SAR), Singapore Dollar (SGD), South African Rand (ZAR), South Korean Won (KRW), Swedish Krona (SEK), Swiss Franc (CHF), Thai Baht (THB), Turkish Lira (TRY), UAE Dirham (AED), US Dollars (USD), Vanuatu Vatu (VUV), Vietnamese Dong (VND)